In the ever-evolving realm of environmental responsibility, 2023 marked a turning point for climate reporting. As we step into 2024, it’s evident that Australian capital markets are on the cusp of a transformative shift towards embracing the reality of addressing climate challenges. While the final details are still being hammered out following a series of (still ongoing) industry consultations, the overall direction and scope remain clear. Many companies and fund managers will soon need to start embracing climate reporting.

The launch of the IFRS International Sustainability Disclosure Standards from the International Sustainability Standards Board (ISSB), marks a significant positive milestone. This global initiative sets a new baseline for sustainability-related disclosures in capital markets, requiring companies to communicate their sustainability risks and opportunities over the short, to long term, as well as specific climate-related disclosures.

By and large, we believe this is a positive step. But with Australia poised to be one of the first countries to mandate the use of an ISSB-based standard, what will this mean for the funds management industry? Where are the implementation challenges? And is it too late to seek better outcomes?

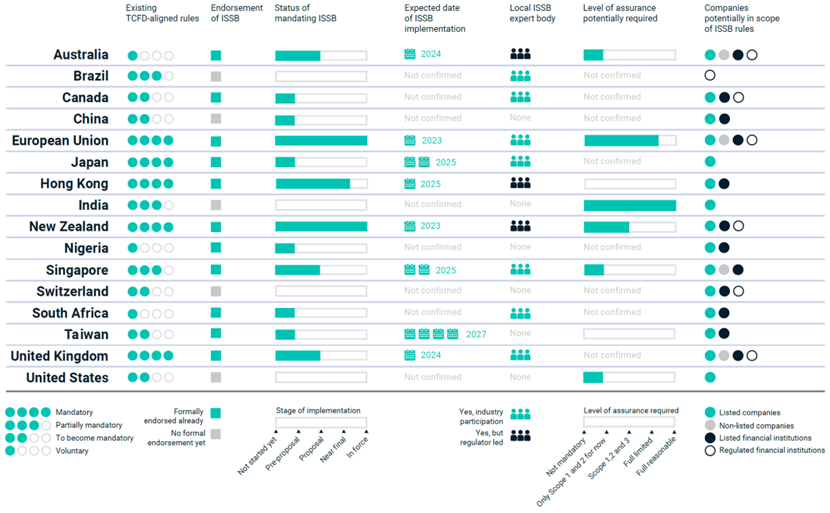

Global ISSB adoption around the world

Data as of October 2023. Source: MSCI ESG Research

Implementation challenges

The ISSB is a global baseline designed to ensure that companies provide investors with information relevant to their decision-making. These disclosures are designed to be delivered alongside financial statements as part of the same reporting package.

However, there are nuances in applying the ISSB standards to the diverse landscape of capital markets. The ISSB standard is designed for companies issuing debt and/or equity, enabling them to deliver decision-useful information to investors. The standard is not designed as a disclosure tool for funds.

This is not to say the standards aren’t useful. Investors opting for funds over direct investments in companies are showing a growing interest in obtaining comparable information concerning climate-related matters. We believe it makes sense to apply the same disclosures, which is what regulators are currently proposing. But will implementing the same rules around disclosures across both companies and funds actually work?

Timeline ambiguities

The creation and implementation of the new standards in Australia relies on Treasury and the Australian Accounting Standards Board (AASB) to work together to create and legislate the new rules. To date, the basic timeline on the various industry consultations has occurred as follows:

Observant readers will note the overlap between the consultations from the AASB, who are ultimately responsible for developing the local standard, and Treasury, who will need to legislate it in Parliament. This lack of alignment creates uncertainty within the investment management landscape. A synchronised effort is crucial for the smooth creation and legislation of the new rules governing sustainability reporting .

