Key points

- Periods of higher Cash rates have historically been supportive for Liquid Alternative strategies.

- Through periods of higher rates, asset class volatility is generally elevated as investors demand higher compensation for assuming market risk and uncertainty, creating pricing dislocations and trading opportunities for nimble liquid alternatives managers.

- More trading opportunities for managers occur as markets diverge in terms of expectations for rate hikes and as central banks pursue restrictive policies at different speeds.

With global Cash rates sitting at their highest level for more than 15 years, the hurdle to allocate away from the safety of Cash and into riskier strategies, such as Liquid Alternatives, can be high for some advisers and their clients. However, after surviving a decade of zero interest rate policies and unfavourable trading conditions, Liquid Alternatives managers are enjoying some time in the spotlight.

The category ‘Liquid Alternatives’ is a catch-all phrase and includes a range of strategies such as Managed Futures, Global Macro, Alternative Risk Premia (ARP) and Multi-Strategy.

Periods of higher Cash rates have historically been supportive for Liquid Alternative strategies, with some of the benefits directly measurable, such as returns on excess Cash held or higher income from holding physical assets, while other positives are less visible, including the market environment and the lack of consensus that’s observable during these periods.

Liquid Alternative strategies profit from markets moving (up or down), higher volatility, pricing dislocations and investors demanding additional compensation for assuming risk in periods of economic uncertainty.

Strategies such as Managed Futures seek to capture price trends or momentum across a range of markets (including Equities, Fixed Income, Currencies and Commodities), while Global Macro managers invest opportunistically by expressing both directional views and relative value positions, with the latter referring to corresponding long and short positions (e.g. long ASX SPI Futures and short NASDAQ futures). The following section explores the direct and indirect benefits of investing in Liquid Alternatives during periods of higher Cash rates.

1. Liquid Alternatives – drowning in Cash

A number of Liquid Alternatives strategies, such as Managed Futures, Global Macro and ARP, invest via derivatives including futures, forwards and over-the-counter (OTC) options. Typically, these instruments only require a small percentage (i.e. less than 10%) of the market or notional value of the contract to be invested at the time of purchase.

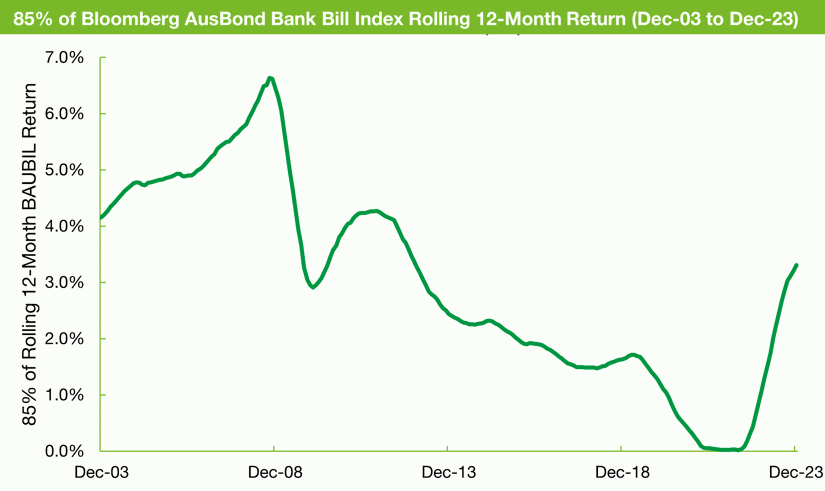

Due to the inherent leverage in derivatives, typically only 5% to 20% of a dollar invested in a Liquid Alternatives strategy is required to support positioning, with the remainder held in liquid Cash instruments. Therefore, most strategies generate a large portion of the prevailing Cash return. To illustrate this, the following chart plots the rolling 12-month Cash contribution for an Alternatives strategy – assuming that 85% is held in excess Cash.

Source: Bloomberg

With most funds on Zenith’s Approved Product List holding surplus cash in Australian Dollar denominated Cash, investors can expect a return of approximately 3.7% p.a. based on the prevailing Reserve Bank of Australia Cash rate of 4.35%. As recently as April 2022, this return was effectively zero and a major drag on returns.

