The swift and violent impact of COVID-19 has been clear for all to see, with lockdowns, rising unemployment rates and growing budget deficits putting significant strain on the global economy.

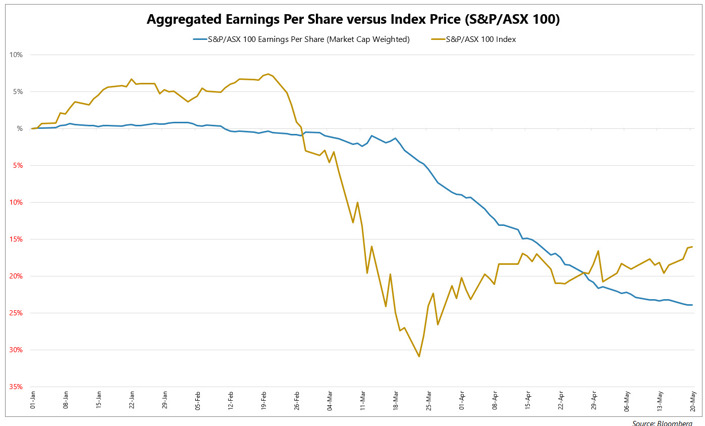

Australian equities have not been immune to the effect of the virus, with company earnings taking a material hit, despite the equity market rallying from its lows in mid to late March.

The following chart shows the estimated aggregated earnings per share of Australian equities (as represented by the S&P/ASX 100 Index) against the corresponding index performance since the start of the 2020 calendar year. The decline in earnings is clearly evident.

A flow on effect of an earnings downturn is the subsequent impact on dividends, as companies retain earnings, reduce payout ratios and raise capital to shore up balance sheets. Consequently, since the downturn, we have observed a number of companies cut, defer or cancel their dividends.

What impact has COVID-19 had on Australian dividend yields?

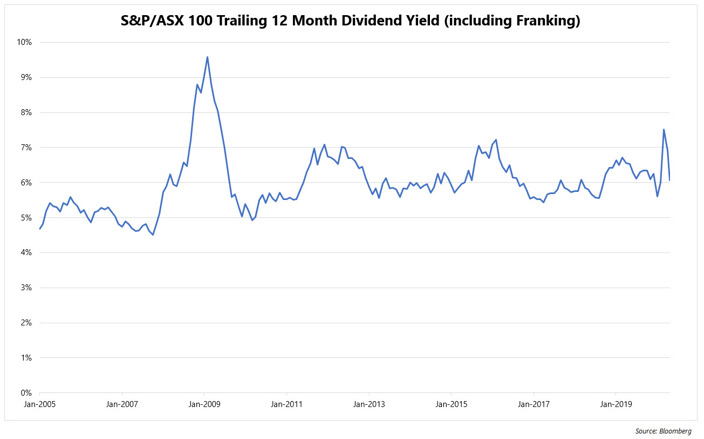

Dividend yields are a function of both dividends paid and the underlying price of a security or index. As the price of Australian equities have fallen by a significant amount, the trailing dividend yield of Australian equities initially increased before readjusting.

The chart below shows the trailing grossed-up dividend yield of the index for the last 15 years.

Over the assessed period, the grossed-up dividend yield for Australian equities has typically remained within a defined band of 5% p.a. to 7% p.a., with the exception of the global financial crisis (GFC).

As observed during the GFC, dividend yields were artificially inflated by the fall in the price of the underlying index. As such, we are acutely aware that this is not a true reflection of the current market environment for dividend yields.

What dividend yields can investors expect in the coming 6 to 12 months?

Although earnings for Australian equities have collectively fallen, different segments of the market are affected to varying degrees. That is, a company like Qantas has seen its revenues fall to almost zero whilst Woolworths, with toilet paper selling like hotcakes (and other grocery items in high demand), should experience revenue growth.

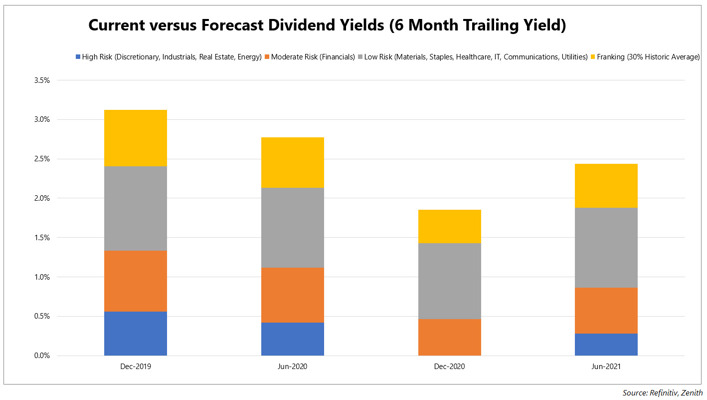

As such, to estimate the dividend yields investors can expect going forward, we have categorised each sector according to the likelihood and severity of dividend cuts into three risk levels – low, moderate and high. This output is shown in the table below.

