Given Real Estate Investment Trusts (REITs) recent challenging performance during the COVID shutdown, investors are naturally questioning their allocations to the asset class. However, while it is tempting to draw conclusions surrounding the drawdown and recovery to date, considerable uncertainty remains around the speed at which economies re-open and the shape of a longer-term recovery.

Despite the uncertainty of this outlook, we believe a case remains for both Australian REITS (A-REITs) and Global REITS (G-REITs). With long-term asset allocation principles in mind, we believe REITs offer attractive attributes including diversification benefits and a yield advantage over other asset classes. In addition, we view current valuations as an opportunity for investors based upon a valuation dislocation between the publicly traded REITs and directly owned property, and, also large valuation discrepancies across different REIT sub-sectors and regions.

Diversification and the yield advantage

While the historical asset class returns and their co-variances support the diversification benefits of REITs, it is the underlying characteristics of the asset class which drive the diversification benefits to investors.

Property is a real asset, which is generally owned to provide rental income with some capital growth. While the length of leases underpinning the cashflows will vary, rental income remains a contractual obligation which features higher in a business’ cashflow priorities than the distribution of earnings via dividends.

While the certainty of cashflows does vary according to tenant credit quality and lease duration, typically rental income in normal times is considered more reliable. In addition, rents from commercial leases are typically structured to adjust upwards annually, creating structural growth to cashflows and ultimately, values.

These income characteristics can also be enhanced by a landlords’ ability to create additional value through operational management via refurbishment and/or repositioning. By creating additional points of return generation from asset management, this can make assets more resilient to market cycles, adding further diversification benefits.

In addition, REITs can actively grow their asset base not only through acquisitions and disposals but also the development or re-development of assets in a build-to-own capacity. Furthermore, many REITs supplement their rental income with corporate earnings from funds management fees or development (build-to-sell). The ability of a property investor to actively manage the property through the cycle and grow the rental income ensures that the capital values of the property can be maximised, providing REITs with growth along with their income returns.

With REITs being publicly traded and valued on a forward-looking basis, they are subject to equity market movements and thus have equity beta which direct property does not. While this does potentially dilute some of the diversification benefits, this equity beta is the price of liquidity for REIT investors. Direct property’s highly illiquid nature poses potential liquidity difficulties for investors and implementation challenges in constructing portfolios.

Liquidity Disconnect

While REITs are expected to move in line with direct property over time, the difference in liquidity is important with respect to the relative valuations between REITs and direct property. This is abundantly evident in the current disconnect between the REIT valuations and those in the underlying direct market.

Direct property valuations are fundamentally appraisal-based and infrequent due to their illiquid nature. As a result, this typically results in a material time lag in rolling returns. In contrast to the dynamic mark-to-market prices of listed securities, material discrepancies can emerge. While this is not necessarily an arbitrage opportunity, over the long-term, returns of direct and listed property tend to track together.

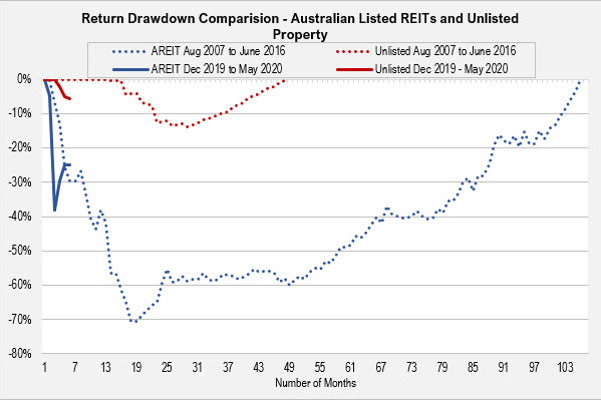

This is clearly illustrated in the following chart, which shows the drawdown in index returns between listed and unlisted property over the last two major negative periods.

Source: AMP Capital, Zenith Investment Partners

What can be clearly seen is the higher velocity of drawdown in listed REITs as confidence eroded more rapidly during this recent period. While differences in leverage impacted A-REITs through the GFC, from a valuation perspective, movement in underlying asset values were similar.

