Warren Buffett, billionaire investor and business magnate, is known for his shrewd financial acumen and philanthropic endeavours. But what does he have in common with Chris Hemsworth, Michael Jordan and Jennifer Lopez?

Outside of all being successful professionals in their own right, they are also middle children, the family member often stereotyped as overlooked or forgotten. Similar can be said for mid-caps, the ‘middle child’ of Australian equities, which has historically been an underappreciated segment of the market. However, will this continue to be the case?

Flight to safety

Periods of economic uncertainty often drive investors to liquid and higher quality investments. Within the equities asset class, this is generally captured by a move up the market capitalisation spectrum. Given the market volatility over the 2022 calendar year, this dynamic was particularly apparent within the Australian equities market.

What about mid-caps?

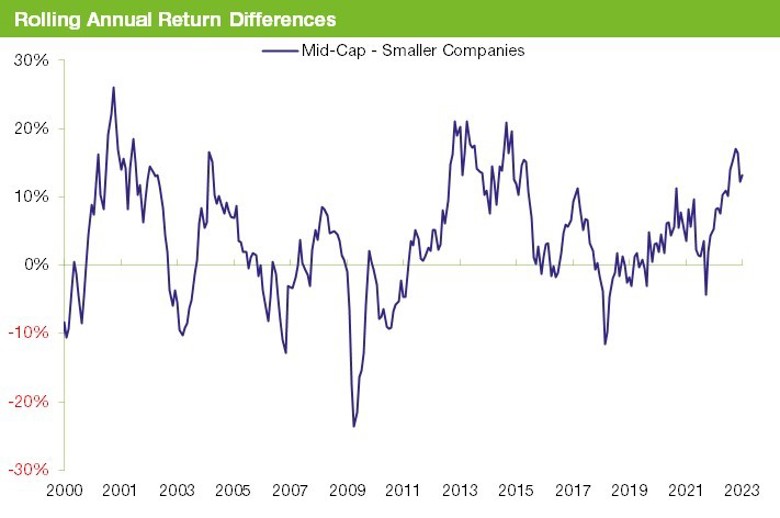

The chart below illustrates the rolling annualised 12-month performance differential between the Australian mid-cap companies (S&P/ASX Mid-Cap 50 Index) and Australian smaller companies (S&P/ASX Small Ordinaries Index) segments since 2000.

Source: Bloomberg

Whilst smaller companies sold off meaningfully in the 2022 calendar year, both mid-cap and larger companies offered investors a degree of downside protection.

How are small-cap managers positioned?

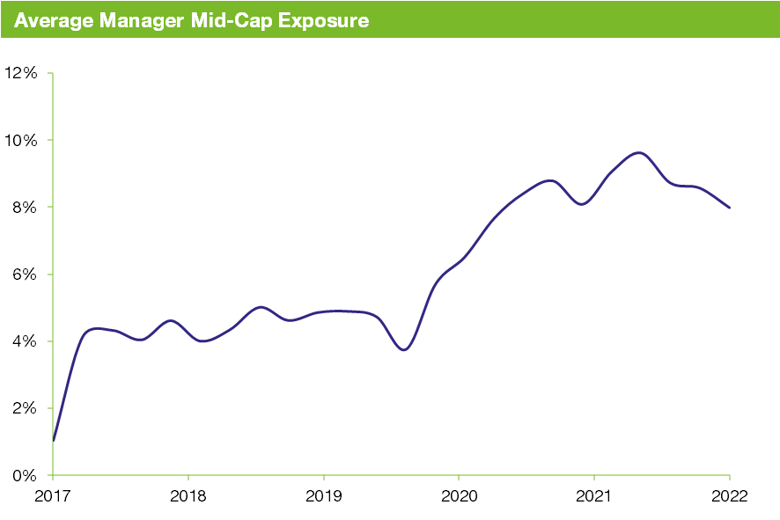

While smaller companies funds are restricted from gaining exposure to the larger companies segment of the market, exposure to the mid-cap segment is typically permitted to an extent. Within the context of our rated small companies funds, mid-cap exposure has been trending upward over the last five years, as illustrated in the chart below.

Source: Fund Managers

Smaller companies funds are typically required to sell-down securities that graduate into the mid-cap market segment. However, some managers maintain the flexibility to keep positions over a certain period or may be allowed to retain exposure up to a predetermined limit. For this to occur, we would expect to see one of the following three factors:

- Letting winners run – Managers maintain positions in stocks that have graduated into the mid-cap segment. These positions typically require stock upside to remain in the funds.

- Search for quality – Certain industries, whilst represented in the smaller companies universe, may be uninvestable due to a lack of quality companies or illiquidity. In such cases, managers may hold mid-cap positions for diversification and/or risk management reasons.

- Relative attractiveness of mid-caps – Changes in market conditions may mean certain segments are more attractive from a valuation perspective or offer higher growth opportunities.

We’ve noted there have been several smaller companies funds that have adjusted mandate constraints, over the past two years, to allow for increased levels of mid-cap exposure.

Dedicated allocation to mid-caps?

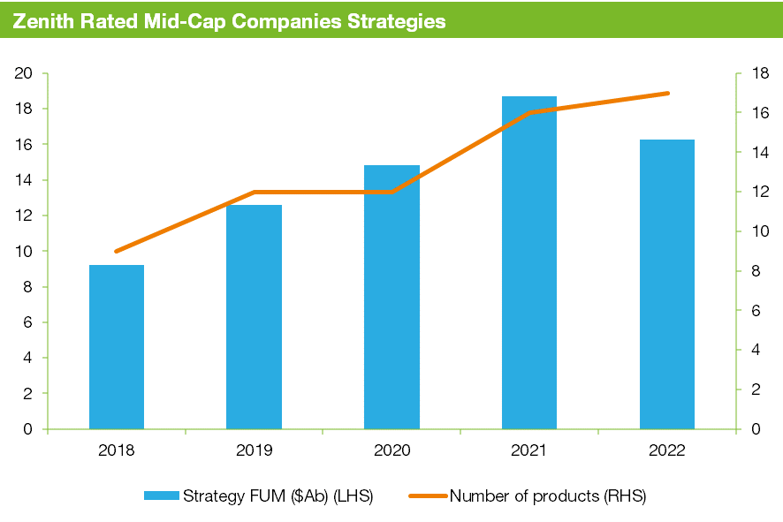

Historically, mid-cap funds in the Australian market have been underrepresented relative to their larger and smaller-cap peers. However, we've observed strong growth in the number of offerings in our Australian Shares – mid-cap companies universe over the last four years. The following chart highlights the number of products within the peer group from 2018 to 2022 and the corresponding funds under management (FUM) levels.

Source: Fund Managers

In conjunction with the growth in available products, there has also been considerable growth in FUM of the underlying strategies. Whilst negative market performance was a headwind to FUM throughout 2022, in the preceding three-year period total assets grew by over 100% to more than $A 18 billion.

For retail investors seeking a dedicated mid-cap exposure, the breadth of options has never been better!

From middle child to golden child?

In summary, if you want the stability and quality of larger companies and the upside potential of smaller companies, there is clearly a robust case to be made for mid-caps. With the strong growth of investment options in this previously underrepresented market capitalisation segment, it appears that the overlooked middle child is quickly becoming the golden child.