Zenith's managed accounts deliver an efficient, scalable and powerful way for financial advisers to secure their clients' financial futures while growing their client base, seamlessly and with confidence.

As one of the first multi-asset managed account providers in Australia, we’ve built a wealth of knowledge on the development and management of these investment structures. Our deep understanding of the Australian wealth industry ensures our solutions are designed to help advisers grow and streamline their businesses. Learn more about the benefits a Zenith managed account can offer you in this short video.

At the heart of our managed account offering are our customised portfolios, which we build to suit a range of investment objectives, including those driven by responsible investment principles. We also offer a suite of public menu portfolios which are available on Australia's leading investment platforms.

A tailored managed account built to meet the unique requirements of your business & its clients.

Diversified portfolios incorporating RI principles which seek to reduce exposure to harmful industries and increase exposure to funds with strong ESG incorporation.

Low cost portfolios that incorporate a broad range of exposures using a proprietary dynamic asset allocation approach.

Portfolios designed to provide exposure to a diversified range of quality active fund managers using a cost aware approach.

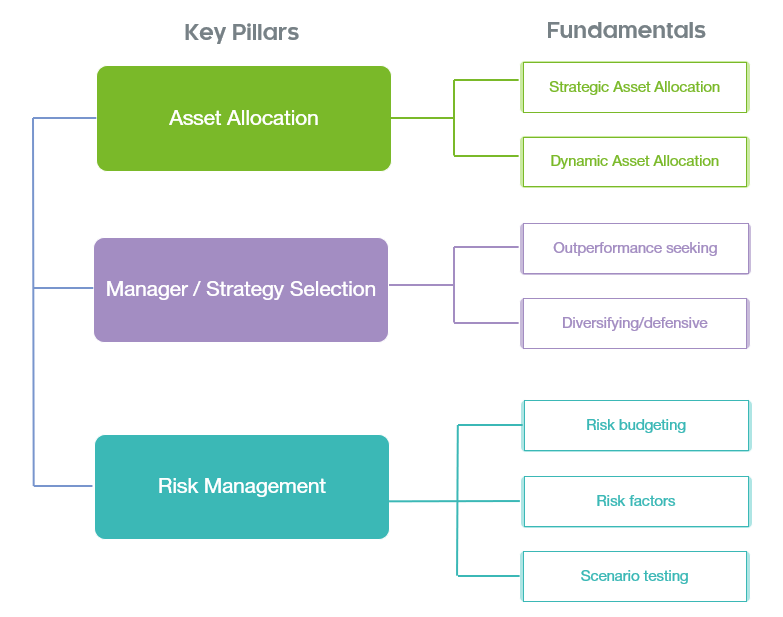

Premium portfolios that invest in actively managed funds, leveraging our full capabilities in asset allocation, strategy selection and manager selection.

Our portfolios are constructed and managed by the Portfolio Solutions team, which includes investment professionals with extensive portfolio management experience. The team works closely with our Asset Allocation, Investment Research, Risk and Governance, and Administration teams, ensuring you receive a comprehensive and robust solution that meets your needs.

Our tailored, market-leading service includes:

Our team ensures that portfolio risks are regularly reviewed, and that governance and regulatory requirements are continuously monitored by a focused, experienced team, giving you and your clients peace of mind.

Our investment philosophy is driven by six fundamental beliefs.

Markets are inefficient and present opportunities to outperform.

Diversification leads to higher confidence of meeting objectives.

Medium-term risks, opportunities and thematics should be managed dynamically to achieve better outcomes.

Accept that markets are risky, but manage, allocate and monitor risk.

Research is key, adds value and permits evolution over time.

Be aware, prepared, patient; review, adjust and adopt according to objectives, beliefs and process.

These beliefs underpin our investment decisions and inform the process we employ to create and deliver our managed account portfolios.

You can find our managed account solutions on the following platforms.

Our team has a depth of experience across all markets and a breadth of portfolio creation, management and execution capabilities that are second to none.

We provide easy-to-use tools, client-friendly reporting, expert market insights and practical marketing guidance which help you effectively communicate with your clients.

We become a trusted partner, working to understand your client base so we can best support your needs while maximising operational efficiencies for your staff.

Our market-leading investment research informs our portfolios and ensures the most current market insights and data are powering your portfolios.

For more information about our managed account solutions, please submit an enquiry and one of our team members will be in touch with you shortly.