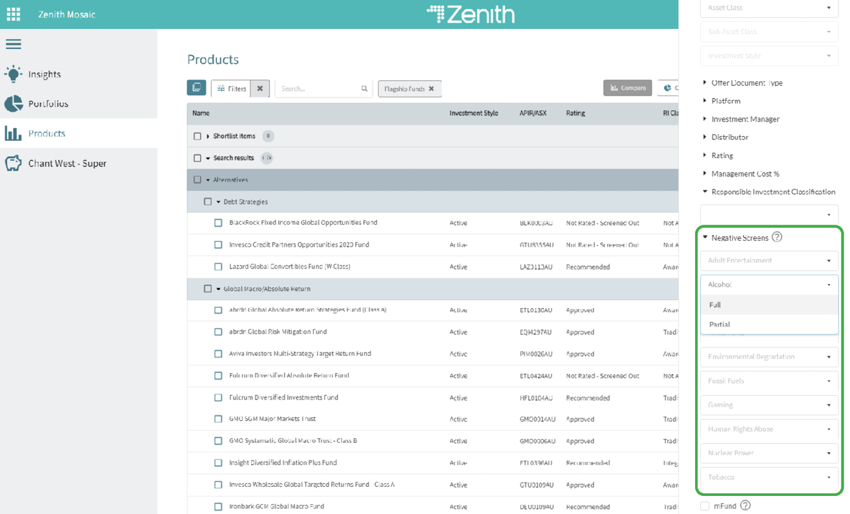

A new negative screen filter has been launched within Mosaic, providing additional Responsible Investment (RI) insights on the extent to which managers incorporate negative screens within their investment process.

While negative screens are just one of several approaches that can be used when considering RI issues, it nonetheless remains one of the most widely used approaches to implement a responsible investment policy. Screening often serves as a basic tool, to which other approaches such as ESG integration or active ownership can be added.

The negative screen filter allows advisers using the Mosaic portal to select products that exclude securities from certain sectors or based on certain practices. Covering all our rated products, the filter provides advisers with additional information on how managers approach stock selection, by recognising how a fund’s mandate restricts exposure to certain activities.

This information has been provided by fund managers during the annual review process. We’ve elected to prioritise issues that have historically been prioritised by investors as follows:

Negative screen filter categories

|

Adult entertainment |

Animal cruelty |

Environmental degradation |

Tobacco |

Fossil fuels |

|

Alcohol |

Armaments |

Human rights abuses |

Gaming |

Nuclear power |

Advisers can elect to search for funds based on whether each screen is applied by the manager as a ‘full’ or ‘partial’ exclusion of securities. Full exclusion is where all securities are removed and the company has no primary business operations to the screened practice. Partial exclusion implies the screening of the securities is subject to a threshold test, for example, a percentage of company revenue.

Considerations when using the RI Filter

Given the nuances of individual fund mandates, two critical issues should be considered.

Firstly, we’ve not sought to quantify any specific threshold parameters that apply to ‘partial’ exposures, so attention should be given to the individual fund documentation regarding each manager’s approach to these issues.

Secondly, the extent to which managers consider exposures to screened issues on a direct basis as opposed to with a company’s value chain is highly variable. As such, we stress that users should utilise the screening tool to filter down funds for further investigation, rather than assume that screening actions will fully reflect individual preferences.

How do I use the screening tool?

- Login into the Zenith Mosaic portal

- Select ‘Negative Screens’ from the filter list

- Select ‘Full’ or ‘Partial’ in the relevant screen

- Fund list will update automatically