A common pain point amongst our clients in recent years has been the diminishing defensiveness associated with fixed income allocations and the expectation that future returns will be lacklustre. This frustration peaked last year when bond yields were languishing at all-time lows, and clients were questioning the defensive qualities and return potential of their fixed income allocations. These concerns were understandable as developed market central banks have interest rates anchored near zero, with seemingly little wriggle room to cut rates further should economic conditions deteriorate.

However, it’s important for investors to realise, with interest rates near record lows, this is likely to translate into lower future returns across other asset classes, not just fixed income. For example, share market forecasts may need to be revised downward as expected returns are derived from the prevailing risk-free rate (i.e. 10-Year government bond yield), which despite a recent move higher, remains stubbornly low. Admittedly, this trend has yet to transpire, noting the rapid rebound in equity markets suggests a disconnect between investor psychology and economic theory. That said, we strongly believe this dynamic will reassert itself over a longer time horizon.

Despite the low yields currently on offer from traditional government bonds, the fixed income landscape is constantly evolving and encompasses a myriad of opportunities. For those comfortable creeping along the risk spectrum, higher yielding securities may be a suitable alternative income generating prospect. However, venturing into the riskier subsets of the fixed income market can reduce the defensive attributes of your portfolio, as these bonds become increasingly susceptible to default risk and are more correlated with equity markets in risk-off environments.

Animal spirits are back…

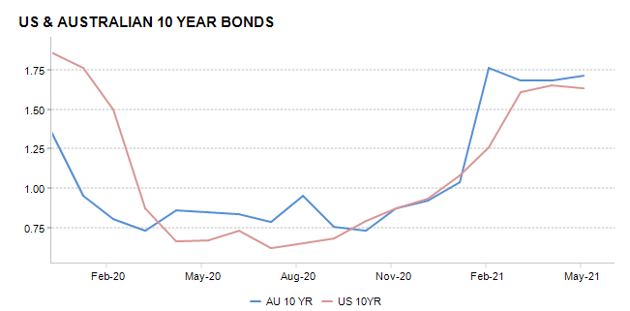

More recently, an improved global economic backdrop as evidenced through a stronger than expected recovery in growth rates post the COVID-19 pandemic, has produced a powerful rise in inflation expectations. These emerging inflationary jitters have spooked bond markets as investors began to question whether central bankers may seek to increase interest rates to choke off demand - which flows through to bond yields. And due to the inverse relationship shared between yields and the capital value of bonds, this prompted a marked sell-off in bond valuations over the March quarter.

Source: Heuristics Investment Systems, RBA

When yields rise in a short and sharp fashion as witnessed earlier this year, the result can be painful for bond investors. Ordinarily when yields rise in an orderly fashion, the market can absorb these gyrations as yields typically increase in response to improving economic conditions. Therefore, provided the rise in yields is gradual, this shouldn’t interfere with the economic recovery.

Short-term pain, long-term gain

Unfortunately, investors relying on passive fixed income exposure have had most of their pandemic-induced gains erased as yields unexpectedly spiked during the March quarter (and, experienced the associated capital declines). This highlights our emphasis on quality, active management in the fixed income space to navigate mispriced opportunities and avoid potential pitfalls.

Furthermore, we’ve been underweight duration in recognition that inflation represented one of the key headline risks that markets were grappling with. As such, our portfolios have been less sensitive to these interest rate ructions, and pleasingly, our investors have experienced a more subdued pullback from their fixed income allocations.

A positive development from the volatility observed in fixed income markets has been that developed market government bonds now offer yields similar to pre-pandemic levels. This means the risk-return proposition associated with investing in fixed income has improved, thereby increasing the attractiveness of an allocation.

One-two punch

The reason for this is twofold: investors can now expect to generate an improved yield from an allocation to government bonds; and yields have further to fall in a market drawdown which would deliver bond holders sizeable gains to offset equity losses.

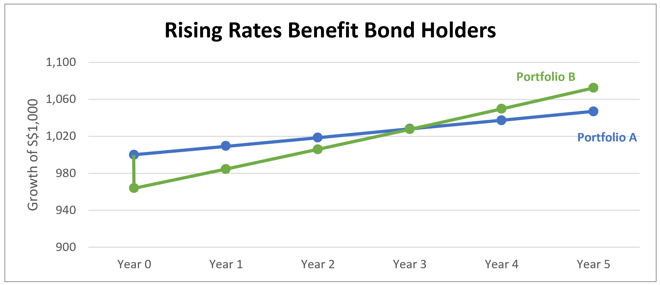

Whilst we understand investors’ disappointment that recently, their fixed income allocations haven’t demonstrated defensive qualities, we’re more optimistic that moving forward the value proposition of the asset class has improved. It’s also important to recognise that over the long term, rising rates are beneficial for bond investors as coupons (interest payments) are reinvested at higher yields.

This is illustrated in a hypothetical example below, where ‘Portfolio A’ experiences a stable rate environment, and ‘Portfolio B’ experiences a sudden 1.25% rate rise. As shown, ‘Portfolio B’ experiences a painful initial loss of capital, although is still generating income which is being reinvested at a higher yield. This ultimately offsets the initial losses and outperforms a scenario where interest rates remain static.

Source: US Department of Treasury and AllianceBernstein

The silver lining

Considering the challenges associated with this evolving fixed income landscape, our Investment Committee recently voted to reduce our cash allocation in favour of short-term credit. This is in response to the relatively unattractive yields generated on cash and the renewed attractiveness of the income available on shorter-dated, investment grade securities.

In addition, our capital markets forecasts demonstrate that emerging market debt screens as undervalued versus developed market bonds. This means that investors may be well-compensated for holding these bonds through disproportionately higher yields. Consequently, our Investment Committee has likewise approved an allocation to an ‘unconstrained’ fixed income manager with a flexible mandate targeting emerging market regions.

Through our specialist fixed income managers, we believe we’ve optimised the competing pressures between liquidity, capital preservation and yield enhancement in a low-rate environment to bolster portfolio performance and enhance risk management. And whilst the initial decline in bonds was painful, this has reset the scene for improved yield generation and capital preservation from investors’ fixed income allocations in the future.

This is increasingly important as the unbridled enthusiasm we’ve seen in financial markets over the last year is unlikely to be sustained into the future. As such, a more concerted risk management approach is warranted when navigating the return of the fixed income animal spirits.