Head of Real Assets & Listed Strategies, Dugald Higgins, answers six burning questions on fixed income ETFs and breaks down the practical information you need to know.

What are fixed income ETFs and what should retail investors look for in the category?

Fixed income ETFs cover a wide range of strategies across cash, government and/or corporate bonds and hybrids. They also offer exposure to both Australian and international markets. Strategies can range from index-based to smart beta to full active management, and underlying credit quality can also move across the full spectrum, from AAA-rated sovereign bonds to corporate high yield. This means that the first thing to understand is what sits inside an ETF and know what characteristics you are looking for.

You also need to decide if you’d prefer an index-based strategy or active management. Index ETFs are more suitable for cost sensitive investors who want to avoid the risk that the manager underperforms a benchmark. Active ETFs however might be preferred by those who’d rather not to take a benchmark exposure and are comfortable in the risk posed by active management, as they seek to navigate and potentially outperform markets.

Understanding the basics of fixed income markets is also essential, as these are not like term deposits. Yield to maturity, duration and credit quality are all key metrics in ETFs, particularly for index-based products. You should also look at differences in costs, trading spreads, liquidity and price to net assets over time. While ETFs are usually relatively simple, some of these measures carry material implications which need to be understood thoroughly before diving in.

What sort of performance should you expect?

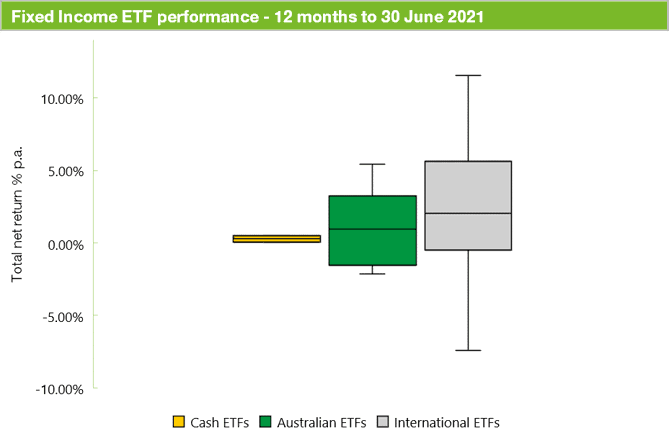

Given the differencing in exposures and strategies, performance varies hugely. In the 2021 financial year through to 30 June, top performers ranged from 0.5% for cash, 5.4% for Australian fixed income and 11.6% for international fixed interest. By comparison, the poorest performers were 0.05%, -2.1% and -7.4% respectively, as the following chart shows.

Performance is also impacted based on factors such as how the ETF’s index selects and weights its holdings and how the ETF replicates that index. Although many fixed-income indices are constructed based on market value, some may use credit ratings or liquidity, all of which influence outcomes.

You should also consider if the ETFs hold bonds whose coupons are fixed, floating or linked to inflation as these influence not only income generated but capital value. If the ETF uses active management, understanding the objectives, management style and relative risk exposures are also essential. For index-based ETFs particularly, understanding the concept of duration, which is a measure of the sensitivity of the portfolio to change in interest rates, is essential to gaining an understanding of potential performance outcomes. For example, index ETFs in global markets with very long duration (highest sensitivity) were amongst the worst performers in FY2021. Ultimately, performance variations can be more than might be expected, so it pays to have a thorough understanding of what’s under the hood of an ETF before clicking that buy button.

What fees are involved?

Fees vary according to strategy and implementation. For simple, broad market index-based exposures, fixed income ETFs can be very cheap, with annual fees (management fees and any additional expenses), averaging 0.12% p.a. for cash ETFs and 0.27% p.a. for index based ETFs. Actively managed ETFs are generally more expensive, averaging 0.53% p.a. Some active ETFs may also have performance fees, which should also be accounted for. While not a ‘fee’, investors will also be subject to a bid/ask spread as part of the transaction, which is similar to a buy/sell spread in managed funds. Unlike managed funds however, spreads in ETFs are dynamic, varying during trading hours. While a necessary part of effective market functioning, it pays to familiarise yourself with what typical spreads look like over time and compare these to what’s currently in the market. Spreads are generally at their widest at the start and end of the trading day and so trading during these times should generally be avoided. Use of limit orders can also be very effective in limiting spreads, but frequent trading in ETFs can result in material erosion of returns due to these trading costs.

Are there any innovations in this area?

The two biggest recent changes in fixed income ETFs are probably the adoption of actively managed strategies and increasing availability of ETFs which offer sustainability characteristics by accessing the green bond market. Active ETFs are potentially attractive for investors who prefer the ease and simplicity of transacting via the ASX or Chi-X rather than the voluminous paperwork associated with direct investing in managed funds or the additional costs associated with investment platforms. As ETFs continue to find use not only in the hands of direct investors but also fintech platforms, the move for active managers to embrace the ETF format means that just as index ETFs democratised market investing, easy access to active strategies in fixed income is now more easily accessible than ever before.

In ETFs more broadly (not just fixed income) the advent of ‘dual register’ products which combine funds and ETFs is also a real game changer. This essentially allows an investor to either invest through a fund and get fixed unit pricing at net asset value (NAV), or, transact on an exchange as an ETF and take advantage of easier transacting and intraday pricing around NAV, all in the same vehicle. You can even change from the fund to the ETF or vice versa. It’s a really useful innovation.

What about actively managed FI ETFs?

Active ETFs should be seen as a complementary alternative to index-based products, and play an increasingly important role in providing diverse solutions for investors. Given the macro environment with low/zero interest rate policies being pursued by much of the developed world, including Australia, active management will be a valuable risk management tool to extract returns from fixed income when interest rates ultimately turn. Notwithstanding this, we have long believed that choosing between active and index strategies should be a considered choice rather than simplistic argument around cost and active risk that ignores the pros and cons of each approach.

The advent of more sustainability centric offerings in fixed income ETFs is also a welcome evolution as this is an area that has been lacking optionality for those seeking to apply a responsible investing layer to their choices. While the options in this space are relatively limited at present as the green bond market is still developing, especially in a local context, this is an important evolution. Markets are increasingly feeling the heat (pun definitely intended) of investors placing their values at the forefront of their investment decisions. In addition, increasing global regulations for both companies and investment vehicles is also paving the way for action to drive greater sustainability in investing.

What would you tell your grandmother if she asked about investing in FI ETFs?

Fixed income is generally used as a source of stable income through market cycles as well as a diversifier relative to other asset classes like equities. Using ETFs can be an easy way to access these features, but you must look below the surface to understand the specifics of each ETF.

For more information please contact our sales team at [email protected]