Key points

-

While the potential benefits of the managed account structure for investors and advisers are clear, their fee structure, however, tends to be less so.

-

ASIC has acted on this in the form of RG97, though the outcome will likely be continued variability in fee disclosures and potential investor confusion, through to September 2022.

-

The presence, or otherwise, of underlying fund performance fees may contribute to a distortion of the disclosed cost of a managed account and dissuade investors from accessing appropriate fund options.

-

Performance fees and returns are co-dependent and seeking the 'cheapest portfolio possible' runs the risk of capping the risk-adjusted return potential of portfolios.

Advisers using managed accounts do so for the many benefits this structure provides to their clients and their broader business. In the process of establishing their suite of managed accounts though, advisers must also understand the nuances that exist in how fees are structured and disclosed to ensure their clients fully understand them. Unfortunately, the inconsistent application of ASIC’s fee guidelines adds a layer of confusion that makes comparing managed account portfolio options more challenging than it should be in the market today.

Giving investors and advisers more clarity

ASIC are aware of the issues surrounding the inconsistent application of fee information and have stated that: “value of fees and costs information to consumers is lessened if there are significant inconsistencies in the compilation of fees and costs information.”

There have since been several reviews, consultations and recommendations made to improve ASIC’s Regulatory Guide 97, ‘Disclosing Fees & Costs in PDSs and periodic statements’ (RG 97) and the fee clarity that should flow from it for investors and their advisers.

The most significant change to RG 97 occurred in September 2017 when the fee disclosure regime was changed, requiring the disclosure of a number of costs that were not previously disclosed. Due to the complexity of the September 2017 version of RG 97, there have been different interpretations of these new regulations, which have resulted in unintended variability in the fee disclosure methodologies used by product providers.

The current iteration of RG 97, released in November 2019 and finalised in September 2020, greatly simplifies the previous disclosure regime. However, there’s no ‘hard’ date for compliance as product providers can adopt the new regime any time from September 2020 to September 2022. This will mean that for a two-year period, funds will be disclosing fees and costs under two different regimes – this is far from ideal and the continued variability of fee disclosures needs to be understood by advisers in developing their recommendations to clients.

Current platform disclosures

From September 2017, many platforms have updated their fee disclosures to align them to an RG 97 world. Broadly, this means including indirect costs and performance fees within the overall cost of a managed account offering, in addition to applicable application, redemption and ongoing investment management fees. Nonetheless, a lack of consistency is also an issue when comparing fees for managed accounts across platforms.

The following table illustrates how disclosable fees of the same managed account product are categorised and disclosed across different platforms. They all comply with the disclosure requirements, but their fee outcomes are different across platforms.

|

Portfolio Name |

Investment management & Responsible Entity Fee |

Estimated Cash Fee |

Indirect |

Estimated performance related fees |

MER + Estimated performance fees |

Total ICR |

Estimated Transactional |

||||||

|

PANORAMA |

|||||||||||||

|

Zenith Elite Blends Balanced Portfol�io |

0.200% |

N/A |

0.820% |

0.140% |

0.960% |

1.160% |

0.37% |

||||||

|

Lonsec Managed Balanced Portfolio |

0.200% |

N/A |

0.700% |

0.060% |

0.760% |

0.960% |

0.24% |

||||||

|

Morningstar Balanced Portfolio |

0.616% |

N/A |

0.380% |

0.000% |

0.380% |

0.996% |

0.23% |

||||||

|

Quilla Wealth Accumulator Portfolio |

0.330% |

N/A |

0.630% |

0.160% |

0.790% |

1.120% |

0.35% |

||||||

|

NETWEALTH |

|||||||||||||

|

Zenith Elite Blends Balanced Model |

0.220% |

0.041% |

- |

- |

1.055% |

1.316% |

0.425% |

||||||

|

Morningstar Balanced Portfolio |

0.610% |

0.068% |

- |

- |

0.172% |

0.850% |

0.063% |

||||||

|

Lonsec Managed Portfolio –Multi-Asset Balanced |

0.330% |

0.024% |

- |

- |

0.767% |

1.121% |

0.287% |

||||||

|

CFS FIRSTWRAP |

|||||||||||||

|

Zenith Essentials Balanced Portfolio |

0.200% |

N/A |

0.600% |

- |

- |

0.800% |

0.180% |

||||||

|

Morningstar Balanced Portfolio |

0.570% |

N/A |

0.190% |

- |

- |

0.760% |

0.010% |

||||||

|

Elston Balanced Portfolio |

0.480% |

N/A |

0.210% |

- |

- |

0.690% |

0.010% |

||||||

|

Innova Balanced Portfolio |

0.360% |

N/A |

0.600% |

- |

- |

0.960% |

0.140% |

||||||

|

KEY |

|

|

Investment management & Responsible Entity Fee |

Includes both the cost of the Investment Manager/Consultant (the cost of managing the portfolio) and the Responsible Entity fee (the price of the entity that has legal custody of the client’s assets) |

|

Indirect Costs (MER) |

The management cost of the underlying investments as disclosed within the PDS, This is often calculated as a weighted average |

|

Estimated performance related fees |

Fees payable to underlying investment managers for performance in excess of a hurdle or benchmark For Managed Account disclosure is general, the disclosed fee is typically historical or estimated based on historical and therefore may not be the actual fee payable by the investor – which may be higher if the fund manager performs better than historically, or lower if it doesn’t perform as well as it had historically |

|

Total ICR |

Refers to the total amount payable by an investor within a managed account on an annual basis, generally excluding transaction costs |

|

Estimated Cash Fee |

In some cases, an estimated cash fee (implicit cost of the cash account), if the cash account is in the portfolio |

|

Estimated Transactional |

An estimation of the transaction costs an investor will be exposed to. These calculations are often an average of the Buy/Sell spreads of the underlying managers. It is worth noting these costs do not relate to the transaction costs of the underlying investment managers which were not required to be disclosed in the RG 97 regime that applied up to 30 September 2020 |

Source: Zenith

What’s driving this divergence?

