Despite a very strong 2019 where Global Listed Infrastructure (GLI) continued to deliver attractive equity-like returns, the sector succumbed to the COVID-19 crisis in Q1 2020, with the median manager returning -19.56% (hedged) for the period. While the median manager outperformed global equities, which returned -21.08% (hedged) over Q1, the magnitude of GLI’s drawdown has some investors questioning the defensive characteristics of the sector.

GLI typically provides a greater level of downside protection when compared to broader global equities as it has less exposure to short-term business conditions, competition, economic conditions and commodity prices than broader industrial equities. While we believe it is too early to write off GLI’s defensive attributes, especially in the face of a recessionary environment, a decomposition of returns for the sector may help.

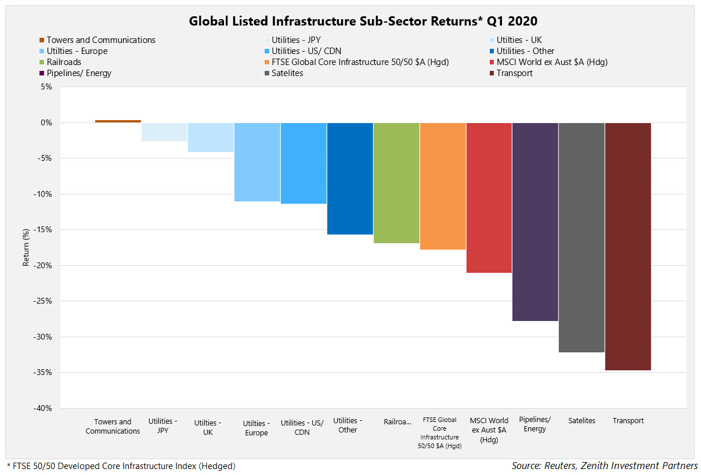

A large contributor to GLI’s negative returns has been the transport-related segments of the infrastructure market (airports and toll roads), which have been some of the hardest hit due to large falls in patronage levels. In contrast, regulated utilities have outperformed global equities as their regulated earnings are more resilient due to their essential role in society, especially in a COVID-19 shutdown.

In addition to the shutdown of transport assets, the GLI sector was impacted by the Russian-Saudi oil price war, with the North American energy pipeline stocks underperforming global equities. Despite the companies mainly transporting LNG (and not crude oil) on long-term contracts with no volumetric or commodity price risk, these stocks sold off with the market’s perceived credit worthiness of their customers the upstream producers.

Will infrastructure remain resilient going forward?

The key to GLI’s defensive attributes is the sector’s typically stable earnings profile. These stable earnings are a result of the characteristics of the underlying assets, namely those with high barriers to entry, long-life assets, providing essential services with regulated or contracted revenue models. For simplicity purposes, we can divide infrastructure into regulated assets such as utilities and ‘user pay’ assets such as transport for comparison.

Regulated utilities operate under a Regulatory Asset Base (RAB) model whereby asset owners receive a regulated return on their investment which is sufficient to service capital expenditure, service debt and to generate profits. Under the RAB model, regulated utilities assets have low exposure to user demand and little competitive pressures. This means these assets typically have the most certain earnings streams in the GLI sector.

While each utility company will be facing different idiosyncratic factors pertaining to their operation under the COVID-19 lockdowns, utilities’ earnings are broadly expected to be largely insulated from the crisis.

For ‘user pay’ assets the earnings impact will vary across different asset types, particularly with the length of the shutdown unknown. For airports, passenger volumes have fallen more dramatically than toll roads, although they are expected to recover quicker as travel restrictions are eased. For communications assets such as cellular towers, Zenith would expect limited COVID-19 impact on earnings.

While certain asset types face greater short-term earnings uncertainty than others, when viewed through the cycle, we believe the GLI sector will continue to offer a stable earnings profile. This, in turn, provides an attractive return profile of equity-like returns with greater defensive characteristics.

Infrastructure’s unique return profile

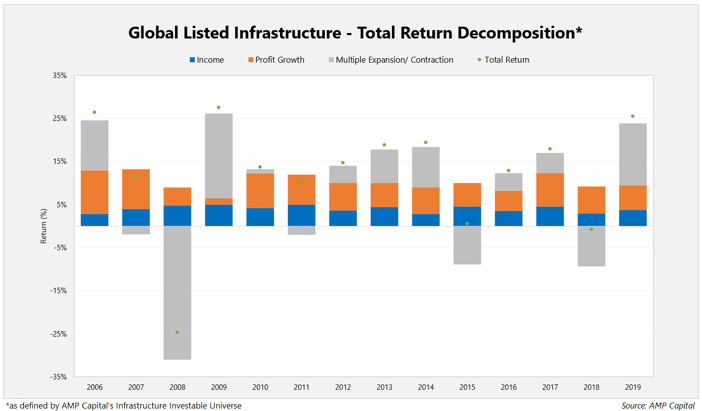

To highlight the sectors’ differentiated return profile, GLI’s annual returns can be broken into yield, earnings growth and multiple expansion/contraction. While the current situation is very different to the ‘great financial crisis’, a breakdown of GLI’s total returns over time provides us with a useful reference point, showing GLI during the last major economic downturn.

Income: The reliable income provides return diversification and an attractive level of yield. In addition, the presence of this yield helps provide a cushion when the sector faces capital volatility.

Earnings growth: Infrastructure’s earnings growth has demonstrated consistency from year-to-year with steady CPI-linked earning streams such as utilities, supplemented with higher growth sectors.

Multiple expansion/contraction: The listed nature of GLI means that changes to equity markets valuations will result in multiple expansions (contractions) of the companies, as the capital value changes.

With so much uncertainty surrounding COVID-19’s impact on global markets, the real economy and the length of the shutdown, we acknowledge the full impact on the sectors’ earnings is unknown at this stage. Furthermore, re-ratings have, and will continue to occur, with capital volatility impacted by multiple expansion and contraction.

That said, utilities make up a large portion of the GLI universe (50% of the benchmark) and given the inevitability of traffic returning to the roads and the sky, we maintain the asset classes’ inherent defensiveness relative to general equities through the cycle. Furthermore, we believe infrastructure is an investable asset class, now and over the long-term.

We believe that GLI adds a unique return profile to an overall portfolio, driven by the characteristics of the underlying assets of the infrastructure companies. While not all infrastructure segments have performed in a defensive manner in the recent market drawdown, we believe that an allocation to GLI provides diversification benefits to investors through the cycle.