After the bond market meltdown in 2022, Cash and Term Deposits (TDs) have become more appealing for investors seeking attractive rates and respite from losses experienced across broader defensive portfolios.

Up until 2021, many advisers were yet to experience negative losses from Global Fixed Income (GFI), with flat or zero returns widely accepted as the potential downside scenario. However, when the Bloomberg Global Aggregate Index (Hedged to AUD) lost -12.3% over 2022, coinciding with large losses in equity markets, many advisers began questioning the role of GFI in diversified portfolios.

As the economic backdrop stabilises and the US Federal Reserve nears its 2% inflation target, the environment for GFI is more favourable. Bonds play an important role in diversifying portfolios and it could be an opportune time to consider making the switch out of Cash and into GFI.

Cash and TDs

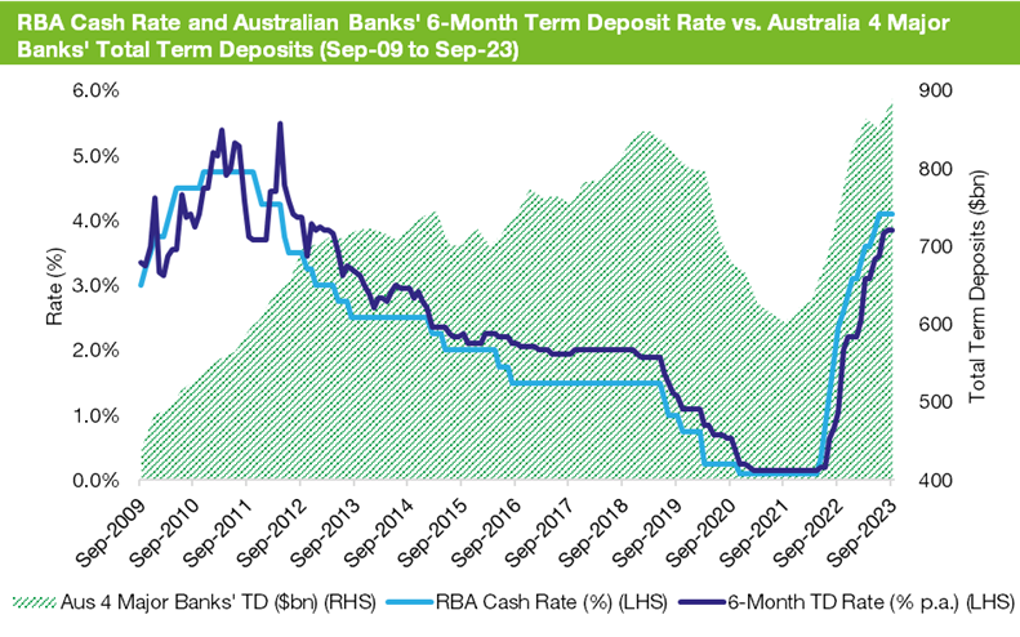

Cash and TDs have enjoyed strong inflows over the past couple of years, as TD rates recovered from close to near-zero levels following the aftermath of COVID-19. They’ve managed to keep pace with the increases in the RBA Cash rate. The following chart illustrates the trajectory of the RBA Cash Rate and the average six-month TD rate from 2010 to 2024 (on the left-hand axis) and the cumulative TDs for Australia’s big four banks.

Source: RBA, APRA | Link: Aus TD tab

With TDs offering a secure 4% p.a. return, it is unsurprising that TDs across the major banks have increased by around 50% over the last couple of years.

Comparing the relative attractiveness of Cash versus Fixed Interest can be challenging, particularly when assessing yields across different options. For example, the major banks are currently offering five-year TD rates of 4% p.a. (as of the end of Feb 2024), which look attractive relative to the 3.62% expected total return (known as Yield-to-Maturity) for the Bloomberg Global Aggregate Index (Hedged). Hence, if the yield pick-up is minimal - why expose clients to additional volatility and drawdown risk?

However, it is important to realise that maintaining a high allocation to Cash and TDs over the long term can impact portfolio diversification and ultimately the attainment of a client’s financial goals. After satisfying a client’s liquidity and cash flow requirements, holding additional liquidity represents a potential opportunity cost, both in terms of investing in growth and defensive asset classes and achieving optimal portfolio diversification.

When to pull the capital gains lever?

