A key asset allocation trend in the adviser/wholesale market is the use of private market strategies in client portfolios, to enhance returns and lower portfolio volatility. Private market funds include Private Equity (PE), Private Debt and Real Assets, such as Infrastructure and Real Estate, with a general belief they will generate excess returns (relative to listed market equivalents) from an illiquidity premium.

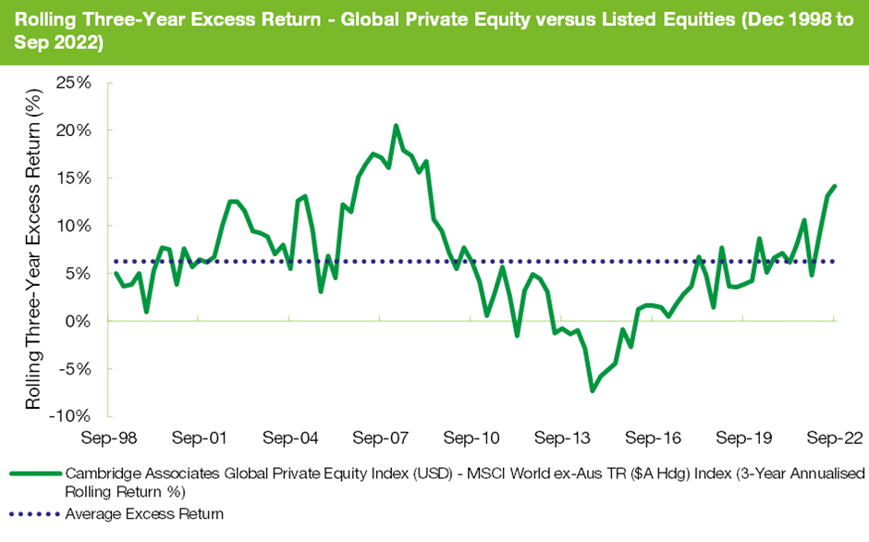

While the story is broader than just extracting an ‘illiquidity’ premium, it’s commonly accepted that private assets outperform their listed-market equivalents due to a range of factors including: innovation, exposure to higher growth sectors and industries, leverage and reduced volatility due to the frequency of asset valuations. Using PE as an example, the following table and chart plots the rolling three-year excess return of the Global PE sector relative to Global Listed Equities.

The flexibility to invest with a long-term horizon has contributed to the Global PE sector outperforming its listed counterpart by approximately 6.9% p.a. over more than 25 years.

Private market opportunities on the rise

The lack of private markets exposure in client portfolios has been a constant challenge for advisers, particularly when clients and the media benchmark performance against industry fund returns. With the growth in the number of options available in the private markets segment, we see a levelling of the playing field and a great opportunity for advisers to incorporate highly attractive assets/strategies into client portfolios.

To meet this demand, fund managers are launching products and working with key stakeholders such as wraps/platforms, managed account providers and asset allocators, to ensure that these can be managed efficiently alongside daily priced funds. One of the key steps in launching a fund is to develop a liquidity plan and to manage the mismatch between redemption terms and the long-dated nature of private market portfolios.

With PE, managers employ a range of strategies including sub-allocations to liquid asset classes, investments in Listed Private Equity (LPE) and/or the use of external leverage facilities. Unfortunately, not all liquidity solutions are created equal and different approaches have the potential to impact risk/return outcomes, or under some scenarios, create inequitable outcomes between remaining and departing unitholders.

Liquidity enhancement under the microscope

Let’s now take a look at the different forms of liquidity enhancement used across our PE universe, including our views on the effectiveness and key risks of each strategy.

Cash

Cash generally forms a core component of any liquidity strategy, either as a full or partial liquidity solution. Typically, Cash investments are held in low-risk instruments such as Overnight Cash Deposits, Bank Bills, Floating Rate Notes and Short-Term Call Deposits.

Cash by its nature is a safe solution, with most managers generally holding sufficient Cash to meet several months of redemption payments, based on orderly markets. Further, the decision on the amount of Cash to hold should link to the rate of inflows/outflows, vintage profile of the PE portfolio, potential capital call commitments and asset realisations.

Listed Equity

A popular form of liquidity enhancement is to invest in Listed Equities, via physical securities, ETFs or futures, providing growth-based returns and the ability to liquidate these securities generally on a T+3 basis. Equity portfolios can be passively managed based on global or regional equity benchmarks, or directly linked to a PE thematic, such as an ETF that replicates the performance of a PE benchmark.

