A common belief amongst advisers is that alternatives or absolute return strategies are designed to exhibit an inverse relationship with equities in crisis periods – that is, deliver positive performance when equity markets decline. While a small number of strategies achieve this, for the most part, performance is driven by a range of factors including portfolio positioning leading into market shocks, investment process design and the robustness of risk management approaches.

While generating positive performance in a negative equity environment provides strong ‘proof of concept’ and assists with adviser/client discussions, our expectations are longer-term focused. We expect our alternatives allocation to enhance portfolio diversification via long-term performance, volatility reduction and lowering portfolio drawdowns.

So, let’s de-bunk the myth of why targeting positive performance in negative equity environments is impractical, and explore some of the inputs that determine the performance of alternatives strategies in these periods.

De-bunking the myth

To achieve a perfect inverse relationship to equities, a derivative-based strategy, that directly profits from falling equity markets would need to be a permanent feature of an investment process on an ongoing basis. This can include systematically buying equity protection in the form of options, futures, VIX related strategies etc, and implemented to provide perfect downside protection or protect against a proportion of a market loss.

While the strategy sounds intuitive - is it feasible? Can it be implemented in a cost-effective manner? Portfolio protection could be applied to achieve 100% capital preservation (i.e. at-the-money) or slightly below the prevailing market, where investors participate in the first 5% or 10% of losses (or more) before the protection kicks-in. The degree of loss participation has a large bearing on the cost and how sustainable the strategy is on a through-the-cycle basis.

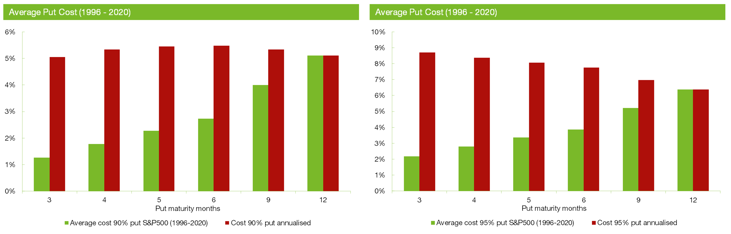

The following charts illustrate the average annualised cost for implementing a protection strategy where investor losses are limited to the first 5% and 10% of an equity drawdown - before the benefits of protection are realised. The analysis is applied to the S&P 500, based on rolling three-to-12-month maturities, with the methodology drawing on Insight Investment Management’s Proprietary Options Dashboard.

Source: Insight Investment Management

Based on the red bars in the charts above, the cost of implementing a protection strategy ranges between 5% p.a. and 8% p.a., depending on the level of desired protection. In addition, investors are also exposed to the initial losses of an equity market drawdown, subject to the level of put options selected (i.e. initial 10% of a market loss for a 90% put option).

In a low-return world, achieving a perfect inverse relationship with equities is largely prohibitive from a cost perspective. Therefore, alternatives managers need to rely on their ability to dynamically manage portfolio exposures and the quality and robustness of their underlying investment processes, to manage portfolio drawdowns.

So what drives the performance of alternatives strategies during crisis periods? What are the key messages that should be communicated to clients to manage expectations?

1. Risk Asset Positioning – Pre-Crisis

Positioning in risk or growth assets leading into a market crisis has a large impact on the performance of alternatives strategies, particularly during the early stages. If managers are broadly constructive on global growth and positioned with a long bias to equities, and there is a major shift in market sentiment or large exogenous shock, typically losses can be expected through these periods.

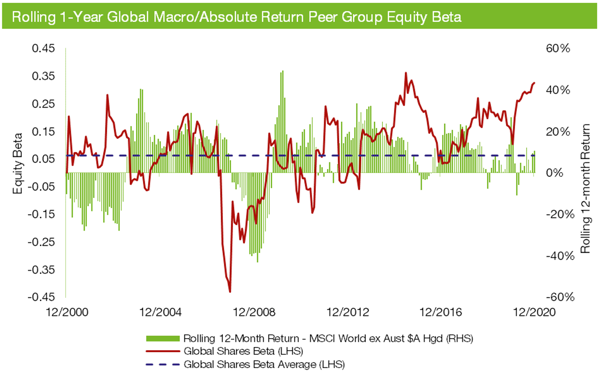

Using the COVID period as an example, the following chart plots the rolling 12-month Global Macro/Absolute Return Peer Group equity beta (LHS) and the rolling 12-month return of the MSCI World Index (hedged) (RHS) for the period 1 January 2000 to 31 December 2020.

