Key points:

- Discounts (and premiums) in Listed Investment Companies and Trusts are a normal part of market operation.

- All investment structures have different features which influence performance. Investors should choose the structure that prioritises features they value more highly while accepting compromises on others.

- Evidence suggests that investing over longer timeframes materially reduces the variance between the investor return and the underlying investment portfolio.

- Using a decision-based framework to choose between LICs/LITs or managed funds can help ensure an investor is compatible with listed structures, or not.

The issue of premiums and discounts in Listed Investment Companies (LICs) and Listed Investment Trusts (LITs) is subject to one of the longest-running debates in the history of managed investments.

For anyone observing LICs and LITs in March 2020, their price action relative to net assets was a fast-moving train wreck.

Along with the rest of the global equities market, prices dived at record speeds as social distancing and lockdowns threw economies into turmoil. Across all asset classes, liquidity proved priceless and investors proved willing to pay anything for it. Predictably, LIC and LIT price discounts to net assets widened at a vicious speed amid the sell-off.

Sentiment was already soft in the sector following the stamping fee debate in Q4 2019, which caused some LICs and LITs to trade materially away from their underlying value. For the vocal critics of the structure, these events have served to feed their claims that LICs and LITs are flawed. As most managed investments transact at net asset value, having vehicles which can trade at discounts of 30% or more is undoubtedly an easy target for critics.

However, we believe such attitudes lack critical thinking. Flawless investment structures do not exist. Trade-offs in various features are an inescapable reality.

Clearly, a different thought process is required.

Predictably irrational

Attributing premiums and discounts to any specific cause is difficult. There are multiple factors at play, operating at various strengths at different times. They can also intersect, compounding positive or negative effects.

When adding in the complexities of human behaviour (which may not always be rational), the only guarantee is that the price action of LICs and LITs relative to their stated asset value is rarely a predictable affair.

Issues regarding discounts are neither new, simple, or easily solvable. Arguably, many of these issues are not solvable at all. Events during the pandemic are a case in point.

LICs and LITs Catch a Cold in 2020

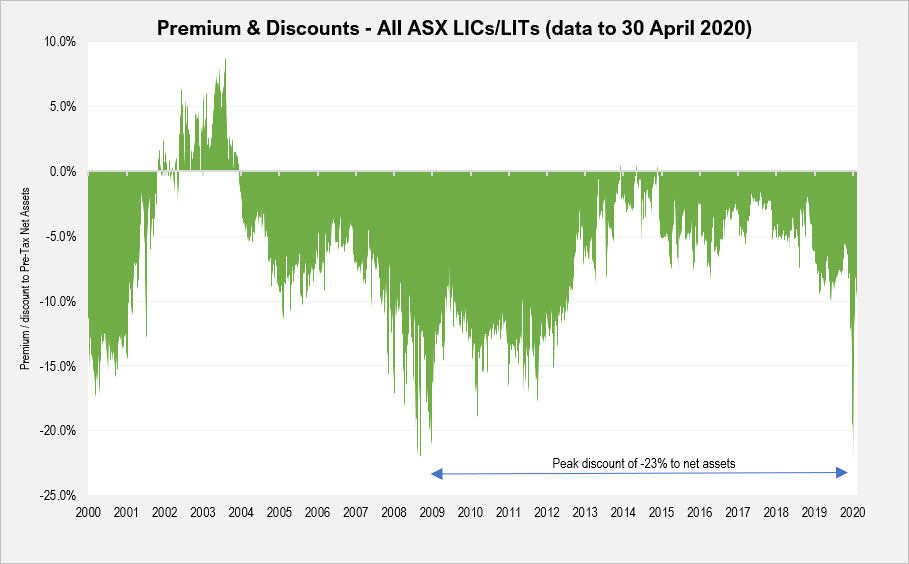

Consistent with the falls in broader equity markets, the speed of the downturn for LICs and LITs during March was unprecedented. Extreme volatility further exacerbated the average differential between share prices and net assets, with the entire sector reaching levels equal to that seen in the depths of the GFC, as the following chart shows.

