Despite continued tightening of monetary policy from central banks’ interest rate hikes, bond portfolios could still generate positive investment returns in the years ahead, says Zenith Investment Partners head of multi-asset and fixed income, Andrew Yap.

Mr Yap says that while such a view may seem counter-intuitive, the performance of bond markets is determined by the market’s anticipation of future rate rises rather than the actions of central banks.

That considered, he believes official cash rates across the US, UK, Europe and Australia are likely nearing the market’s forecast of peak cycle.

“Should inflation surprise on the upside, this may extend the current interest rate hiking cycle. That said, the yield on offer across developed market sovereign bonds is sufficiently high to offer a cushion to offset capital losses on any subsequent bond repricing,” Mr Yap says.

“Retaining an overweight to bonds may translate into outsized returns as central banks loosen policy to stimulate growth. Active management may prove to be rewarding in the years ahead, and managers with a proven track record in interest rate management are positioned to outperform.”

Mr Yap says an unexpected rate hike would result in downward pressure on bond prices.

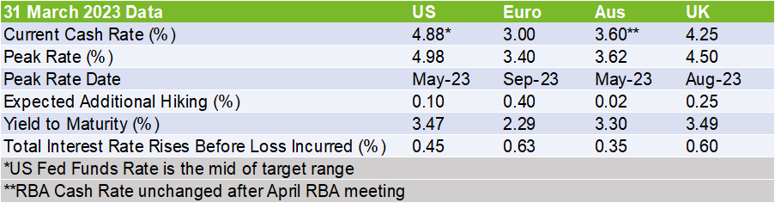

However, given the recalibration in global cash rates and the subsequent rise in bond yields, he adds that cash rates would have to rise significantly higher than anticipated before the capital losses exceed the income generated from bonds (see table below).

Source: Zenith Investment Partners

“Interest rates in Australia would need to rise a further 0.35 per cent above the market’s implied peak cash rate before the 3.30 per cent yield to maturity is fully offset,” Mr Yap says.

“While such an outcome is not outside the realms of possibility, it’s a lower probability event and as such sovereign bond holders have a reasonable level of insulation against unexpected hikes in the official cash rate.”

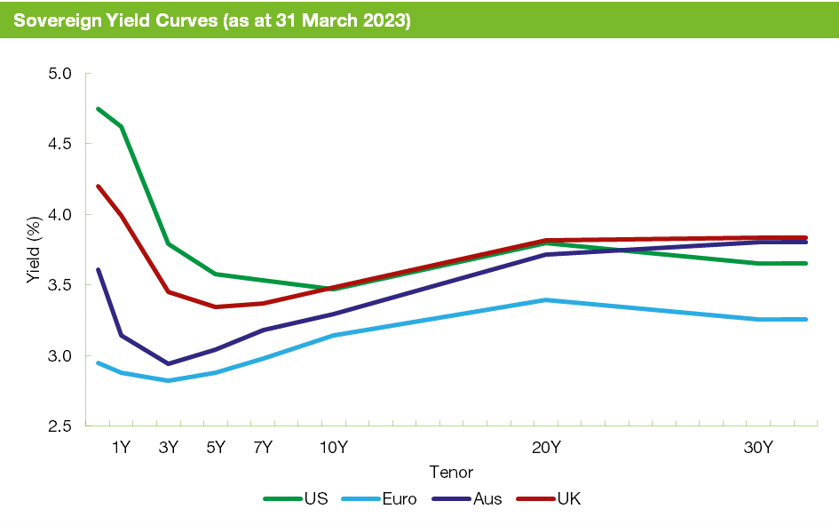

Mr Yap says the yield curves of 10-year Treasury bonds issued in the US, UK, Europe, and Australia reflect the market’s forecast of where cash rates will be in the future, taking into consideration near-term expectations, inflation and real long-term growth rates (see graph below).

Source: Zenith Investment Partners

Based on the 10-year Treasury bond yield curves, Mr Yap concludes that the market is pricing in further rate hikes for each of the above geographies to combat inflation.

“In the case of the US, markets are anticipating that the Fed will raise interest rates to 4.98 per cent by May 2023, up from its current level of 4.88 per cent (being the midpoint of its 4.75 to 5.00 percent),” he says.

“Should subsequent increases in this rate remain within this range, it’s unlikely that the 10-year sovereign bond yields will significantly shift.”