Dividend Risk Levels Across Sectors

| Low | Moderate | High |

|---|---|---|

| Consumer Staples Telecommunications Information Technology Materials Utilities Healthcare |

Financials | Consumer Discretionary Industrials Real Estate Energy |

Further to this, we have assigned conservative dividend downward adjustment rates to each category over the next 6 and 12 months, relative to the 31 December 2019 dividend yield (pre-COVID19). When determining the adjustment, we have assessed each sector’s dividend profile, its forecast payout ratio and the potential of dilutive capital raisings. Our estimates are shown in the table below.

Estimated Downward Adjustments to Dividend Yields (Relative to 31 December 2019)

| 6-month period ending | Low | Moderate | High |

|---|---|---|---|

| 30 June 2020 | 5% | 10% | 25% |

| 31 December 2020 | 10% | 40% | 100% |

| 30 June 2021 | 5% | 25% | 50% |

From these assumptions, which were determined in consultation with our rated equity income managers, we have derived dividend yields for Australian equities over the next 6 to 12 months. Given the majority of dividends for the six months to 30 June 2020 were captured before COVID-19 fully took off, we have marginally adjusted the dividend yield downwards for the six-month period ending 30 June 2020. In addition, we have factored in a modest economic recovery for the six-month period ending 30 June 2021.

For the purpose of this analysis, we have assumed that the underlying index price level has remained static from 31 December 2019, which was pre-COVID-19. In addition, we have assumed that franking adds 30% to the underlying yield, which is the historical average.

The results are shown in the chart below. We have shown the dividend yields for each 6-month period, rather than an annualised yield, to highlight the changes from period to period.

As expected, dividend yields fall before reverting to higher levels, as companies and the economy recover from the COVID-19 shock.

How does the dividend yield on Australian equities compare to other asset classes?

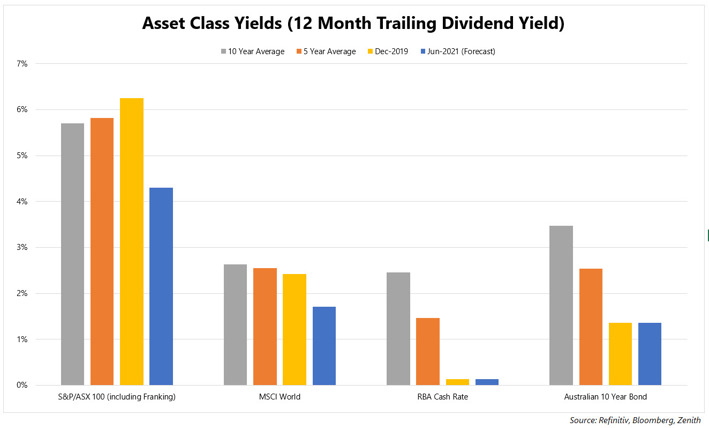

Despite a lower expected dividend yield for Australian equities in the near term, we believe it is important to view this dynamic across broader asset classes.

The chart below shows the yields from other asset classes. We have adjusted the dividend yield of global equities using the same method as above and have assumed the RBA Cash Rate and 10-year Australian bond yields remain static.

Despite the expected contraction of yields in Australian equities, it has arguably become even more attractive relative to other asset classes and should be viewed as a key source of income for investors.

Active management – the path to higher income

Although dividend yields for Australian equities are going to be lower in the near term, we note that there are active management techniques that can enhance income yields. The three main techniques are described below:

- Avoidance of companies with dividend concerns

A passive exposure to the S&P/ASX 300 Index would be significantly impacted from an income perspective. This would also be the case for passive high-yielding strategies that simply hold the highest yielding stocks (on a trailing basis) in the index.

Conversely, active managers who focus on fundamental drivers such as balance sheet strength and revenue/earnings forecasts should be in a stronger position to anticipate whether a company’s dividend-paying ability is under pressure and adjust their portfolios accordingly. - Dividend rotation

Active managers can enhance income through adopting a dividend-rotation technique, which takes advantage of company dividends being paid at different times in the year. This technique involves rotating in and out of dividend-paying companies throughout the year around ex-dividend dates and holding the position for at least 45 days to gain an entitlement to franking credits. Active managers can use this technique at various intensity levels to enhance income accordingly. - Options strategies

Active managers who can use options may further enhance income, particularly during highly volatile market environments. Active managers predominantly generate income through selling call options on stocks that they hold. Furthermore, an option’s value increases as the underlying stock’s volatility increases. As such, selling options in volatile markets can result in greater levels of income generation.

With these income generation levers available to active managers, Zenith believes our rated Australian equity income funds are well-positioned to deliver attractive income yields relative to the passive benchmark, with the typical yield premium ranging from 0.5% p.a. to 2% p.a. In addition, we view this yield to be appealing versus other asset classes available to investors.