February 2020 saw the beginning of the COVID-induced market meltdown, when share prices fell at the fastest rate ever seen. From peak to trough the Australian market shed 36% in just 22 trading days, and global markets fared little better. Super fund members, not surprisingly, were unnerved. They contacted their funds in droves and – despite reassurances – many succumbed to their fears and switched out of growth options into something safer, mainly cash. Two years on, we look at the consequences.

Investor panic drives switching activity

The COVID crisis struck quickly and perhaps because it was a public health crisis as well as a financial one, it sparked a strong nervous reaction from super fund members. Funds’ call centres were inundated and despite their best endeavours, received record numbers of investment switch requests. It appears that the range from fund to fund was about 2%-4% of members – higher than in the GFC. This likely translates to over 500,000 members switching out of their funds’ default growth option (61 to 80% invested in growth assets). The majority of those switched all the way to cash rather than to an intermediate conservative option.

Most of the switching activity occurred between late February and mid-April 2020. As it turned out, the COVID-induced downturn was relatively short-lived and markets started staging a recovery from the end of March. These early signs weren’t enough for the switchers, however, and only about 25% had switched back out of cash by the end of June that year. While most of those switching back returned to a growth option, that was not universal. Funds’ experience varied, particularly due to differing demographics. For example, funds with older members saw the majority who initially switched to cash move back to more conservative diversified strategies.

Central bank stimulus around the world and the rollout of support measures such as JobKeeper domestically improved sentiment as the year wore on, as did positive news about the development of a vaccine. The US election result in November 2020 further boosted confidence. By the end of December 2020, about 50% of members in most funds had moved back out of cash, meaning about half remained in cash, and funds tell us that 20%-25% were still in cash a year later at the end of 2021. Those members are languishing in close to zero return cash. They missed out on the post-COVID recovery and will continue to miss out on any meaningful growth if markets keep rising.

These people have either lacked the confidence or the motivation to restore their accounts to Growth, which in all probability is where they should be. Many are in the latter stages of their careers, maybe within 10 to 15 years of retirement, but as we often point out, most will keep at least some of their money in the super system well into retirement, so a significant exposure to growth assets is still important.

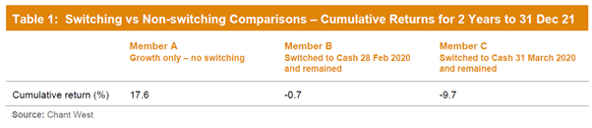

The financial implications of these switching decisions is sobering. Table 1 shows that hypothetical Member A, who sat tight in the median growth option throughout the two years to the end of December 2021, received a cumulative return of 17.6%. Contrast that with Member B, who switched to cash at the end of February 2020 (ie. early in the crisis) and has remained there ever since. Their cumulative return for the two years is -0.7%. Even worse is Member C who hit the panic button a little later at the end of March 2020. If they were still in cash at the end of 2021, their cumulative return would have been -9.7%.

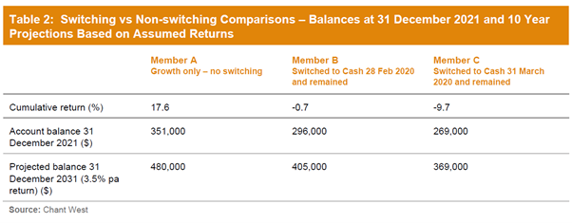

These percentage returns start to tell the story, but the real damage done by those switching decisions is only revealed when we convert them to dollars. In Table 2 below, we’ve assumed that Members A, B and C all started 2020 with account balances of $300,000. This would not be untypical for people within sight of retirement. We’ve further assumed that they’re all aged 55 (or 10 years away from retirement age) at 31 December 2021. The table shows their account balances at the end of 2021 and projected balances in 10 years’ time, assuming a 3.5% p.a. real growth rate to reflect the projected balances in today’s dollars. This assumes each member switched back to the growth option on 31 December 2021. For simplicity, we’ve ignored future contribution flows and applied a 0.3% p.a. administration fee.

Even after just two years, we can see that the implications of those switching actions for Members B and C are quite dramatic. Looking ahead to retirement, they end up with considerably smaller nest eggs, which if they take no remedial action such as additional contributions or delaying retirement, will see them with a diminished standard of living.

The timing is too difficult

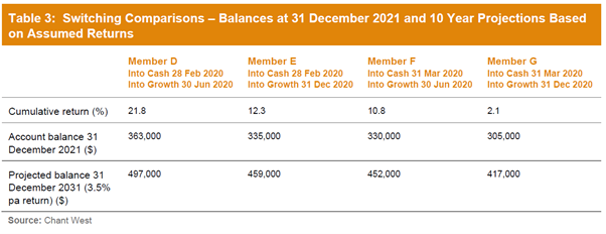

So how have those members who switched to cash and subsequently switched back (most of them to their original growth option) fared? The answer is that it all depends on the timing.

Table 3 looks at the experience of four more hypothetical members who all switched to cash and back to growth but at different times. Three of the four fared worse than our ‘sit tight’ Member A, although all four did better than Members B and C who are still in cash. The best result was achieved by Member D who was an early mover, switching to cash at the end of February 2020 and then back to growth at the end of June. By doing so they missed the worst month’s return for growth, which was -9% in March, and picked up most of the recovery which occurred in the second half of the year.

It’s important to note here that Member D got lucky, because to achieve what they did required them to get two very difficult decisions right – when to switch out and when to switch back. There were no obvious triggers for either move, and the chances of getting the timing right are very slim even for experienced investors. Member D is hypothetical and in reality, very few people would have got both those decisions correct, which is why the majority of switchers ended up worse off.

Making big decisions without advice is dangerous

Apart from the folly of switching on impulse, this episode reminds us of the value of advice. The funds we’ve spoken to tell us that members who sought advice from their fund were less likely to switch than those who didn’t. Had they done so, they might well have saved themselves from the self-inflicted financial damage. They would most likely have been told that the option they were in suited their investment timeframe, that it was well diversified into assets other than shares and that this would cushion the blow of the share market collapse, which proved to be correct.

The fear of losing money, even if only on paper, is a powerful emotion and difficult to overcome without the calming influence that expert advice – either from within the fund or from an external adviser – can exert. For the hundreds of thousands of members who did switch, the anxiety proved to be too much. They’ve now discovered that risk aversion comes at a cost.

For more information on Chant West's super fund product research or switching tools, please contact our team at [email protected]