…result in testing times

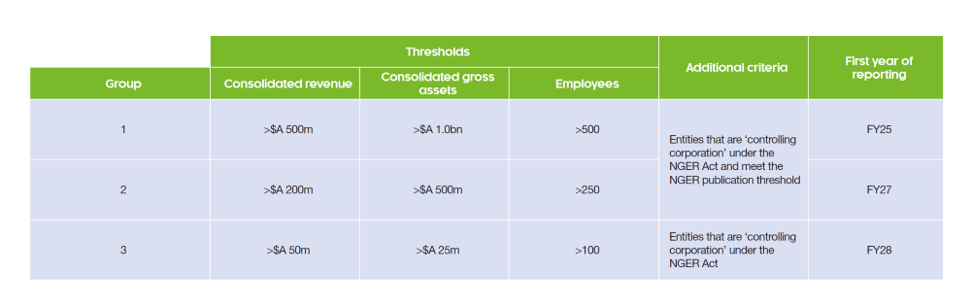

In the initial Treasury proposals, which were later developed by the ASSB into draft standards, both companies and registered Managed Investment Schemes (MIS) would fall within the reporting scope based on a set of threshold tests and specific timing criteria for various groups, as shown below.

Source: Treasury, Climate-related financial disclosures, July 2023; Zenith Investment Partners

However, in a seeming about face, in Treasury’s draft legislation released on 12 January 2024, the threshold tests have been altered with the introduction of “Asset Owners” as a category that will sit in Group 2. Under this category, reporting will be required for Asset Owners with $5 billion or more of assets under management.

This sudden lack of unity between Treasury and the ASSB raises urgent questions for funds. From a legal and regulatory perspective, there is no such thing as an “Asset Owner”. So who is being referred to? Depending on whether you look at the Responsible Entity, the Fund Manager, or an individual MIS, you get materially different outcomes regarding both reporting obligations and the availability of information to investors.

It's all about placement

The other issue arising from the ISSB design comes from its focus on financial reporting. Designed to be presented within financial statements, this works well for companies where annual reports hold significance in the investment decision-making process, however it proves less applicable to funds. In the case of funds, annual reports rarely play a pivotal role in an investor's decision-making process. Most fund financial reports lack substantial information about a fund's objectives, performance, or other characteristics crucial for assessing their suitability.

Secondly, there is the matter of these reports’ availability. There is no requirement for issuers of funds to make fund annual reports publicly available to non-members. Based on an examination of the websites of nearly 1,500 MIS, we estimate that over 45% of unlisted funds do not make annual reports publicly available to non-members. And of those that do, only a fraction are available over multi-year periods. Naturally, this differs significantly from ASX listed companies. While we recognise that the recent draft legislation from Treasury proposes that Product Disclosure Statements (PDSs) must inform people of the right to obtain a copy of the sustainability report, this doesn’t mean it’s made openly available.

If regulators follow through with current proposals to only mandate climate information in financial reports, we believe they risk unintentionally withholding vital information for investors to make informed decisions in funds.

The urgency for clarity

Treasury has stated that “the Government’s objective is to reduce information asymmetry between investors and firms” and that this will “improve the comparability, quality, and timeliness of disclosures”. They have also stated that this “also provides Australian companies with a framework for reporting, improving comparability of decision-useful information”. While we believe Treasury’s latest proposal does this for companies, we are less confident the same can be said for managers and investors in funds.

With over 3,600 registered MIS managing approximately $3.5 trillion in funds under management, the stakes are high. The ISSB’s efforts to standardise sustainability-related financial disclosures should improve data quality and support internationally comparable reporting. But it will only do so if reporting for the market, being both companies and funds, is fit for purpose. The current ambiguity between both Treasury and the AASB as well as between companies and funds, seems unhelpful. It seems to actively create information asymmetry, not reduce it.

We are not suggesting that every fund can, or should, report under the proposals. But clarity is urgently needed. We encourage those in the funds management landscape to take the opportunity to raise any concerns during the current industry consultations from both Treasury and the AASB before they close (9 February 2024 and 1 March 2024 respectively). Greater transparency not only benefits financial markets but also empowers millions of investors relying on accurate and comprehensive information. Let’s collectively ensure that the standards set are not just globally aligned, but also finely tuned to serve the distinct needs of companies and funds in Australia.