China’s deflating property market has sparked unease amongst the investment community, as the ripple effects from property developers teetering on the brink of collapse are feared to be spreading to the broader economy. The first chip to fall was Evergrande in late 2021, where rumblings of a default had been brewing for months.

Notwithstanding the media hype, the eventual default was relatively anticlimactic, as the Chinese authorities had effectively ringfenced the contagion. Following a brief period of calmness, alarm is once again percolating, as China’s highly leveraged property sector appears to be headed for more turbulence.

Pushing on a string

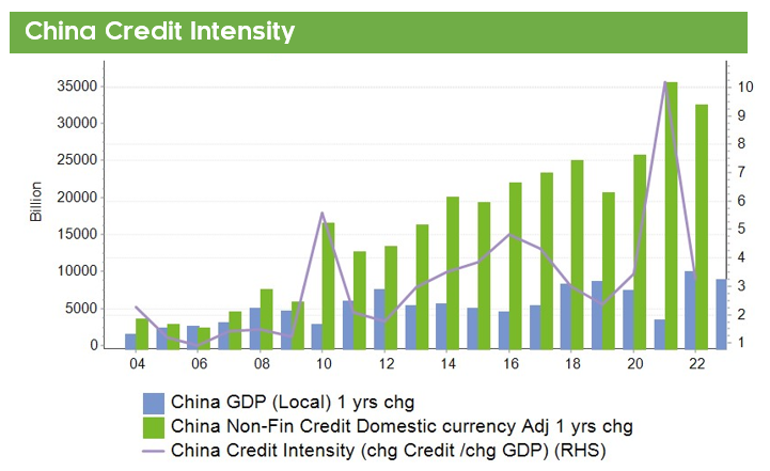

The below chart highlights China’s growing reliance on debt to generate GDP growth, with a clear divergence evident in recent years between the volume of debt required to generate a dwindling amount of GDP. Importantly, although the authorities have sought to curb the speculative excesses on display in the property sector, it’s believed that the People’s Bank of China (PBOC) has sufficient resources to ensure the smooth functioning of capital markets should conditions deteriorate further.

Source: Bloomberg, Zenith

Far from being rogue operators, these developers were emblematic of China’s debt-fuelled expansion, with property now comprising 25-30% of GDP. It’s this once booming property market which underpins Evergrande and others’ rapid ascent, however a recent slowdown in the Chinese economy has exposed the crippling levels of debt that the property sector holds.

Triple threat

In recognition that property developers had been sleep walking into disaster, the ‘three red lines’ policy was introduced in August 2020 to improve the financial health of the real estate sector. The three red lines were imposed on property developers to help stem growing debt levels and unsustainable price increases, and include:

- Liability-to-asset ratio (excluding advance receipts) of less than 70%

- Net gearing ratio of less than 100%

- Cash-to-short-term debt ratio of more than 1x

Exacerbating property developers’ woes has been the Chinese Communist Party’s (CCP) relentless pursuit of ‘common prosperity’, which saw price limits imposed on new property developments and harsh penalties for developers who failed to deliver projects on time. Where previously it had been widely assumed that these behemoths were too big to fail and that an implicit government guarantee would act as a backstop, this optimism has recently faded as the cash-crunch worsens.

Taking the stairs up and the elevator down

Once seen as the posterchild for China’s property boom, Evergrande and other high-profile property developers soon found themselves in the authorities’ crosshairs after having contravened all three red lines. This quickly sparked a chain reaction of high-profile defaults, with upwards of twenty developers having defaulted in the last year alone.

Source: Bloomberg, Zenith

Debt Jubilee

Unlike in Australia, apartments in China are generally purchased in full and off-the-plan. Consequently, the bleak outlook for the property sector has ignited discontent amongst recent buyers who have watched the value of their unfinished apartments plummet.

In response, a large contingent of disgruntled buyers have initiated a mortgage boycott which threatens to destabilise the broader economy. A similarly growing group of suppliers to property developers have likewise followed suit and are now also withholding payments on bank loans until their own debts have been paid.

This payment protest is the latest disruptive move in China’s economy which threatens to spill over to the broader financial markets unless it’s swiftly contained. Importantly, in efforts to restore confidence to the market, China's State Council has recently rolled out a trillion-yuan package in economic stimulus.

Part of the stimulus comprises US$146 billion targeting infrastructure, property, and private business. It also includes an additional $44 billion for State banks to finance infrastructure projects. Along with the recent surprise 10 basis point cut in interest rates, the intention is to signal safety and provide comfort to prospective buyers to enter the market.

Ripple effects

Adding to the negative sentiment around China’s once buoyant property market has been the CCP’s unrelenting zero COVID-19 policy, mass rolling lockdowns, inflationary pressures, and ongoing regulatory uncertainty. This has prompted concerns that China’s insatiable growth trajectory might finally be coming to an end.

The fear is that this might leak into the broader economy and hinder global economic growth. Within our domestic market, this has created some uncertainty given a large portion of our export revenue is derived from the commodities which have historically fuelled China’s growth.

Shaken but not stirred

Moving forward, we acknowledge that the future likely entails a more challenging macroeconomic and geopolitical backdrop, and we expect share markets to remain volatile in the near-term. However, it's incumbent on us to balance these risks with capitalising on the investment opportunities that dislocated markets present.

We continue to believe that elevated uncertainty and indiscriminate selling creates attractive buying opportunities for active managers to exploit. Furthermore, given the range of potential outcomes remains relatively wide, we continue to advocate for well-diversified portfolios comprising high-quality managers to navigate these turbulent markets.

Equally important is to remember that investment markets are partly driven by investor psychology, which is why you see markets move through booms and busts. Maintaining discipline throughout these cyclical fluctuations is vital to achieving attractive returns through the cycle, as inevitably, the best market returns always follow the worst.