There are some ‘green shoots’ in the US economy with earnings estimates, housing and consumer sentiment improving, but investors should have a diversified portfolio as a reliable, protective barrier against all possible market scenarios for the coming financial year, according to Zenith head of asset allocation, Damien Hennessy.

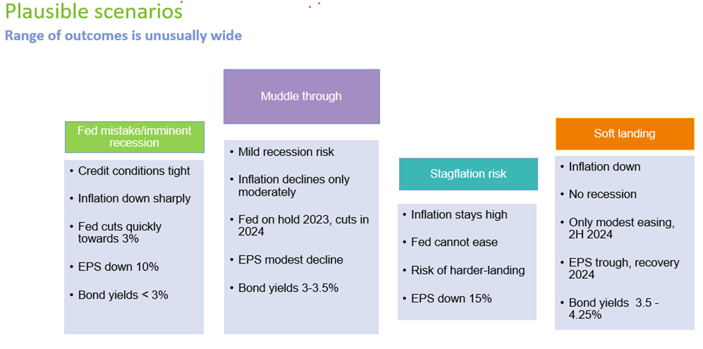

Mr Hennessy outlines four possible investment market scenarios for 2023/24, ranging from the ‘soft landing’ of lower inflation and no recession, to the worst-case scenario of ‘stagflation risk’, each with differing outcomes for markets (see below).

Source: Zenith Investment Partners

He says the markets over the last three months have headed towards a ‘soft landing’ scenario.

“Equity markets have held up reasonably well, while credit spreads have tightened a little bit. Markets are starting to price in a soft landing, with inflation returning to the 2 to 3 per cent range in 2024/25,” Mr Hennessy says.

“Another scenario is that the US Federal Reserve, and indeed our own RBA, fixated on cutting inflation, tighten monetary policy too aggressively, which increases the chance of a recession occurring over the next 12 months.”

“The Fed absolutely doesn’t want to be the central bank that lets inflation get out of control, so they’re prepared to go so far in tightening monetary policy. Ultimately, it’s good for bonds and probably good for cash, but risk assets would struggle.”

Mr Hennessy says the most likely scenario for markets is a period of higher-for-longer cash rates, which means ongoing risks of a mild recession. He calls this the ‘muddle through’ scenario, where inflation falls but remains higher than central bank targets.

“In this scenario, bond yields at least provide yield and recession diversification. Investors need to be selective within equities, underweighting those priced for soft-landing while seeking to overweight those assets and sectors already factoring in pessimistic outcomes,” he says.

“Indeed, there are some analysts predicting the ‘doomsday’ scenario of stagflation, or high inflation and stagnant economic growth.

“In this scenario, the Fed and other central banks feel they can’t do anything about a slowing economy because they’re still fighting the inflationary war. The probability of this happening is low but it’s certainly one that needs consideration.”

Amid such an uncertain market environment, Mr Hennessy says that, perhaps more than ever, the best defence for investors is having a diversified portfolio.

“Bonds have a place in portfolios, perhaps more so than they have for quite a few years now. Yields are in the 3 to 4 per cent range - not exciting, but they provide a bit of protection to investors for those more pessimistic scenarios.

“Cash and other short-dated investments that provide returns in that 4 to 5 per cent range can also provide a bit of flexibility for investors.

“The range of outcomes is so wide and broad, and investors need to respect the uncertainty that currently exists,” Mr Hennessy says.