Share markets have endured a tumultuous start to the year, with the war in Ukraine, lockdowns in China and inflation anxieties relegating COVID-19 news flow to the back pages. In this environment, timing when markets will reach their nadir becomes notoriously difficult to achieve and we implore investors to overcome the temptation to make hasty or reactive portfolio decisions.

The unique nature of this inflation-driven drawdown has meant that both equities and bonds have delivered disappointing year-to-date returns, with the ASX 200 generating -2.77%, the MSCI World -14.28% and our domestic bond market -8.10% - leaving investors with few places to shelter. However, predicting short-term market movements is fraught with danger and the correction’s end will only become clear in hindsight once the market has comfortably recovered.

Whilst the resolve of investors is being tested as the market euphoria of recent years is replaced by panic, remember that to achieve attractive long-term returns, you must be prepared to endure painful drawdowns along the way.

What goes up, must come down

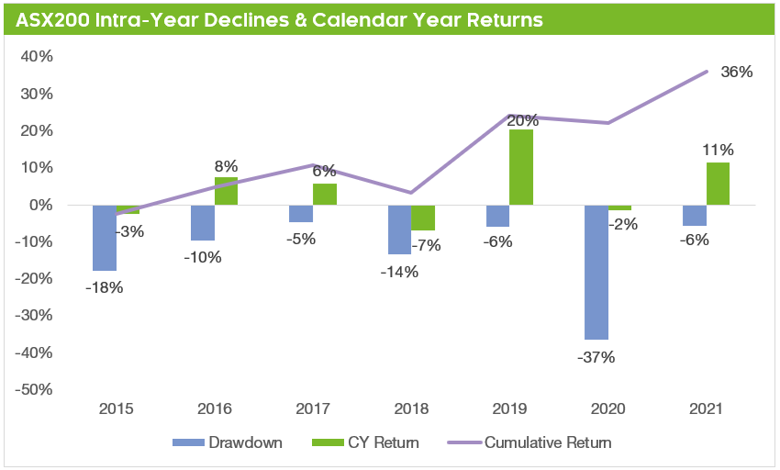

Source: Bloomberg, Zenith

As the above chart demonstrates, drawdowns on the ASX 200 in excess of 5% have occurred every year since 2015. Likewise, drawdowns exceeding 10% have not been uncommon, despite the market still generating a cumulative return of 36% over this period.

This highlights that although painful, the market drawdown year-to-date has been relatively normal and that generally it pays to stay invested during these ructions as the market has always recovered and subsequently breached new highs.

Fortunately, we design our portfolio with the aim of providing downside protection during risk-off scenarios, with multiple levers providing uncorrelated and differentiated return drivers. Specifically, it’s been encouraging to see our alternatives managers dampen volatility and enhance risk-adjusted returns.

Participate and protect

We consistently advocated for the use of alternatives in portfolios due to the insulation offered from typical equity market dislocations. This is due to managers’ unconstrained mandates which allows them to take both long and short positions in non-mainstream assets, such as gold, commodities, currencies and options.

Alternatives styles are varied - whether it's managed futures where directional views can be expressed through trend signals, or global macro where valuation discrepancies can be exploited across securities, sectors, regions and asset classes. Similarly, our market neutral and multi-strategy allocations have proved to be sound portfolio diversifiers amongst broader market turbulence.

The ability to profit in falling markets (shorting) isn’t constrained to our alternatives line-up, with our domestic equity long/short allocation likewise bucking the trend and delivering attractive downside protection as markets have fallen.

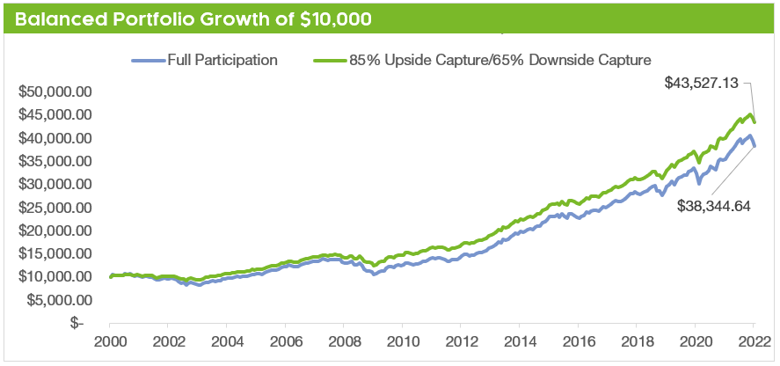

For our longer dated portfolios, this emphasis on uncorrelated return drivers to buffer volatility has delivered a since inception downside and upside capture of 70% and 88%, respectively. The below chart seeks to replicate this positioning and highlights the benefits of maximising capital preservation during falling markets.

Source: Bloomberg, Zenith

By reducing drawdowns when markets are falling, subsequent returns have a higher capital base to rebound from and ultimately deliver greater returns. We believe this asymmetry is optimised to deliver attractive absolute returns in normal market conditions, whilst providing valuable capital preservation in stressed environments.

Time in the markets, not timing the markets

Market corrections are always painful and the bruising sell-off endured this year is no different. However, it’s important to maintain a dispassionate outlook when investing in equities, as a glance back through the last 30-years of returns offered through the Australian market is instructive. The range of returns varies greatly, from a maximum gain of 30.3% in 2008 to a harsh loss of -22.1% in 2009.

Over the long term, the range of potential outcomes is overwhelmingly skewed positively, with an average return over the last 30 years of 10.4% p.a. Importantly, this has been achieved through periods of war, recessions, pandemics and other crises, which reinforces the benefits of investing through-the-cycle and not letting emotions cloud your judgement.

This time it’s different

At the market peaks and troughs, investors will inevitably use the ‘this time it’s different’ rationale to justify emotive-driven behaviours. And although it can be difficult to resist pessimism supplanting levelheadedness, we think viewing this drawdown through a historical lens provides invaluable perspective.

Whilst we remain highly attuned to emerging risks, we don’t feel that these are compelling enough to dissuade us from a constructive outlook on markets. As always, our underlying managers remain discerning in their investment opportunities and are using this indiscriminate selling to take advantage of dislocated markets and adding to their positions in high-quality companies trading at attractive prices.

Remember that markets always bottom well in advance of a positive shift in sentiment and making hasty portfolio decisions is generally to the detriment of meeting your long-term objectives. Instead, we remind you that a robust portfolio construction is the best way to win through not losing.