Active Australian fixed interest managers have multiple avenues through which they may seek to extract outperformance. Included amongst these are interest rate, macro credit and bottom-up security selection strategies. Regarding the former, this can be achieved by betting on the direction of interest rates (i.e. duration positioning) or targeting bonds of specific maturities across the yield curve (i.e. relative value strategies).

Despite the range of strategies available, a common misconception amongst investors is that outright duration positioning is the primary source of active returns when there is a change in market yields. While duration can no-doubt represent an important component, and is highly observable over shorter investment time frames, relative value positioning can be equally accretive in terms of contribution to risk-adjusted returns. This is particularly the case where yield curves exhibit relative ‘steepness’, as it provides managers with scope to extract further value through ‘carry and roll’.

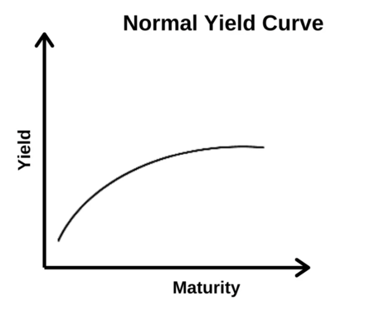

A yield curve in simple terms is a graphical depiction of the yield of a bond over a range of maturities. For example, the hypothetical yield curve as detailed below, shows a positively sloped or normally shaped curve, implying that investors require higher interest to hold longer dated bonds (of the same credit quality), as compensation for higher inflation and default risk. It should be noted however that yield curves are not always positively sloped, rather they may also be flat or inverted.

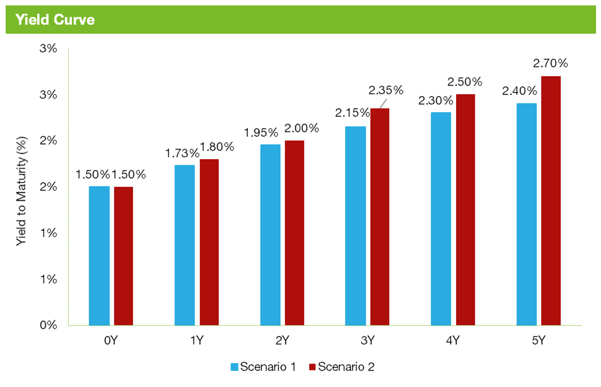

Where yield curves are normally sloped, managers may seek to implement a technique referred to as ‘carry and roll’. Such a strategy seeks to capture two return sources that investors can earn from holding a bond over time. ‘Carry’ represents the income flows that a bond provides periodically. In equity terms, it can be thought of as the yield of the bond. ‘Roll’, in contrast, represents the change in capital value of the bond as time passes. Typically, these two components are intertwined, and represent the total return earned on a bond over a stipulated time frame, as can be demonstrated in the below working example.

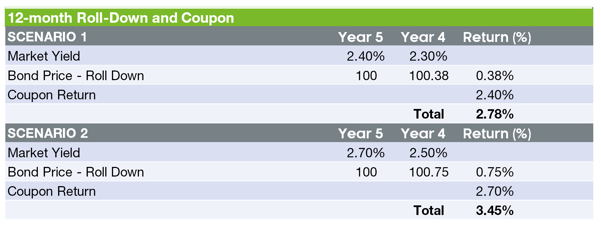

Under scenario 1 above, should an investor purchase the AAA-rated 5-Year Australian government bond (ACGB) with a yield of 2.40% and hold it for one year, the term risk attributed to this bond is lower, given it now has four years to maturity, and therefore the yield required by an investor falls to 2.30%. This change in yield has a positive price impact as the bond’s market price increases from its initial issue price of $100 to $100.38 (assuming yields stay static). If at this point the investor sells the bond, their total return would be 2.78%, comprising the 2.40% coupon received and the 0.38% capital return.

The opportunity to extract value from ‘roll and carry’ is accentuated where yield curves are steep. This can be demonstrated under scenario 2 above, where an investor who purchases the same AAA-rated 5-year bond and holds it for 1 year, achieves a total return of 3.45%.

Active fixed interest managers positioned to outperform

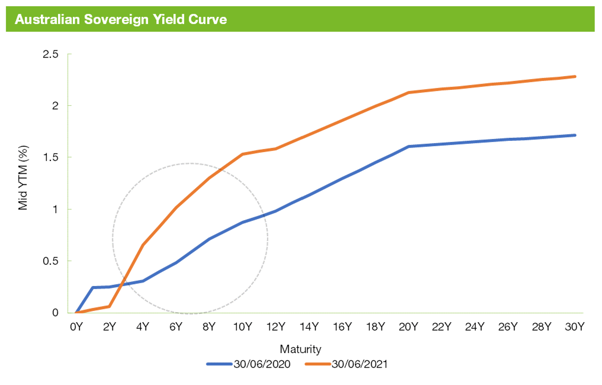

Amidst a global backdrop that supports a resurgence in inflationary pressures, the Australian sovereign yield curve has steepened considerably over the past 12 months as evidenced in the first chart below. This steepness is particularly prevalent in the belly of the curve (ie. the 3 to 10 year point), reflecting the market’s expectation that the RBA will raise interest rates in the medium term. That said, steepness is also evident in the long end of the curve, indicating the potential for a structural shift higher in GDP growth over the medium to longer-term.

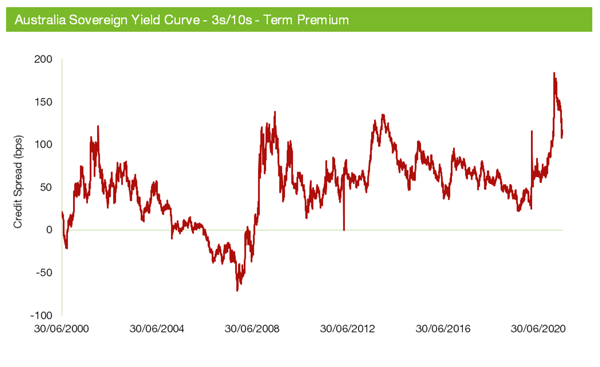

To provide greater context on the extent of steepness across the AU yield curve, the second chart above shows the spread between three and ten-year bonds over time (i.e. the ‘3s/10s spread’). As can be seen, the current level is slightly below the widest point recorded in over 20 years, indicating that the belly of the ACGB curve is extremely steep. This relative steepness is expected to remain in the near-term, corresponding with the RBA’s recent narrative. Specifically, its commitment to accommodative monetary policy until such time as the labour market moves toward full employment, wages growth is materially higher than trend, and inflation is sustainably within its 2% to 3% targeted range.

Consistent with this view, we believe that managers with a demonstrated track record in terms of carry and roll strategies will be well positioned to outperform. We believe such a skillset will be particularly important in an environment where yield curves oscillate in response to changes in inflationary expectations, and there is a need to be more tactical in terms of targeting irregularities across the yield curve. Furthermore, should inflationary pressures change from being transitory to structural, we believe managers that have a preparedness to implement outright directional interest rate views will be well positioned to mitigate capital losses should the RBA embark on a sustained hiking cycle.

We rate several high conviction Australian fixed interest managers that explicitly target outperformance through interest rate strategies. Detailed information on these managers can be sourced from our subscription-based research and portfolio insights platform ‘Mosaic’.