Market volatility has continued into the first two weeks of March. Most recently, a disagreement between Saudi Arabia and Russia over the production output of crude oil in response to the coronavirus, ignited a potential pricing war that saw sharp declines in the oil price. In turn, markets drastically sold off, with 9 March 2020 posting the worst daily return in both Australian and US equities since the GFC. The following table shows the returns of the major asset classes from 1 - 9 March 2020*:

| Asset Class** | Return |

|---|---|

| International Equities | -7.64% |

| Australian Equities | -10.10% |

| Listed Infrastructure | -3.84% |

| Listed Property | -4.79% |

| Australian Fixed Interest | 0.82% |

| International Fixed Interest | 1.37% |

Source: Bloomberg

*Index values derived from Bloomberg as at 10am (AEST) 10 March 2020

**Asset Class Returns are derived from the following indices: International Equities – MSCI World ex-Australia (AUD Hedged), Australian Equities – S&P/ASX 300, Listed Infrastructure – FTSE Global Core Infrastructure 50/50 (AUD Hedged), Listed Property – FTSE EPRA/NAREIT Developed Index (AUD Hedged), Australian Fixed Interest – Bloomberg AusBond Composite Index, International Fixed Interest – Bloomberg Barclays Global Aggregate Index (AUD Hedged).

Given the recent market fluctuation in response to the uncertainty surrounding coronavirus and potential oil price wars, investors may be tempted to sell out of the market to preserve capital. While there is an obvious allure to timing the market in such a manner, the reality is that adding value from these strategies requires near-perfect precision.

Not so perfect timing

Hindsight always seems to be 20:20. However, when investors attempt to anticipate future returns, there is always a vast array of opinions on offer and a plethora of economic scenarios that can play out. Investors often have the misconception that forecasting returns is more difficult in uncertain environments. The reality is that forecasting returns over any time horizon has a large margin of error, particularly over short time horizons.

Investors who make emotional decisions will often exit or reduce their market exposure after a sell-off event. Despite this action, many who react in such a manner will still incur most, if not all, of the losses associated with heightened uncertainty.

In addition, investors seeking to re-enter the market following a strategic exit fall victim to confirmation bias and will wait for a market bounce or recovery before redeploying capital. Inevitably, this response limits the positive returns captured from the market recovery.

A rules-based representation of market timing

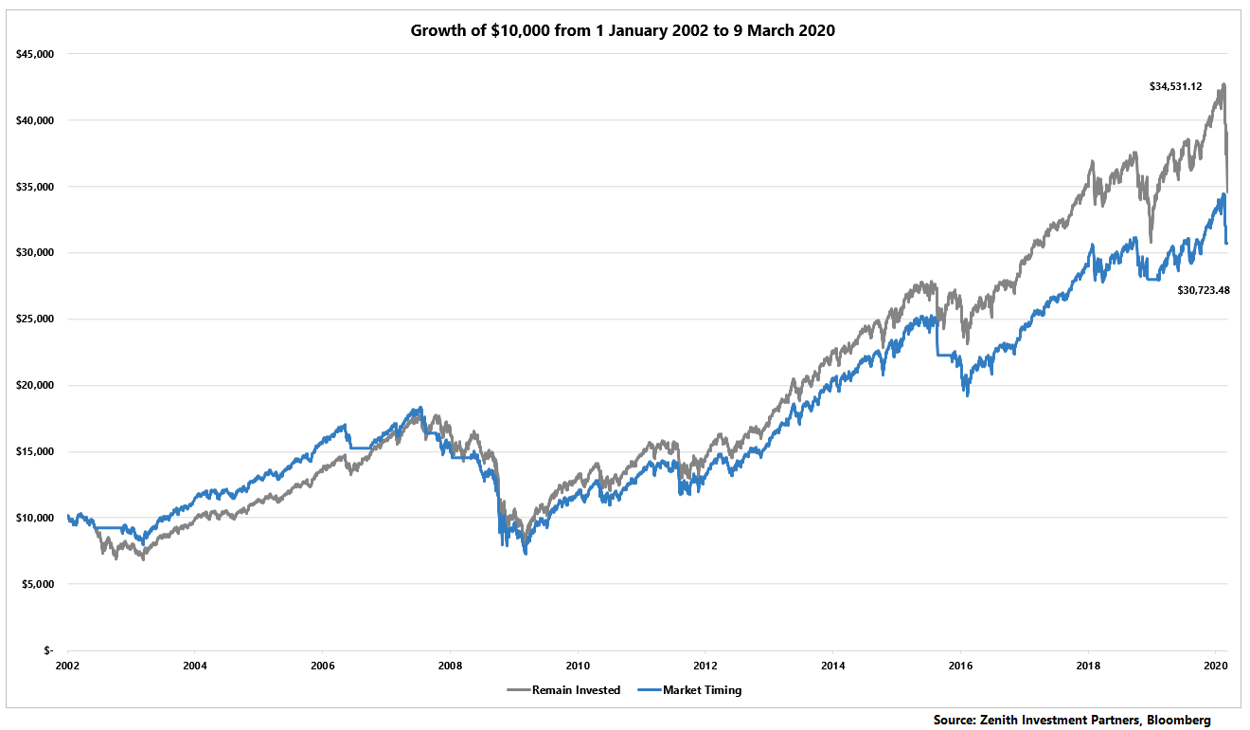

To illustrate the potential impact of market timing, we have attempted to mimic the behaviour of an investor with a market timing strategy, incorporating the behavioural biases described above. We have then compared this to an investor who remains entirely invested throughout the period. The following chart shows the growth of $10,000 in Global Shares (as represented by the MSCI World ex Australia (Hedged to AUD)) for each of these investment strategies.

As you can see, the remain invested strategy ($34,531.12) outperforms the market timing strategy ($30,723.48) for the period.

We caution that there is an additional layer of risk involved in the market timing approach that requires the investor to be disciplined and precise with timing transactions. Even one day too late or too early can meaningfully influence longer-term returns and growth of invested capital. This may diminish any benefit derived from timing strategies.

But let's not forget about tax and transaction costs

One aspect the analysis detailed above does not capture is the costs required to enact market timing. The model predicts that over the period there would be a total of 13 transactions required (either a full sale of invested capital or full purchase using investible capital).

These transactions would be subject to increased trading costs e.g. brokerage and buy-sell spreads, as well as increased realisation of taxable gains that would increase the tax payable. Conversely, the remain invested strategy would not incur these increased tax and transaction costs.

Conclusion

While we acknowledge the apparent attraction of short-term tactical asset re-allocation decisions, we believe the increased timing risks and costs associated with trading tend to outweigh the benefits of these strategies. We advocate remaining invested in a well-diversified portfolio that accesses a range of strategies and styles that each perform well in varying market environments.

As a result, elements of our portfolios will perform even during market uncertainty, which removes the need to engage in risky market timing strategies. We firmly believe that this is the most prudent approach to achieve consistent and strong long-term returns.

Important notes

The market timing model has two settings: fully invested or no market exposure (in which capital earns no return). The setting applied to the model abides by the following rules:

- If cumulative drawdown exceeds 10%, the model will change the setting to no market exposure

- While the model is set to no market exposure, it will re-enter the market if any of the following are satisfied:

- The cumulative return across the last 30 days is greater than 10%

- The cumulative drawdown has completely recovered

- If the model re-enters the market during a drawdown, it will exit the market again if the cumulative return across the last 10 days exceeds -10%