Source: Zenith Investment Partners

Leading into COVID, equity beta was between 0.2 and 0.3, meaning that in the event of a sell-off, the peer group is potentially exposed to 20% to 30% of market declines (of the 21% decline of the MSCI World ex-Aust Index (Hedged) for the 3-months ending 31 March 2020). Understanding the positioning of alternatives managers leading into crisis periods provides an important lead indicator with respect to potential crisis period performance.

2. Investment Process Design

The design of an investment process including the underlying philosophy, security selection and portfolio construction approach are important contributors to determining how managers perform during crisis periods. Some of the key process design considerations include:

- risk/return targets: strategies targeting higher returns with commensurate volatility typically display a wider range of performance outcomes, with the potential for larger drawdowns

- commitment to tail hedging: maintenance of ongoing portfolio protection which could be an annual fee budget or opportunistically buying protection when the cost is inexpensive, and

- directional versus relative value approach: does the manager express outright directional views, such as long US or emerging market equities or employ a ‘pairs’ style approach where a long position is hedged with a short position. Generally, more directional portfolios are likely to experience drawdowns compared to relative value approaches. If a manager returns 20% plus for a rolling 12-month period, there’s a strong possibility that they are running significant directional equity risk.

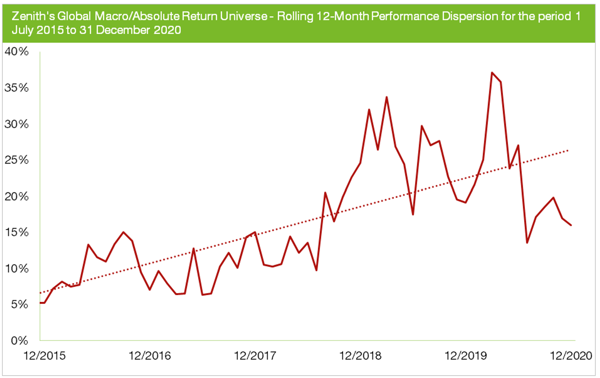

To illustrate the importance of investment process design, the following chart plots the rolling 12-month performance dispersion (difference between the best and worst performed manager) across the Zenith’s Global Macro/Absolute Return Universe for the period 1 July 2015 to 31 December 2020.

Source: Zenith Investment Partners

Over the analysis period the level of performance dispersion across managers has ranged between 5% and 35%, highlighting how the design of each investment process can impact performance outcomes.

3. Risk Management

Risk management is an integral component of each manager’s investment process and ultimately, its ability to deliver performance outcomes in line with stated objectives. While sound risk management processes are a pre-requisite to satisfy our due diligence process, there’s a spectrum in terms of sophistication, robustness and how managers use risk management strategies to enhance returns and protect capital.

Some of the more effective measures include equity beta caps, to limit a portfolio’s sensitivity to equity markets and control market exposure and ultimately drawdowns. Volatility floors can act to limit gross and net exposures and protect against markets that have their volatility suppressed by external pressures.

What does this mean for performance?

Alternatives managers employ a range of sophisticated investment strategies, designed to generate absolute returns with low correlation to traditional asset classes over the long term. However, over shorter timeframes and through large market regime changes, such as COVID, performance is expected to be more variable, driven by a range of factors, including positioning leading into the event and manager process design considerations.

While a perfect inverse relationship with equities is the holy grail, this is an expensive approach to implement on a through-the-cycle basis, requiring managers to use more innovative capital preservation strategies. Importantly, if a strategy is managed with long equities exposure or beta and the market experiences a large exogenous shock such as COVID, expect some participation in the downside.