Questions have recently been swirling around the outlook for unlisted property as investors start to query the seemingly impenetrable valuations. Particularly when contrasted against the backdrop of AREITs (Australian real-estate investment trusts) having endured agonising drawdowns, the market’s conviction in these seemingly gravity-defying valuations is starting to falter.

The driving force behind this extreme divergence is the differing liquidity terms under which AREITs and unlisted property trusts operate. AREITs are liquid trusts traded on the ASX which manage and acquire interests in property on behalf of shareholders. This differs to unlisted property trusts which generally have more limited withdrawal windows given the illiquid nature of the underlying assets.

Historically, in our portfolios we’ve preferred AREITs due to their superior liquidity, as we recognise that our clients value the ability to exit their investments in a timely manner. However, because AREITs trade daily on the ASX, investors are exposed to the vagaries of the prevailing market sentiment – both to the up and downside.

A picture is worth a thousand words

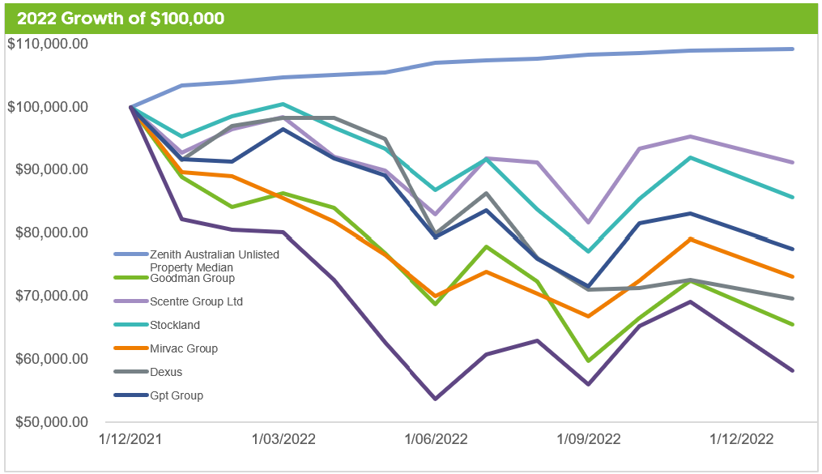

This discrepancy is best illustrated via the below chart which contrasts the performance of the median manager within our Real Assets / Real Estate - Australia sector against a representative basket of Australian AREITs over 2022.

The severe market dislocation over the last 12-months and active price discovery in listed markets has many AREITs languishing in bear-market territory. This is because investors can actively reappraise these stocks and have determined that due to the structural rise in inflation and interest rates, more compensation is required.

Resisting the gravitational pull

Importantly, the dynamic is vastly different in unlisted property markets where valuations are relatively infrequent (typically quarterly to annually), conducted by a valuer, and largely underpinned by transactional evidence. Although generally fit for purpose in normal market conditions, the appraisal-based approach can give the veneer of safety during turning points in the cycle, as transactions dry up and unlisted valuations move slowly.

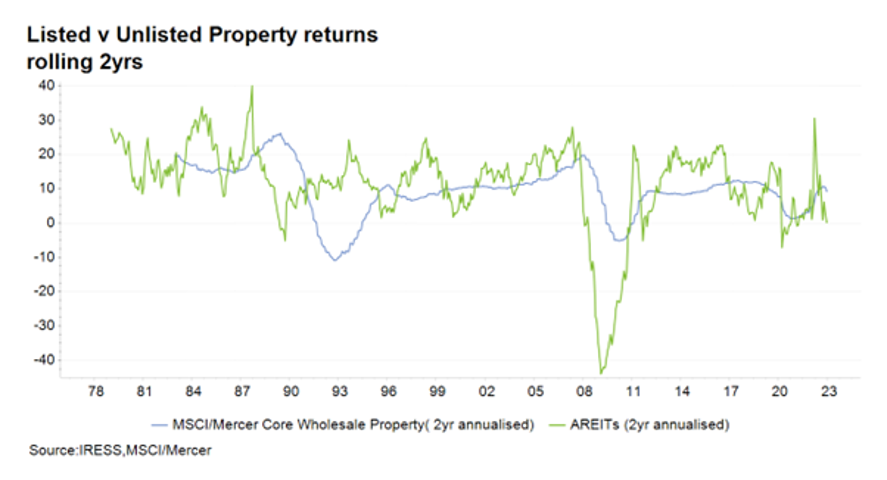

This is captured in the below chart which demonstrates that through-the-cycle, the rolling two-year annualised returns converge, albeit with unlisted property typically lagging.

Illiquidity begets illiquidity

With equity markets characterised by unpredictability, the illiquid nature of unlisted property appears attractive, as investors emerge seemingly unscathed from the market turmoil – that is, until they try and sell. However, investing in unlisted assets purely to reduce short-term portfolio volatility fails to consider the fundamental risk and return drivers of the underlying property assets.

Investors could understandably be forgiven for seeking to cash-in in anticipation of unlisted markets catching-down to their listed equivalents. In concerning signs from offshore markets, rumblings of a stampede for the exit have been growing for Blackstone’s high-profile property fund, BREIT, which recently gated redemptions, thereby leaving investors unable to sell.

Importantly, whilst we’re yet to see any redemption pressures percolating within our peer group, it does highlight the illiquidity risks lurking within the sub-sector.

Sounding the alarm

Now sounding eerily reminiscent of prior property downturns, investors have rightly turned circumspect on last year’s investment posterchild. And due to these shifting winds and the inevitability that unlisted markets will reprice lower, we retain our preference for AREITs at this point in the cycle.

Crucially, this highlights the dilemma facing industry super funds whose performance has been buoyed by their meaningful allocations to unlisted assets. And with these hidden risks now laid bare as the cracks emerge, we have full confidence that the conditions are ripe for our highly liquid portfolios to outperform.