With equities going up, down, and sideways, it can be challenging to determine where to invest your client's money. Yet there's an alternative investment strategy that can generate attractive returns without having to predict market directionality. Introducing market neutral strategies!

Come forward, market neutral strategies

Unlike traditional equity investments, market neutral managers hold offsetting long and short positions, resulting in a portfolio with limited equity market exposure and returns predominantly driven by stock-specific risk. This means the peer group generally delivers absolute returns that are uncorrelated to traditional equity markets.

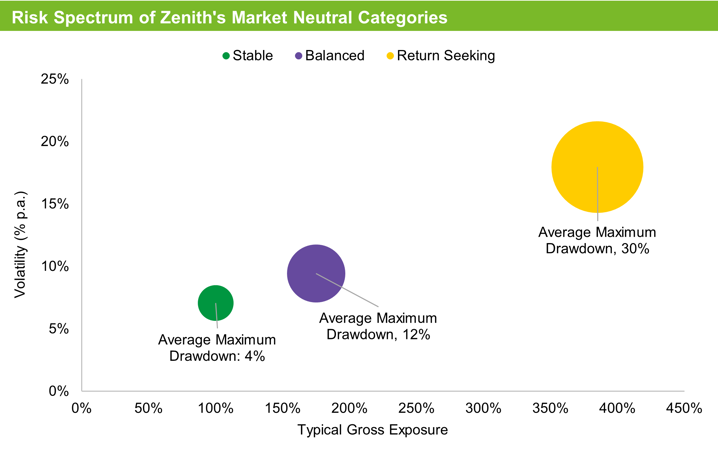

As the peer group consists of a small number of strategies each seeking to deliver absolute and uncorrelated returns, investors commonly misconstrue the market neutral cohort as homogenous. However conversely, the approaches undertaken by market neutral managers vary significantly and lead to drastically different exposures along the risk/return spectrum.

To illustrate this concept, we’ve classified the rated market neutral peer group into three categories based on their risk and return characteristics – stable, balanced and return seeking.

Source: Zenith Investment Partners

In classifying the products into the above categories, we considered the typical leverage employed, realised volatility, and the historical ability to protect capital.

Source: Zenith Investment Partners

As you can see, the various measures of risk progressively increase across the categories, with each category offering a markedly different risk and return profile.

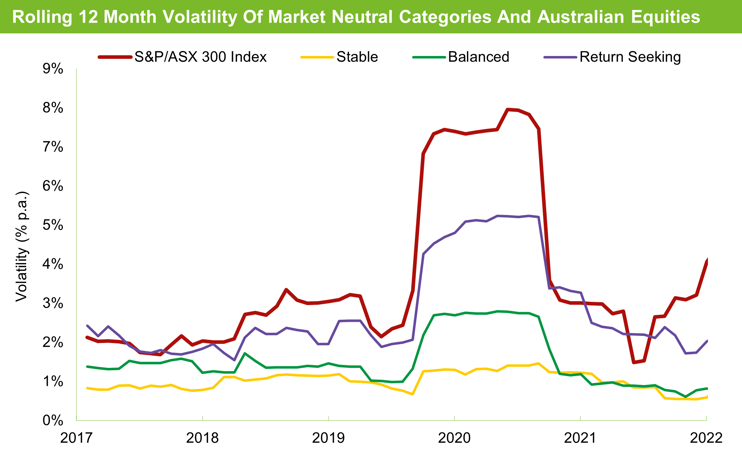

But what about volatility reduction? All categories demonstrated significant volatility reduction relative to the S&P/ASX 300 Index, with the relative reduction between categories remaining broadly consistent over the assessed period.

Source: Zenith Investment Partners

Source: Zenith Investment Partners

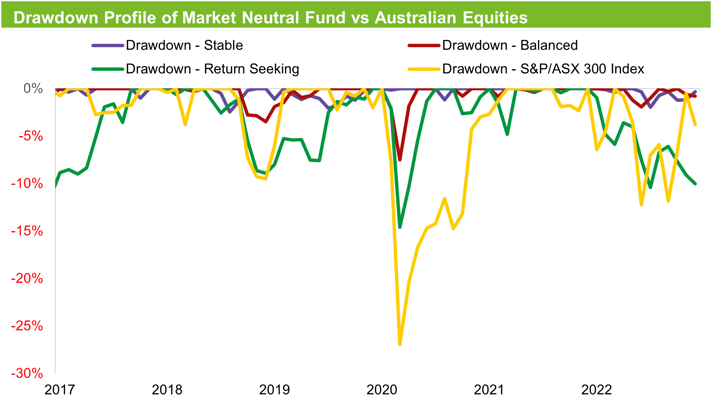

And lastly, from the drawdown perspective, the market neutral peer group has demonstrated a propensity to protect investor capital in declining markets. The stable category protecting capital most effectively, while the return-seeking funds experiencing larger relative drawdowns.

And there you have it – take your pick!

Despite increasing market volatility, our rated market neutral peer group continues to offer investors an avenue for attractive and uncorrelated returns. With differentiated approaches and risk tolerances assumed by managers within the cohort, investors have the flexibility to optimise their exposures based on individual risk/return objectives. Remove the difficulty in predicting market directionality, and capitalise on the investment abilities of managers to generate attractive risk-adjusted returns with market neutral funds.