|

As the need for ESG practices and regulation grows across the Australian financial services industry, Dugald Higgins, Head of Responsible Investment and Sustainability at Zenith shares his insights and commentary as the ESG landscapes evolves. With continued growth and change anticipated within the ESG space, Dug breaks down what this means for investors, advisers, and businesses. |

The rise in consumers demanding greater sustainability in products, business practices and investments is a welcome change. Increasingly however, businesses are being caught between a rock and a hard place between growing regulations on sustainability disclosure on one hand and regulators poised to crack down on greenwashing on the other. Everyone, whether they know it or not, is walking a fine line.

In a previous article, we provided some suggested questions to test claims for greenwash. Today, we now turn our attention to the big issues we see in the future as greenwash targets.

What’s in a name? Expect more fund label crackdowns

In May 2023, ASIC released Report 763: ASIC’s recent greenwashing interventions, which looked at actions on claims and disclosures for a range of issues, including fund labelling. While noting several instances where funds were not ‘true to label’, there seem to be few actions resulting in name changes or in managers inserting other clarifications into documentation.

Given ASIC stated they reviewed 122 Product Disclosure Statements as part of this surveillance, issuers escaping unscathed could be forgiven for thinking they were in the clear. We believe such relief will be short lived.

Regulators are aware of the complexities of governing without guidelines. ASIC have clearly stated that other policy initiatives are coming, with a focus on:

-

development of new taxonomies for sustainable investment

-

further initiatives to strengthen ESG investment labelling, and

-

further initiatives to reduce greenwashing.

There’s a logical sequence here. Combating greenwashing will be aided by more effective investment labelling. Effective labelling is aided by formalising taxonomies. We’ve already seen this play out in other jurisdictions around the world. Australia’s sustainable finance taxonomy is already under development. The pieces are falling into place, so stay tuned.

The negatives in being positive

In responsible investing (RI), funds have extended past just using negative screens, to approaches that focus on aligning with positive action.

This is necessary as economies are reshaped to focus more on sustainability. Being able to channel investments toward those companies and industries seeking to deliver better outcomes for society is critical. However, there’s typically a catch.

Generally, most human actions don’t happen in a vacuum. Production of goods and services is, by necessity, usually an extractive process. When we talk about issues like decarbonisation or other targets addressing societal problems, there are always trade-offs to be navigated.

Clean energy can come at the cost of greater resource consumption to build the required infrastructure and can threaten job displacement for local communities if not handled appropriately. Minerals critical for the energy transition can have their own environmental and biodiversity impacts. Construction of technology such as solar panels can attract human rights controversies. The world is complex, and issues are usually not independent but rather interdependent. In pursuing one positive goal, it’s easy to negatively impact others.

Increasingly, issues will be judged on a net basis, rather than on the gross outcomes. We already see this happening in other jurisdictions like Europe, where for many market participants, disclosures on the negative impact of investment activity on sustainability factors is required. Local fund managers need to be aware that the days of merely focusing on ‘the green and the good’ may be numbered and that avoiding disclosing the inevitable negative externalities associated with most activities will need to give way to a more balanced approach, so that investors can make an informed choice.

Risk on, risk off – beware different fund risk profiles

For individual single sector funds, describing sustainability characteristics is relatively straightforward. However, this picture can become murkier in multi-sector portfolios where the extent and characteristics of RI principles applied across funds varies widely.

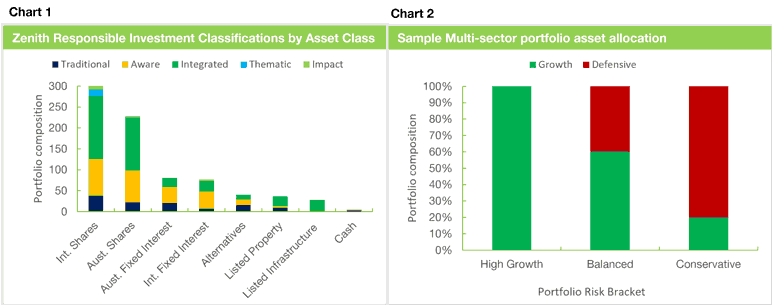

For example, when looking across the asset classes of Zenith’s rated funds used in our portfolios (chart 1), we recognise that there are a relatively large number of funds who are either incorporating ESG into their investment processes or pursuing deeper forms of RI such as thematic or impact strategies (sustainable funds are typically within integrated, thematic or impact categories - see here for further information on our Responsible Investment Classifications).

While there are plenty of options in growth asset classes, these start to narrow quickly for defensive assets. And depending on how portfolio construction has been approached, we see evidence that some ‘Responsible’ portfolios in the market are focusing heavily on RI in the growth component at the expense of incorporation in the defensive assets. This obviously risks the RI integrity of a portfolio for conservative investors (chart 2). Issuers offering RI portfolios across the risk spectrum need to be careful to ensure that these characteristics are consistent, not lopsided.

Source: Zenith Investment Partners, May 2023

In April 2023, ASIC released an update to Regulatory Guide 78: Breach reporting by AFS licensees and credit licenses. While focused on breach reporting for AFSL holders, they also cited a specific example regarding ‘ethical’ investing. The example noted that for funds promoted as having an ethical investment mandate, failure to comply with the mandate may result in documentation being misleading and be a deemed significant breach. We believe that managers need to exercise caution when describing RI across different risk profiles as these portfolios become more prevalent.

Trust me, I’ve got a logo!

There are a glut of memberships, certifications, regulations and market initiatives in RI, creating a maze of acronyms and logos which decorate presentations, fact sheets and websites.

In principle, having managers elect to join groups and pursue certifications can provide a valuable indication of at least some intent regarding RI and this should be encouraged. However, all too often we find that such pursuits are being casually referenced with little to no context as to what the adoption of such a membership or certification means to a particular fund.

Much of this comes back to the historical problems associated with a mish-mash of industry terms such as ESG versus sustainability or lack of transparency around what membership of an organisation means in a practical sense.

We believe investors need to ask some basic questions when confronted with the next scattering of colourful logos:

-

What applies at a fund level as opposed to a firm-wide level?

-

Does a membership mandate active outcomes or can members be passive participants?

-

Is there a difference between a supporter versus a reporter? What actually changes behaviour?

As part of a review of corporate greenwashing, the ACCC has noted concerns regarding “use of trademarks and labels” that are misapplied or claim greater application to a product than the reality. Given the Senate has also recently referred an inquiry into greenwashing, businesses of all types should be bracing for greater scrutiny on labels and logos.

The bottom line

Regulators are stressing that greenwash claims are eroding trust in the system. Misleading claims can advantage businesses, creating a competitive disadvantage against those who are seeking to be genuine.

Whether they’re intentional or inadvertent, greenwashing is a problem. Consumers often have limited ability to validate such claims, particularly if they’re highly generalised. Product issuers, investors and advisers need to understand clearly how they can avoid transgressing not only the regulatory issues of today but also be alert for those of tomorrow.