It has been 21 years since the critically acclaimed science fiction film The Matrix was released in which Neo had to choose between the red pill that reveals an unpleasant truth, and the blue pill which allows him to remain blissfully ignorant to reality.

So how does Neo’s experience relate to the Australian equities funds management industry?

Active Australian core managers have been presented with these two pills for a number of years, with those choosing the red pill understanding the headwinds that face the industry:

- The shift towards global equities investing

- Fee pressures driven by the rise of passive investing

- Internalisation of investment functions by superannuation funds

These issues have led to structural changes within the Australian equities funds management industry, with a number of core managers closing operations (those who, unfortunately, chose the ‘blue pill’), whilst many managers that remain have reduced management costs to compete with passive offerings.

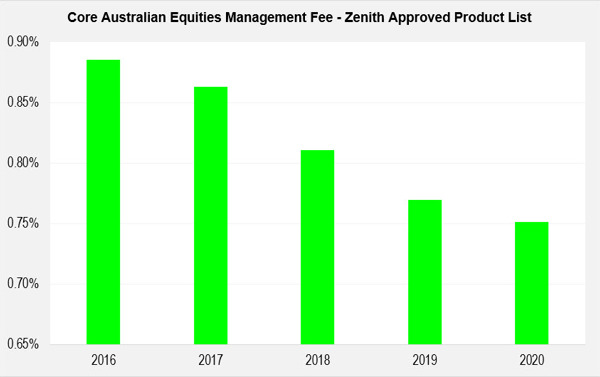

The chart below highlights the fee compression experienced by core long-only funds on our approved product list (APL) over the past five years.

Source: Zenith

We believe this fee compression trend will continue going forward for core long-only managers.

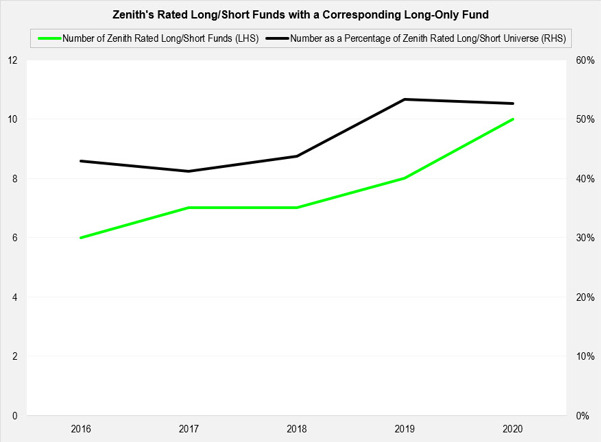

In an effort to remain relevant, a number of managers have also launched more creative responses. ”We have seen a clear trend showing the migration of long-only core managers into the long/short space over the past five years”, commented Quan Nguyen, Head of Equities Research at Zenith.

Source: Zenith

Short selling is a specialised skillset

Zenith believes short selling requires different skillsets when compared to traditional long-only investing and, as such, managers who employ shorting require an investment framework that differs to that of long-only managers.

For example, short sellers rarely short stocks purely due to heightened valuations, typically requiring near-term identifiable catalysts before initiating a short position.

In assessing the growth in long/short offerings in the Australian market, it has been evident to us that managers launching a long/short offering have taken one of the following approaches:

- Hired shorting experts with proven track records

- Gained experience and developed a demonstratable track record with internal capital before offering the strategy to external investors

Given the complex nature of short selling, we generally require a degree of shorting experience before initiating coverage on long/short strategies. To borrow a line from Morpheus:

“There is a difference between knowing the path and walking the path.”

Why have managers gone down this path?

Given the greater flexibility, specialised skillset and the use of leverage, it comes as no surprise that investors are willing to accept higher management and performance fees for long/short strategies.

Are the higher fees justified?

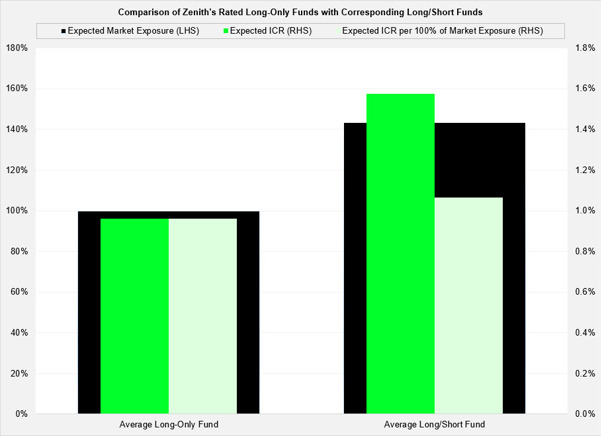

Long/short strategies typically have a higher gross market exposure (long plus short exposures) than their long-only equivalents. This effectively leverages or increases an investor’s exposure to a manager’s investment insights, as illustrated in the chart below.

Source: Fund Managers, Zenith

While a basic assessment in comparing the expected ICRs* of the offerings illustrates a material difference in fees, when adjusted based on the products actual dollar value invested (gross exposure), the fees remain comparable. In fact, there is just a 0.1% p.a. premium for long/short managers when ICRs are assessed per 100% of market exposure.

Furthermore, risk management results in managers setting the capacity of long/short strategies materially lower than that of their long-only counterparts. We have found that long-only strategies had a capacity limit that was over 12 times higher than their long/short counterpart.

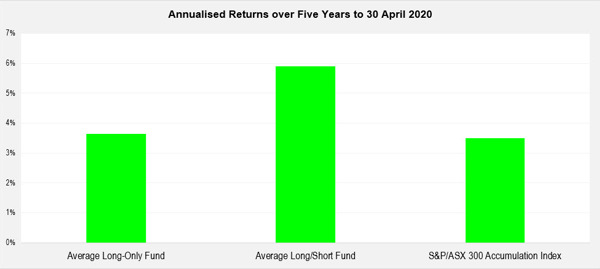

Do long/short funds outperform after fees?

Long/short managers have demonstrated an ability to outperform long-only managers on an after-fee basis.

Source: FactSet, Zenith

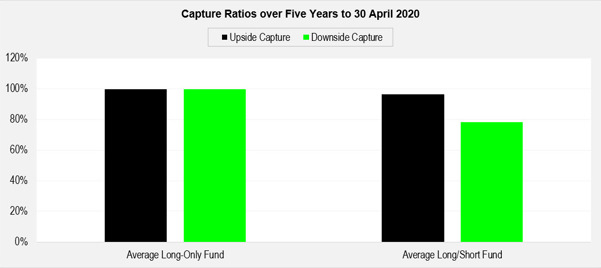

Furthermore, we wish to highlight the performance profile in up and down markets of long-only and long/short managers, shown in the chart below.

Source: FactSet, Zenith

Compared to its long-only peers and the benchmark, long/short funds have exhibited a differentiated performance profile, highlighted by their heightened downside protection (relative to the benchmark). In essence, long/short funds have demonstrated a stronger ability to protect investors when they want it most.

What can we expect going forward?

Going forward, we expect more differentiated and targeted equity products offered to market, with managers that identified changing market trends earlier, thriving. Conversely, we anticipate further consolidation for managers that have been slower to adapt.

Ultimately, we believe the market has clearly indicated to managers what is required to remain relevant. Taking the red pill approach may no longer be optional.

*Expected ICR has been calculated by assuming a fund exactly achieves its annual performance objective.