The approach of holding Listed Equities in a private markets portfolio can provide a tailwind to performance in rising equity markets and a reliable source of liquidity. In addition, an allocation can assist with maintaining investment levels where the rate of inflows exceeds deployment rates.

The underlying index selection is an important consideration given different regions and sectors can outperform at various points in the cycle. Selecting a benchmark that links to the private markets thematic is the most philosophically pure approach, however it introduces additional volatility and drawdown considerations.

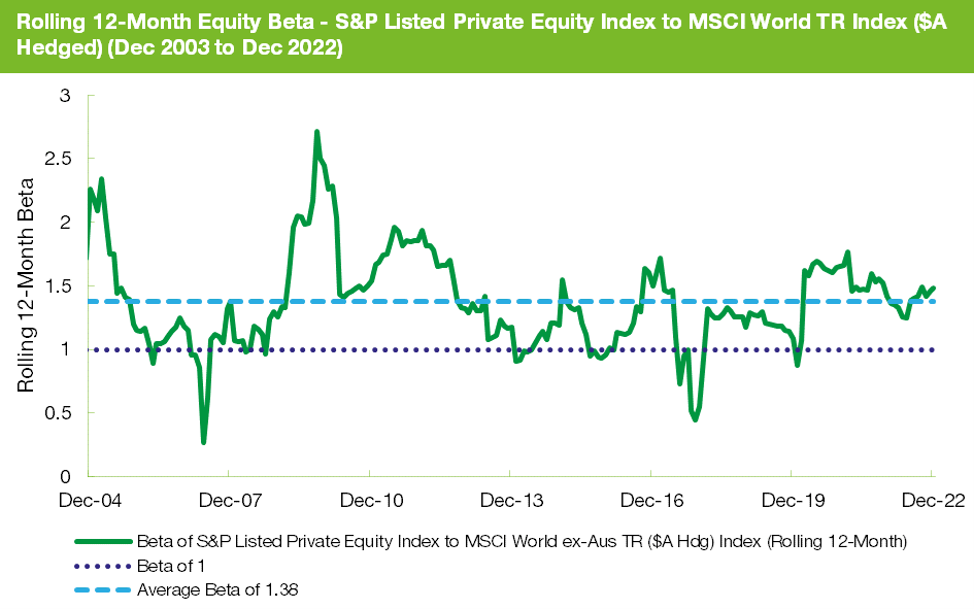

For example, investing in an ETF that tracks the S&P Listed Private Equity Index, provides exposure to the performance of the largest global PE companies (as opposed to their underlying funds), however these securities typically exhibit higher beta relative to global equity benchmarks and elevated drawdown sensitivity. To illustrate this, the following charts plots the rolling 12-month beta of the S&P Listed Private Equity Index to the MSCI World.

Including an allocation to Listed Equities has the potential to dilute the ‘private market’ premium, or in other words, introduce Listed Equity beta to the return stream. Based on our research, a 20% allocation to listed PE, lowers the historical Sharpe ratio of unlisted PE by more than 0.3 and increases the drawdown sensitivity.

External leverage / Financing Facility

A number of managers utilise external financing or leverage facilities, as a source of bridging finance, to fund the payment of redemption proceeds, while portfolio assets are sold, and the facility repaid at a later date. Consequently, the investment exposure of the portfolio typically exceeds 100%, while the leverage facility is drawn, with managers capping the amount of leverage up to 30% of the portfolio’s net asset value (NAV).

We believe the use of external financing can be accretive to long-term fund returns, where the performance of underlying PE assets exceeds the cost of financing. Over shorter periods, there is a risk of facilities being drawn while a portfolio is pending potential revaluations – noting the tendency of PE valuations to lag public market valuations. This can create a scenario where managers are indirectly transferring futures losses from redeeming investors to remaining unitholders. More broadly, external financing is our least preferred form of liquidity enhancement, given the risks around treating all unitholders equally.

What is the optimal outcome?

Achieving the optimal liquidity solution is a complex challenge for private market strategies managers who look to combine philosophical, investment and operational considerations. Based on our research, we’re confident that the liquidity approaches employed by our rated managers will satisfy the primary objective of supporting the redemption terms offered under each offer document.

Selecting a private markets fund with the right liquidity enhancement is an important consideration for advisers, as they seek to blend these funds with traditional asset classes. There’s a risk continuum of options ranging from the most conservative cash-based approaches to more growth-orientated models, where managers seek to minimise cash drag and maintain full investment.