Ole, ole, ole

Arguably the world’s biggest sporting tournament, the 2022 FIFA World Cup, is in full swing. Competing for the coveted trophy and eternal adoration of their compatriots, the best players in the world have descended on Qatar to represent their respective countries. The tournament occurs every four years, with the last tournament held in July 2018.

Whilst four years is a long time in soccer, the last four years in global equities has felt even longer. The period has seen seismic shifts in the macroeconomic environment, strategy performance, investor preferences and, most importantly, our global equities peer group. As a result, we have conducted our own point-in-time of assessment of our rated global equities products, contrasting them with the 2018 vintage.

Plenty of new entrants

By its nature, investing in global equities encompasses elements from all over the world. As the largest and most competitive sector of our approved product list (APL), fund managers from across the world offer products to the Australian public. In 2022, the global equities peer group had managers located across 9 countries and 27 different cities.

Encouragingly, Australian-based managers represent 43% of the rated manager universe, showing that they mix it with the best – just like the Socceroos!

Since 2018, we have seen an increase of 11 new locations, including Boca Raton (US), Bridgewater (US), Brussels (Belgium), Camas (US), Fort Lauderdale (US), Laguna Beach (US), Milwaukee (US), Minneapolis (US), Singapore (Singapore), St. Petersburg (US) and Zurich (Switzerland).

Strong growth in products

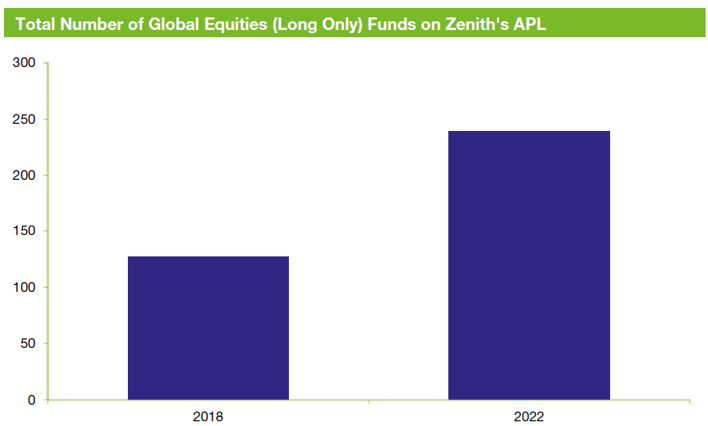

Whilst the number of countries competing in the World Cup is limited to 32, the number of global equity offerings in Australia has increased significantly.

The chart below highlights the growth in the number of global equities products under coverage.

Source: Zenith Investment Partners

Over the last four years, there has been a rapid acceleration of products offered in Australia, coinciding with significant growth in the number of our rated global equity offerings. Which begs the question…

What is driving this strong growth?

We have identified four key drivers of this pronounced growth.

1. Responsible investment

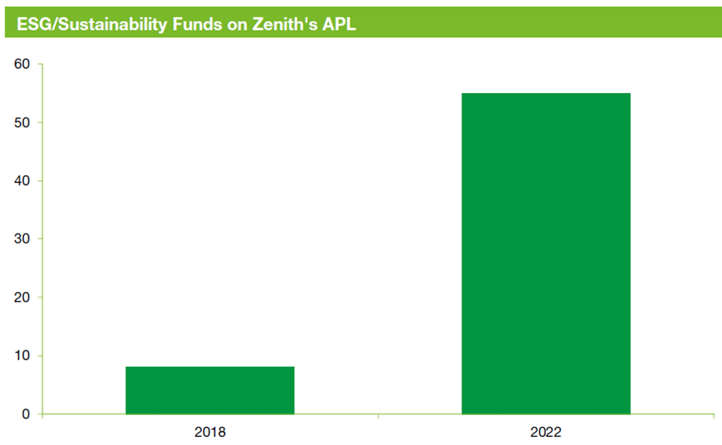

Since 2018, responsible investment (RI) and environmental, social and governance (ESG) have been the most significant contributors to growth in the global equities peer group. Investor demand for products that align with their values has driven a multitude of new products in the space, with the following chart comparing the number of RI-focused product offerings on ourAPL since our 2018 International Shares review.

Source: Zenith Investment Partners

The growth has been swift, with the number of offerings increasing almost seven-fold since 2018. Whilst there has been significant growth in this segment, we note that the underlying approaches to RI and consideration of ESG issues are diverse, with an array of offerings available for investors with varying levels of intensity. We expect= this market segment to be an area of continued growth and evolution.

2. Exchange-traded products

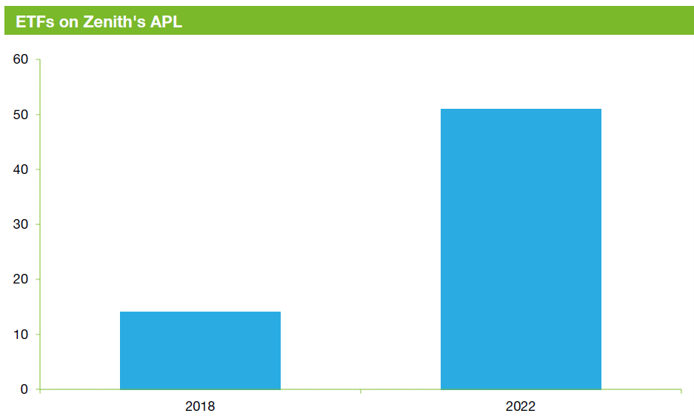

The second largest contributor to growth in the International Shares sector has been listed products. At the forefront of this has been the rapid rise of exchange-traded funds (ETFs), with investment managers broadening their mode of access for investors.