Source: Zenith Investment Partners, Bloomberg

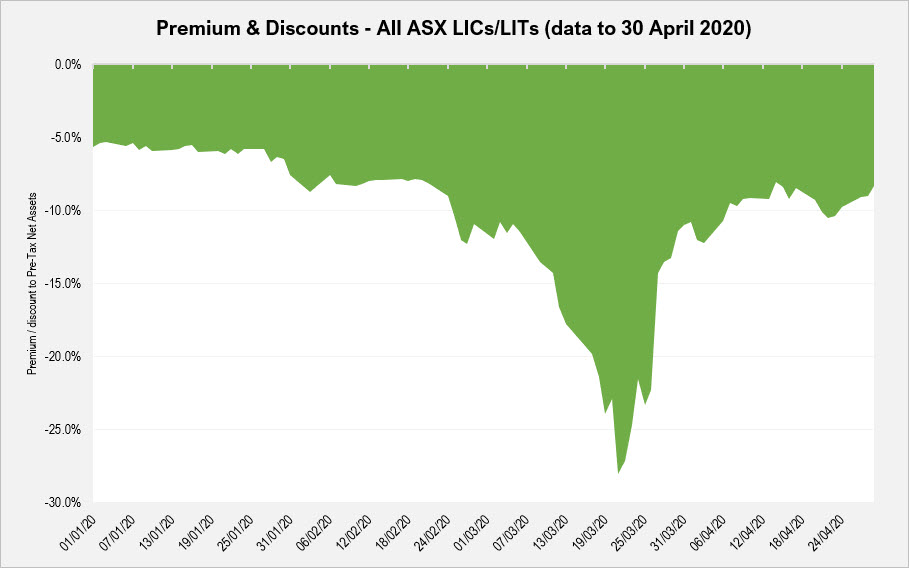

What is also notable is that the extreme discounts during March materially reversed in April. As much of this was attributable to the updating of net asset data, (which is generally lagged) as it was to buying activity, as risk-on appetites returned.

Source: Zenith Investment Partners, Bloomberg

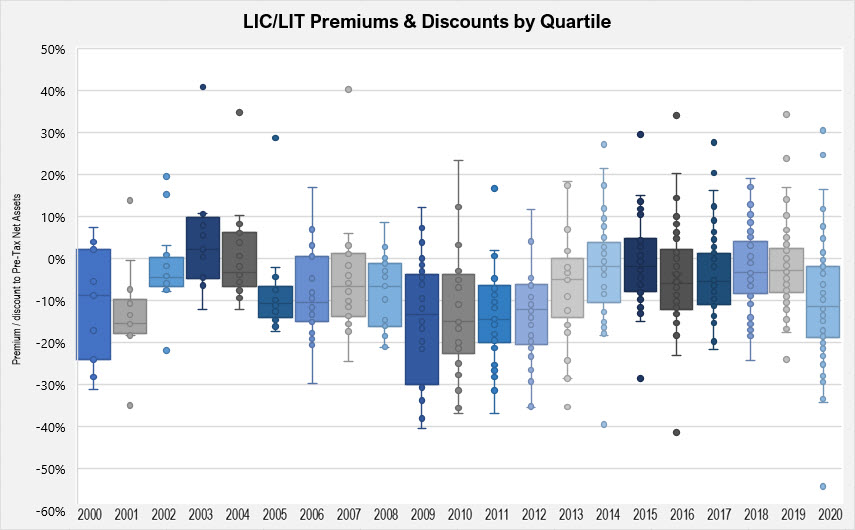

While on aggregate, discounts are pervasive, when looking at the annual spreads of price to net assets across the sector over the last 20 years (shown in the chart below), it is evident that even when the sector trades at a deep discount, individual vehicles can still trade at a premium.

Source: Zenith Investment Partners, Bloomberg

Given the extreme range of outcomes, investors should consider the following fundamental rule.

Investment structures matter

The behaviour of an investment is derived not only from its asset class and level of manager skill. The choice of investment structure is also critical to the outcome. Unlike manager skill, the investment structure is a permanent fixture of a chosen investment. As such, investors should place a high priority on understanding the implications of the different structures.