2. Higher Cash rates equal an expanded opportunity set

Higher Cash rates are a tool used by central banks to fight inflation, whilst balancing the goals of achieving full employment and delivering economic prosperity. Through these periods, asset class volatility is generally elevated as investors demand higher compensation for assuming market risk and uncertainty, which in turn creates pricing dislocations and trading opportunities for nimble managers.

Higher volatility creates more trading opportunities for managers, as markets diverge in terms of expectations for rate hikes and central banks pursue restrictive policies at different speeds. The opportunity set can be exploited directionally, where a manager buys positions in Government Bond markets (or futures) and receives the coupon, whilst retaining the potential for capital appreciation if yields were to decline. Alternatively, positions could be initiated on a relative-value basis, where a manager identifies mis-pricings between two related markets and implements corresponding bought and sold positions. For example, a manager may buy Australian 10-year Bond futures and sell 10-year US Treasury Bond futures.

It's a similar story in equity markets, as different regions and sectors react differently to higher inflation risks and ultimately Cash rates. For example, interest rate sensitive sectors such as Real Estate, Infrastructure and Small Caps tend to underperform, while more defensive sectors such Consumer Staples and Financial Services tend to outperform. Therefore, there’s scope for Alternatives managers to capture mis-pricings between regions and sectors.

3. Higher income

Higher Cash rates contribute to more passive income returns, which is observable across a range of asset classes including Fixed Income, Currencies and Commodities. This is often referred as ‘Carry’ and represents a passive return an investor receives (net of financing) if prices remain unchanged. In a higher Cash rate environment, carry is enhanced via:

- returns derived from Currency carry where the manager receives a short-term interest rate return (i.e. buying high yielding currencies and selling low-yielding currencies), and

- mean reversion-based strategies such as buying cheap assets and selling expensive assets (e.g. a long portfolio of bonds with high real yields and a short portfolio of low real yielding bonds).

Do higher Cash rates benefit all strategies?

The Liquid Alternatives universe includes a range of managers and strategies sharing a common philosophy of generating absolute returns and providing low correlation to traditional asset classes. While the performance of each manager will ultimately be determined by the effectiveness of each investment process and the suitability of the style relative to market conditions, higher Cash rates provide a number of direct and indirect benefits.

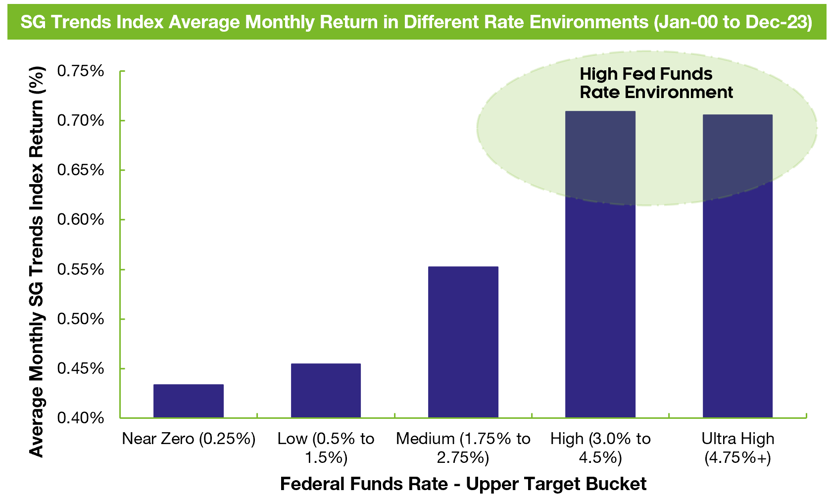

Using the Managed Futures universe as an example, we’ve analysed the performance of the SG Trend Index, which is a leading index that represents the performance of the 10 largest Managed Futures managers. The following chart plots the average monthly return for the index for the period Jan 2000 to December 2023 based on the prevailing Fed Funds rate.

Source: Bloomberg, Fund Managers

Persistent trends remain the lifeblood of the Managed Futures style, however, higher Cash rates have generally supported more attractive returns over the long term. As outlined earlier, the opportunity set is broader and there’s less synchronisation across regions and consensus between market participants.

While forecasting the performance of Liquid Alternatives is fraught with danger, we expect that with global Cash rates sitting at their highest level for more than 15 years and central banks retaining a ‘higher for longer’ mantra, it could be time for those maligned managers to enjoy some time in the sun.

For more detailed information about the broader Alternatives sector, view our recent Alternatives Sector Report in Mosaic.