The differences in fee disclosures create an unfortunate challenge for potential investors and their advisers in selecting both the platform and managed account option that’s most appropriate to their goals and circumstances. Broadly, differences are attributed to several factors:

- differences in disclosure: as can be seen from the above table, some platforms choose to include performance fees and others do not. Similarly, some include other fees such as the fees on cash, while other platforms may not (they may not charge a margin on cash)

- treatment of fees: in some instances, fee calculation methodologies vary. This is particularly the case with the estimation of performance fees and transaction costs, and

- data sources: broadly speaking, the platforms do a good job of ensuring the fee information they are collecting is correct. However, due to a reliance on third party data sources which have their own fee calculation methods, further disclosure inconsistencies may occur.

Performance fees need a closer look

Generally, it’s performance fees and how platforms disclose those fees that’s driving most of the divergence. The inclusion or exclusion of fund performance fees in a portfolio's aggregate ICR can create the impression of an ‘expensive’ or ‘cheap’ cost to invest. Importantly, this ignores the more critical feature of a portfolio, its post-fee return potential.

It’s important for investors to note that the performance fees disclosed by platforms are largely backward looking. This by no means gives investors an accurate indication of what they‘ll pay going forward and, if elevated, generally means the investor has enjoyed strong performance in the past. Where a fund does not have a significant track record, estimated performance fees may be based on periods as short as one year. Funds that adopt the new iteration of RG 97 post-September 2020 will need to show the average performance fees for the preceding five years.

Cheapest and best interest are not synonymous

Advisers and clients wanting the 'cheapest portfolio possible' run the risk of capping the risk-adjusted return potential of their investment - exposing themselves unnecessarily to both modest returns and heightened investment volatility due to reduced diversification.

Sometimes, elevated ICRs are a result of performance fees payable, caused by the returns received by investors in previous years beating their benchmarks by a good margin (which is a good thing!). This is logical, as performance fees and returns are co-dependent.

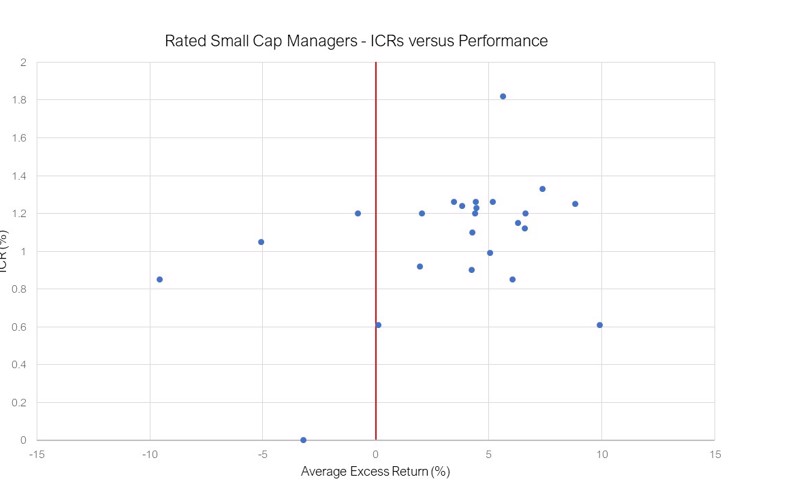

To help illustrate this, we’ve completed a simple analysis of our rated Australian Equities Small Companies peer group, a sector where performance fees are common. The below chart compares fund ICRs (as at 30/06/2019) with the average excess performance (net of fees) on a financial year basis over the last seven years subject to data availability. Noting the outliers, our analysis illustrates that, after taking all fees into account (i.e. net returns to the investor), funds with higher-than-average ICRs are also often those funds that deliver improved returns to investors.

Source: Zenith

Another example to note - relatively high ICRs and performance fees are also common within alternative investments, including but not limited to unlisted assets and hedge fund strategies. The fees of these investments do not necessarily reflect their performance potential, but more often the cost of accessing sophisticated investments that retail investors could not replicate directly or easily. The access to these investments results in diversification benefits. We remain a strong advocate for alternative investments and believe their role in portfolios has never been more critical amid heightening share market volatility and historically low bond yields.

Conclusion

In the right context, we believe that performance fees can suitably align with the interests of both investors and advisers as managers are paid more if they consistently outperform their benchmark for clients. Conversely, if they do not, performance fees won’t be charged and commonly managers have to make-up any performance shortfall for investors before they can again receive these fees (commonly known as a ‘high-water mark’).

The consistent disclosure of performance fees and ICRs by all managed account providers is important, as is the intention of RG 97 to make this clear and informative for investors and their advisers. At Zenith, we’re well equipped to help investors navigate the confusion of fee disclosure and build portfolios we believe provide the best ‘bang for buck’.