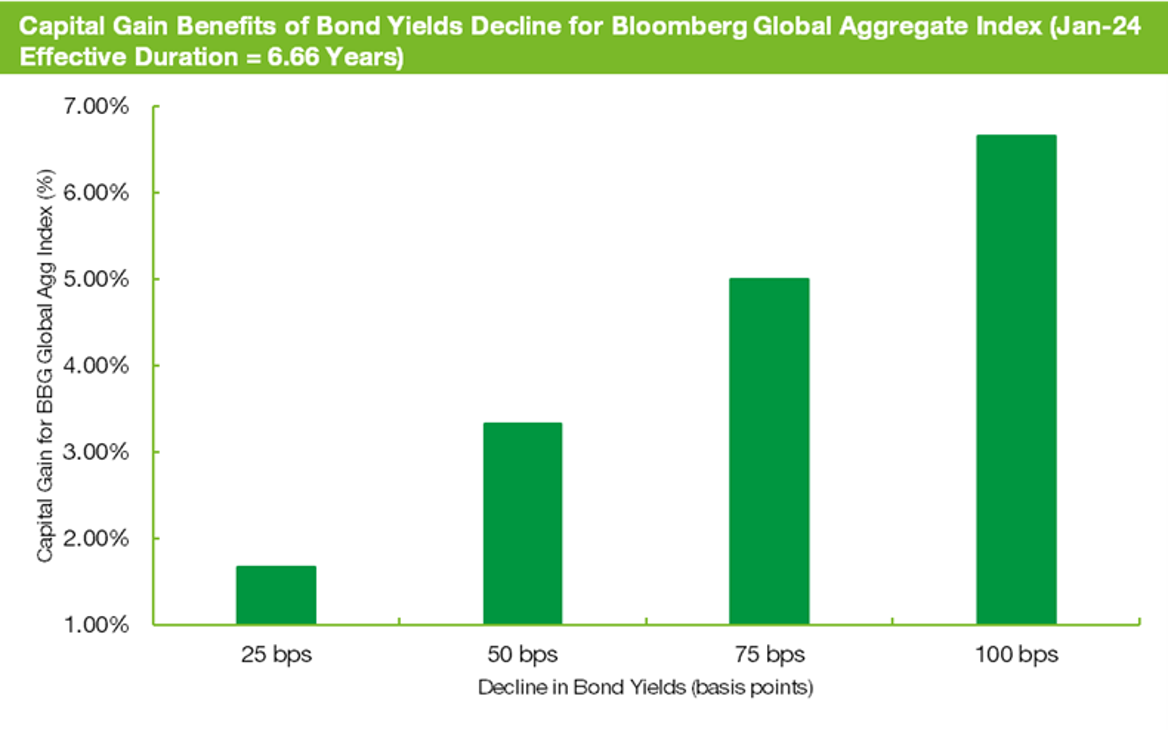

The 5.4% return for the December 2023 quarter for the Bloomberg Global Aggregate Index (Hedged to AUD) highlighted the potential capital gains returns from GFI portfolios and the significance of higher starting yields. Returns comprise a mix of income (known as coupons) and the potential for capital gains, with the latter determined by the movements in bond yields over the investment period. With benchmark yields higher compared to 2021, small rallies in yields can generate attractive gains for investors.

The following chart provides an example of the impact of declining bond yields ranging from 0.25% to 1.0% for the Bloomberg Aggregate Index (Hedged to AUD).

Source: Bloomberg | Link: LEGATRAU tab

Based on the current effective duration of the benchmark, a 1.0% decline in yields could potentially generate a capital gain of approximately 6.6% for investors. Additionally, with higher starting yields, there’s a greater ‘margin of safety’, which means that yields would need to rise significantly before investors experience negative returns. It is worth noting that when the Yield-to-Maturity (YTM) of the Bloomberg Global Aggregate Index bottomed at 0.81% in 2021, investors were almost fully exposed to any increases in yields.

