Driven by advances in technology, evolving investor needs and innovation in administrative systems, managed accounts can deliver higher performance potential, stronger compliance and substantial administrative efficiencies to financial advisers and their clients. With Zenith, you can select from a range of portfolios to suit your investment objectives, time-frames and client goals.

As one of the first multi-asset managed account providers in Australia, we’ve built a wealth of knowledge on the development and management of these investment structures. Learn more about the benefits a Zenith managed account can offer you in this short video.

At the heart of our managed account offering are our customised portfolios, which we build to suit a range of investment objectives, including those driven by responsible investment principles. We also offer a suite of public menu portfolios which are available on Australia's leading investment platforms.

A tailored managed account built to meet the unique requirements of your business & its clients.

Diversified portfolios incorporating RI principles which seek to reduce exposure to harmful industries and increase exposure to funds with strong ESG incorporation.

Low cost portfolios that incorporate a broad range of exposures using a proprietary dynamic asset allocation approach.

Portfolios designed to provide exposure to a diversified range of quality active fund managers using a cost aware approach.

Premium portfolios that invest in actively managed funds, leveraging our full capabilities in asset allocation, strategy selection and manager selection.

Designed for the more cost conscious investor specifically tailored for Colonial First State platform users.

Our investment philosophy is driven by six fundamental beliefs.

Markets are inefficient and present opportunities to outperform.

Diversification leads to higher confidence of meeting objectives.

Medium-term risks, opportunities and thematics should be managed dynamically to achieve better outcomes.

Accept that markets are risky, but manage, allocate and monitor risk.

Research is key, adds value and permits evolution over time.

Be aware, prepared, patient; review, adjust and adopt according to objectives, beliefs and process.

These beliefs underpin our investment decisions and inform the process we employ to create and deliver our managed account portfolios.

You can find our managed account solutions on the following platforms.

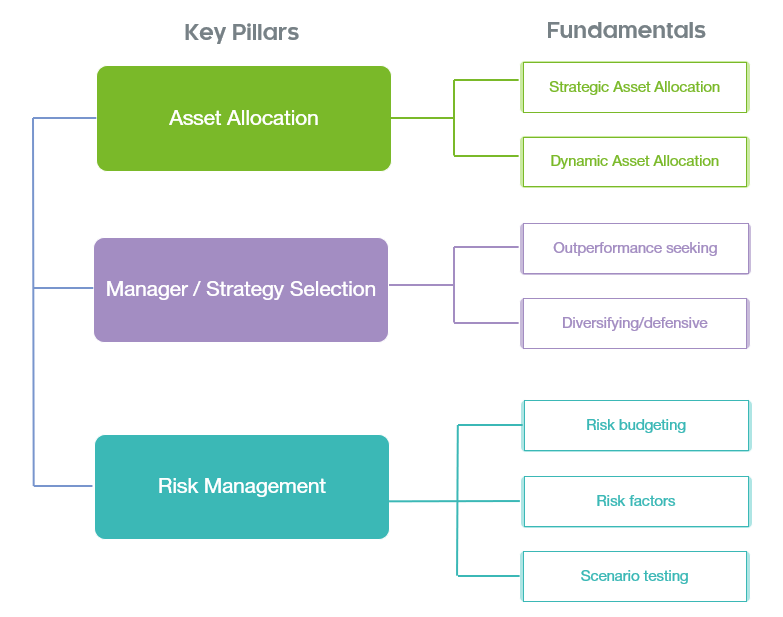

Powered by our leading internal capabilities in asset allocation, strategy selection and investment research including key market and portfolio insights from our parent company, FE fundinfo.

Managed by our highly experienced portfolio solutions team with an in-depth understanding of the needs of Australian financial advisers and their clients.

Access to comprehensive portfolio dashboards and our best-of-breed reporting suite to support more in-depth, constructive client conversations.

Underpinned by continual, considered portfolio monitoring and rebalancing, supported by our internal Investment Risk & Governance team.

For more information about our managed account solutions, please submit an enquiry and one of our team members will be in touch with you shortly.