Over the last decade, there have been two pivotal trends in financial markets: the increase in index-based investing (mainly through ETFs) and the rise of responsible investing. While traditionally most ESG-centric strategies have been actively managed, index-based strategies are rapidly growing in number, size and complexity.

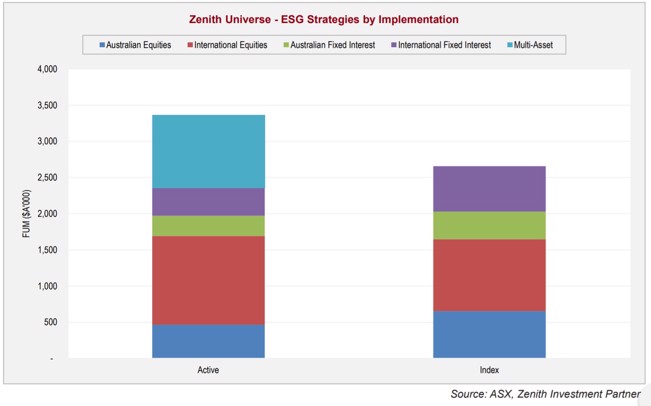

As shown in the following chart, across our investment universe of both unlisted funds and ETFs, approximately 44% of FUM was in dedicated ESG strategies that follow an index-based methodology.

With responsible investing being so highly subjective, can this be captured through an index-based approach such as an ETF rather than employing active management? While we believe the answer is yes, investors must understand which elements of each approach is of greatest value to them before choosing.

For ETFs, utilising an index with a defined set of rules gives clarity on which securities are included or excluded. In addition, ETFs daily disclosure of all portfolio holdings means investors can see exactly what’s held by the ETF at any point in time. Given ESG’s relative subjectiveness and the variance in social values of investors, these elements of process and transparency can be highly attractive for investors using ETFs, relative to actively managed funds.

However, lack of regulatory disclosure and uniformity means ESG data isn’t always robust or comparable and can also suffer from lags, creating potential challenges for indexing. It also typically measures current actions, not transitional activity. For investors seeking to have a more material impact, selecting active managers whose ability to embrace a ‘path to improvement’ may be more likely to result in greater ‘real world’ impact.

Active engagement is also critical to ESG outcomes. Managers of index-based strategies face unique engagement challenges, such as the requirement to cover a larger numbers of holdings with the associated resourcing requirements. In addition, unlike active managers, index managers typically have limited ability to divest at will in the face of sudden controversial issues.

Despite these challenges, large managers of index strategies can bring considerable engagement resources to bear, recognising that they’re forced to be long-term investors and obliged to work with companies to address ESG issues.

It’s also necessary to understand the impact of using an index which creates a bias towards securities of a certain size, industry or geography. While this is logical for a responsible investing objective, these biases may introduce structural consequences for a portfolio’s risk and performance characteristics under different market conditions. While not limited to index-based strategies, active managers typically have a greater ability to shift portfolios and address portfolio construction issues more readily.

Ultimately, we believe ETFs play an important role in ESG investing, however investors need to determine those elements which matter to them and on which they place a higher value. For those seeking higher control and transparency that nonetheless deliver a light to moderate level of ESG sensitivity, an ETF may be preferred. For those who value greater adaptability and engagement more fully, an active approach may be more conducive to meeting investor goals.

* This article is an extract from Zenith’s 2020 Exchange Traded Products Sector Report, released on 27 October 2020.