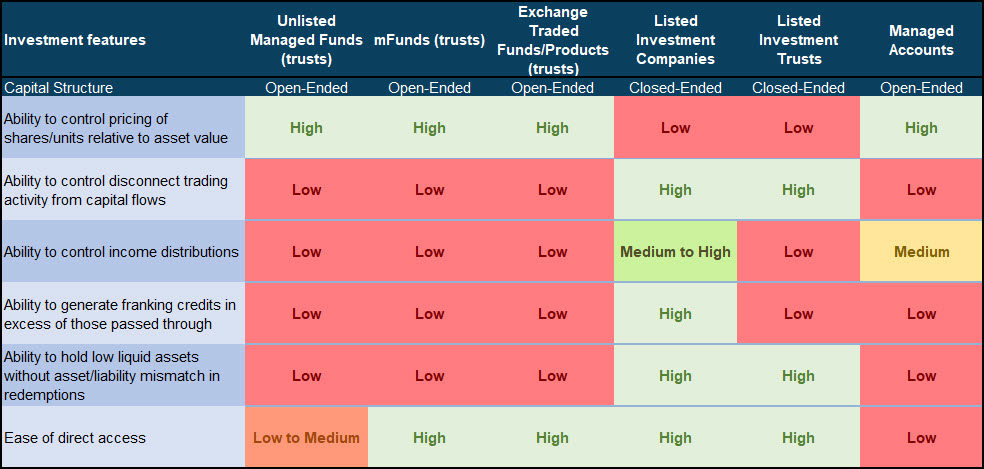

The following table broadly shows the most common investment structures available and highlights their major features and impact on investment outcomes.

Source: Zenith Investment Partners

What should be immediately apparent is that none of these structures perfectly delivers on all investment features. Each has elements which may be unappealing to different investors under different scenarios. Rational investors should therefore ensure they choose the structure that prioritises the features they value more highly and accept that they will have to compromise on others.

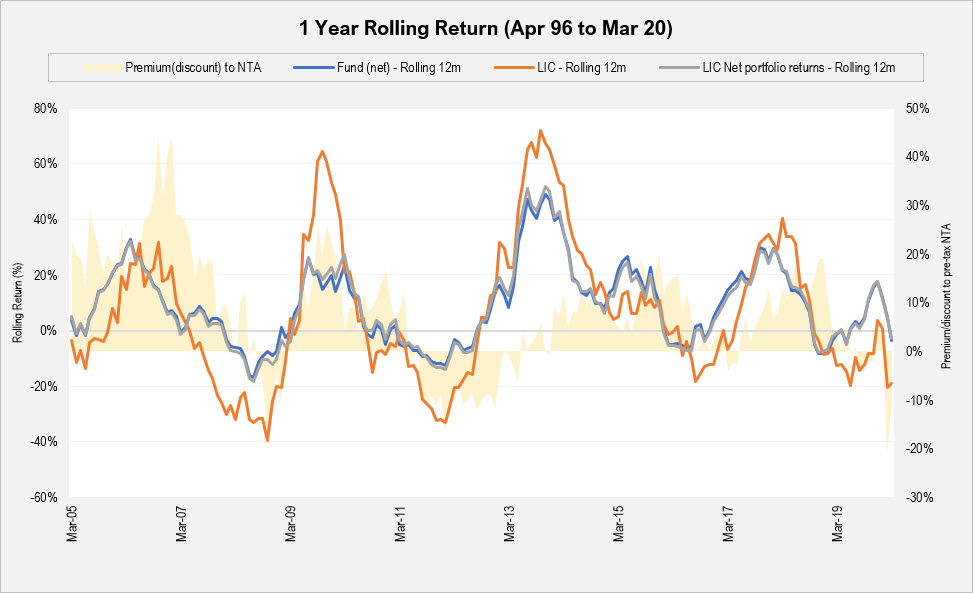

A real-world example can be seen in the following chart, which shows the investor experience using a managed fund and a LIC. Both vehicles are run by the same asset manager using essentially the same strategy.

Source: Zenith Investment Partners, Bloomberg

While the return of the unlisted fund (and the net portfolio performance of the LIC) are very similar, performance of the LIC has been impacted both positively and negatively by premiums and discounts in its share price over time. For investors, tolerance of the higher volatility in share price movements in LICs and LITs is a prerequisite to accessing other features of the structure.