While there is potential for further movements in the values of direct real estate ahead as the impact of COVID-19 on real estate fundamentals become clearer, we can also expect A-REITs to rise to close the pricing gap over the medium-term.

Sub-Sector Value Opportunities

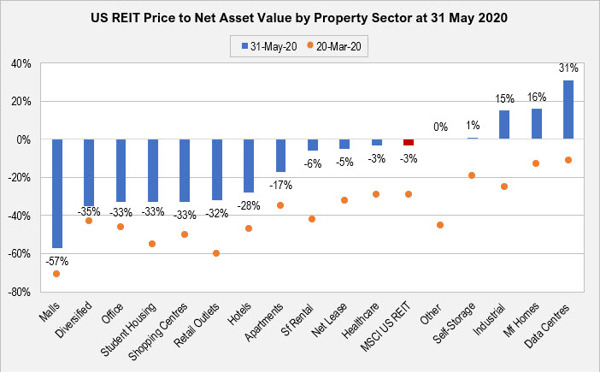

Within both A and G-REITs, different property sub-sectors have drawn down differently based upon their individual characteristics and investor expectations of future earnings. Consistent with observations in broader equities, technology related segments of the G-REIT market have proven to be most resilient. Data Centres REITs have been in high demand, delivering a one year to 31 May return of approximately 18% and industrial REITs, fuelled by logistics and e-commerce, returning -2% over the same period. Conversely, the hotels and resort, shopping centres and the hospitality focused net lease sectors fared the worst returning -49%, -41% and -29% respectively.

To examine valuation discrepancies available to investors, the US REIT market is a good example owing to its scale, well-developed sub-sectors comprised of specialist REITs and its large size in the global REIT market (54% of the FTSE as at 31 May 2020). The chart below shows the discount/premium the property sub-sectors are trading at relative to their Net Asset Value (NAV).

Source: Principal Real Estate Investors

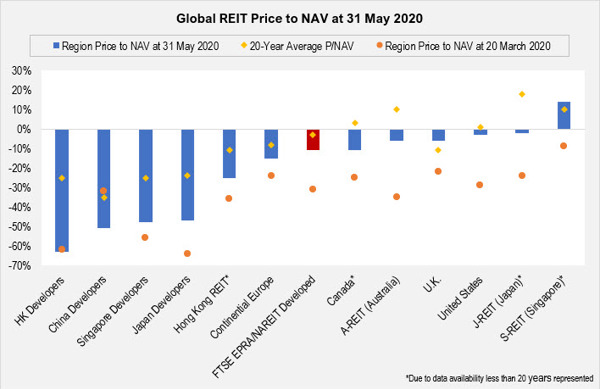

In addition to the value dispersion across US sectors, in the following chart, we can clearly see the valuation opportunity across different global markets. For reference, long-term valuations are provided for some relativity.

Source: Principal Real Estate Investors

A large dispersion in valuations across the sub-sectors is evident. Furthermore, given the large changes in valuations between the March and May estimates (in line with a significant market recovery), we can deduce that the market price of these REITs is the main input into the equation that is driving the changes.

Additionally, given the valuation discounts across property sectors and regions, we believe that both A-REITs and G-REITs represent an attractive opportunity. Furthermore, we believe markets with such large dispersion provide active managers with favourable conditions to deliver alpha. This is consistent across our rated G-REIT peer group with all but one manager outperforming the Zenith benchmark over the 12 months to 31 May 2020.

Despite the challenging performance across many (but not all) of REIT sub-sectors, we maintain the asset class offers investors benefits owing to property’s diversification benefits and yield advantage. In addition, we believe current market valuations provide compelling opportunities either relative to direct property or within REITs, investing across different sub-sectors or regions.

The outbreak of COVID-19 has quickly translated into a severe shock for the global

economy and real estate markets, and the situation continues to be fast-moving. We continue to observe the sector closely, with a focus on how fund managers, landlords and tenants respond to current challenges and how this likely impacts or rewards investors.