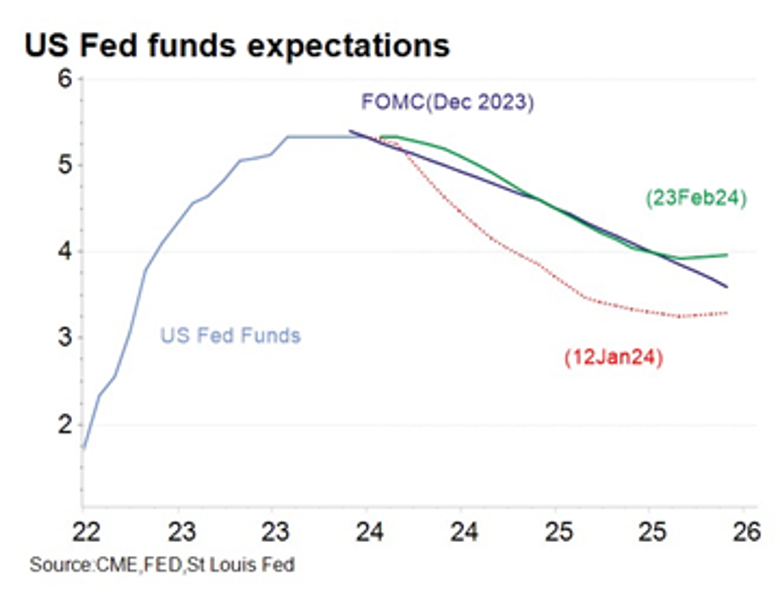

The decision to increase an allocation to GFI should factor in various considerations, including a client’s liquidity needs, the requirement to diversify equity risk and also the views on inflation and the broader direction of interest rates. With the Federal Reserve nearing its target inflation rate of 2% and the market broadly pricing in rate cuts for the second half of 2024, the economic environment for GFI appears more favourable compared to the period leading up to the 2022 downturn.

The defensive role of GFI in a diversified portfolio

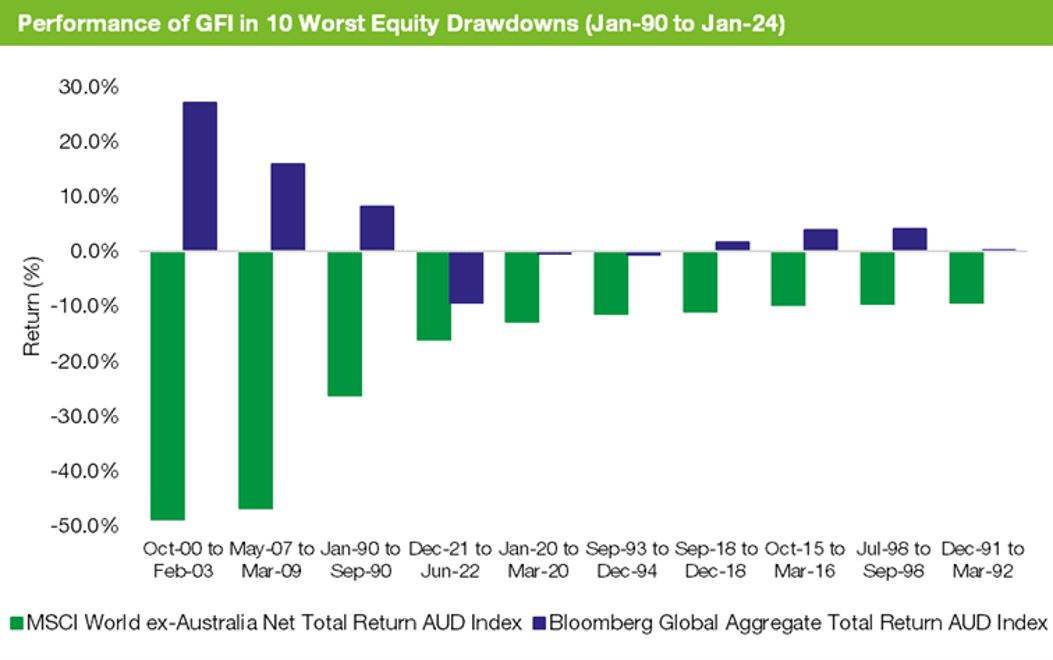

Bonds play an important defensive role in a Multi-Asset portfolio, particularly with respect to reducing volatility and diversifying equity risk. For more aggressive investors, the perennial question of ‘Bonds versus Stocks’ has not changed following the 2022 bond market sell-off and a portfolio with an allocation to GFI remains an important defence for navigating an uncertain environment.

The ability to diversify equity risk is highlighted in the chart below, where the performance of GFI is compared to the 10 worst drawdowns of the MSCI World ex-Australia Index TR (Hedged to AUD).

Source: Bloomberg | Link: Drawdowns tab

After more than a decade of suppressed bond yields, the big reset in GFI markets has created an opportunity for investors to add duration to portfolios and enhance diversification and drawdown sensitivity. With higher starting yields offering a ‘margin of safety’ against any future deterioration in the inflation outlook and potential rate hikes, now could be the ideal opportunity to make the switch out of Cash and TDs to GFI.