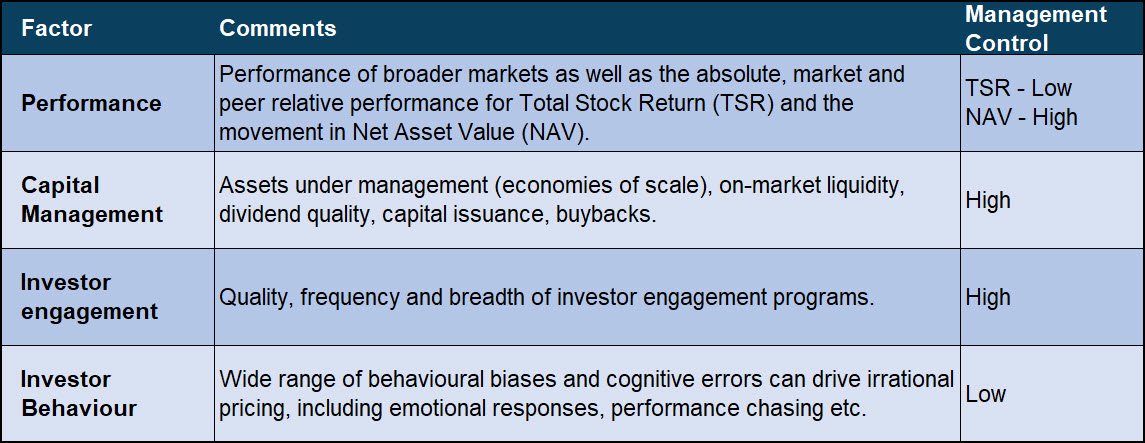

Drivers of premiums and discounts

There are multiple factors which influence premiums and discounts which vary in their timing, strength and interconnectedness. These can be broadly categorised as follows:

Source: Zenith Investment Partners

The frustrating aspect of premiums and discounts is their ability to be both persistent and highly variable over time. While the sector as a whole may trade at a discount, individual vehicles may not.

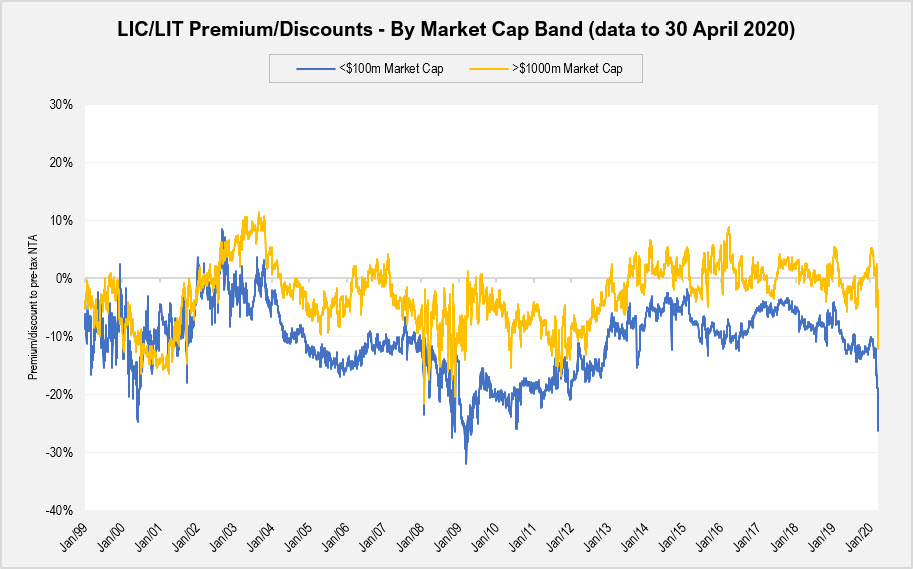

This means that many simple explanations for the existence of premiums and discount can have little ongoing explanatory power. Aspects such as size, asset class and management structure generally show weak results. Even size (shown in the chart below) is at best an impermanent indicator, showing that while larger vehicles tend to not experience discounts to the same extent, this is not always the case.

Source: Zenith Investment Partners, Bloomberg

Ultimately, we do not believe that there is a repeatable formula to determine the extent or frequency to which a LIC or LIT will trade away from its net assets, or to what extent such movements will revert to the mean. At best, investors can assess current price to net assets relative to each vehicles’ own long-term average. This may in some cases be broadly indicative of greater than usual premiums or discounts that may mean revert over time. However, the predictive power of such data is generally low as time horizons for such reversions vary widely.

So, if price to assets have little predictive power, should other considerations come into play?

Think about the time horizon

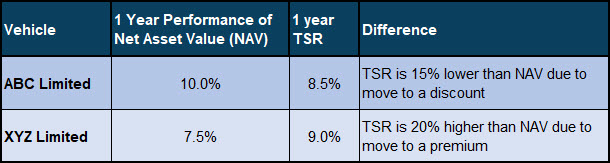

We accept that LICs and LITs which trade at a discount to fair value can be frustrating for investors. However, the difference between the investor experience (Total Stock Return – TSR) and the movement in Net Asset Value (NAV) must also be considered.

As an example, consider the two theoretical vehicles below with returns measured on a NAV and TSR basis. TSR incorporates the impact of premiums/discounts, while NAV does not. Obviously, the impact of premiums and discounts materially drives the investor outcome, particularly in the short-term.

Source: Zenith Investment Partners

This is important because while short-term results can show large dispersions between the return of assets and the TSR, this dynamic tends to change over the longer-term.