While there are a variety of pros and cons for listed products, the two most touted benefits are:

- increased trading flexibility and speed, and

- avoidance of platform fees and minimum investment requirements.

The following chart details the growth of all listed global equities products on our APL.

Source: Zenith Investment Partners

Over the period, the number of listed offerings has grown significantly. A key component of this has been the rise in structures.

Fungible structures combine two different access points, an ETF and an unlisted managed fund, into one underlying trust. This provides investors the ability to buy or sell from either access point, aiming to offer the best of both worlds, whilst retaining the efficiencies of a single vehicle.

In the same manner as RI-focused products, we believe investor demand for listed products will continue to grow.

3. International small and mid-capitalisation products

We also observed strong growth in the number of offerings in our International Shares – Small Companies universe over the last four years.

Over the period, the number of offerings on our APL almost tripled.

Historically, there has been a combination of factors that have led to limited international small capitalisation penetration within the Australian market. At the forefront has been the well-publicised home country bias of Australian investors, which has led to investors preferring small capitalisation exposures through Australian equities.

However, rising investor awareness as to the benefits of international small capitalisation portfolios is changing that, with investors acknowledging the inefficiencies of the market segment, the risk/return characteristics, and the diversification benefits offered by the asset class.

Additionally, small capitalisation equity managers generally have less capacity than their large capitalisation peers. Historically, this has meant that high-quality offshore managers have been able to reach strategy capacity prior to targeting the Australian market. However, the increase in demand from Australian investors has led to several high-quality offshore small capitalisation managers viewing the Australian market as a primary source of capital, offering their products locally with sufficient capacity available. A

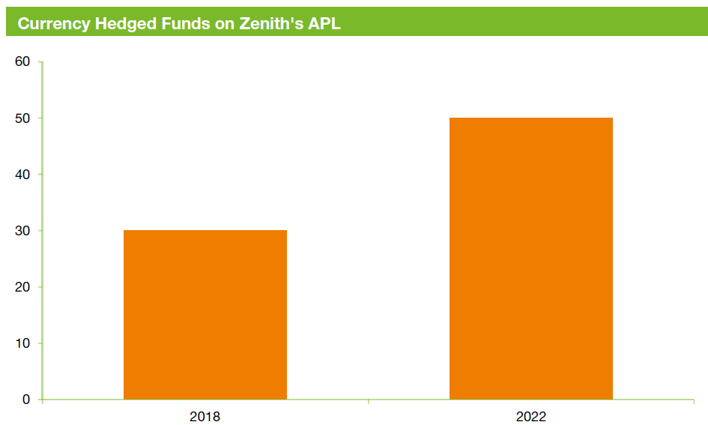

4. Currency-hedged products

Naturally, with the broader growth in global equity offerings, currency-hedged products have also been on the rise, with the growth displayed in the chart below.

Source: Zenith Investment Partners

We believe the growth in currency-hedged products provides investors greater flexibility to determine their own currency exposures, while maintaining access to preferred managers and strategies.

Strong growth in funds under management (FUM) within the asset class

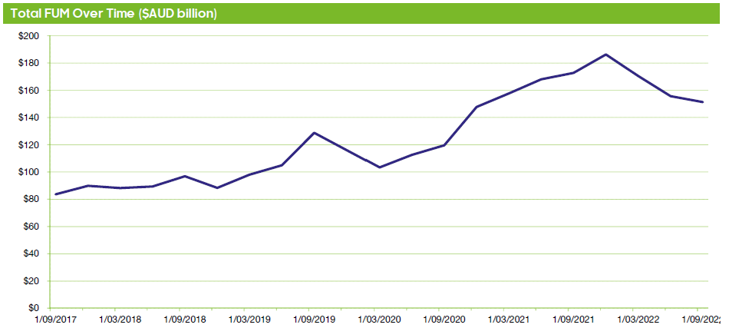

The demand for global equities remains strong. The graph below highlights the growth in FUM over our global equities peer group since 2018.

Source: Zenith Investment Partners

Over the period, FUM has almost doubled, providing commercial backing for the increased number of global equity offerings available in the Australian market.

Who wins the 2022 instalment of the World Cup?

As the largest and most competitive sector on our APL, global equities remain dynamic, having undergone meaningful change since France picked up the last FIFA World Cup in 2018.

The allure of Australian capital remains strong, with Australian investors becoming increasingly spoilt for choice given the increased manager access and differentiated exposures arriving on our shores. With improving access and a broad-based reduction in costs, Australians are getting a much better deal than those seeking a beer in Qatar.

As investors seek increasingly unique exposures, the only thing we can be confident of predicting is that it will once again change in four years’ time.

As for the World Cup, your guess is as good as ours.