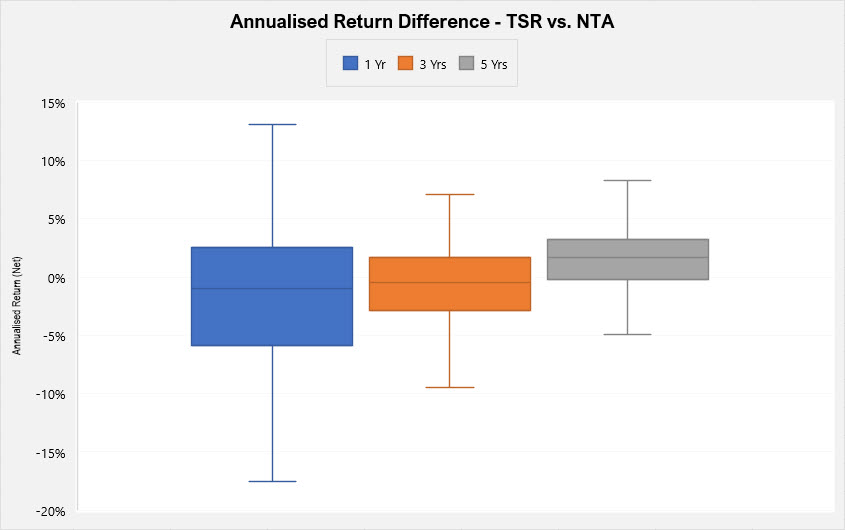

The following chart shows the average performance of all ASX traded equity LICs with a track record greater than five years as measured by the difference in return on NAV and the corresponding TSR over the same period (data measured annually over one, three and five years periods between 31 March 2015 and 31 March 2020).

When aggregating these results, it is apparent that when investors adopt an appropriate holding period for equities (five years), the dispersion of results between TSR and NAV is materially reduced. This is logical, as all else being equal, a key driver of TSR in the longer-term should the performance of the underlying portfolio.

Source: Zenith Investment Partners, Bloomberg

So how do investors choose? A decision framework may help

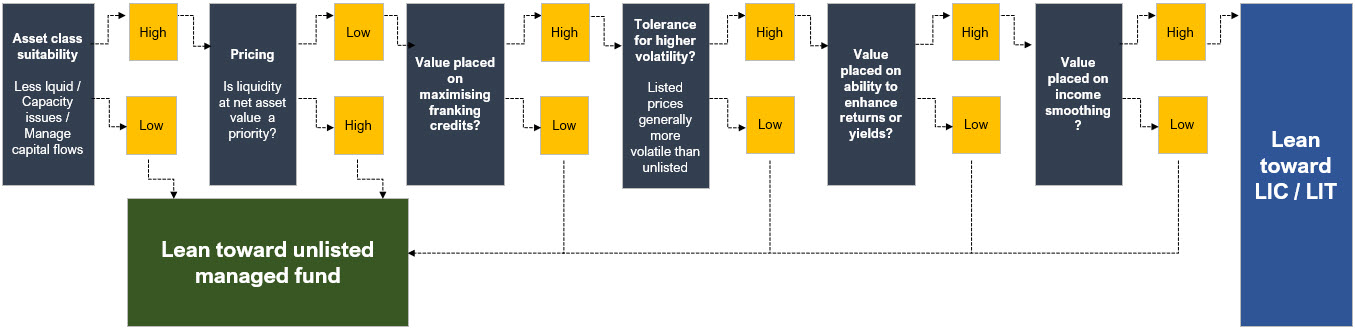

As stated previously, investment decisions should be viewed in the context of matching not only asset classes and investment objectives but also the structure that best facilitates the desired outcome.

To this end, we believe that advisors and prospective investors can utilise a simple framework to help ensure that an investor is compatible with the structural aspects of LICs and LITs, as highlighted earlier. For example, such a framework when choosing between a managed fund and a LIC/LIT could be pursued as follows:

Source: Zenith Investment Partners

Ultimately, we do not believe that premiums and discounts are an issue that can be ‘cured’. Rather, it must be accepted as the price for accessing a closed end structure with a different set of features as an alternative to other fund types.

Premiums and discounts are ultimately noise. While they fundamentally impact investor returns, we believe they should not be the overriding point of focus in the short-term.

Action points for investors using LICs and LITs should be:

- Ensure that choosing a LIC/LIT is appropriate for the goals you are pursuing.

- Understand the mechanics of these vehicles and accept that premiums and discounts are a normal part of market operation.

- Think about the appropriate holding period. If you made an investment last year on the premise of a five-year holding period, should you be changing that view now?