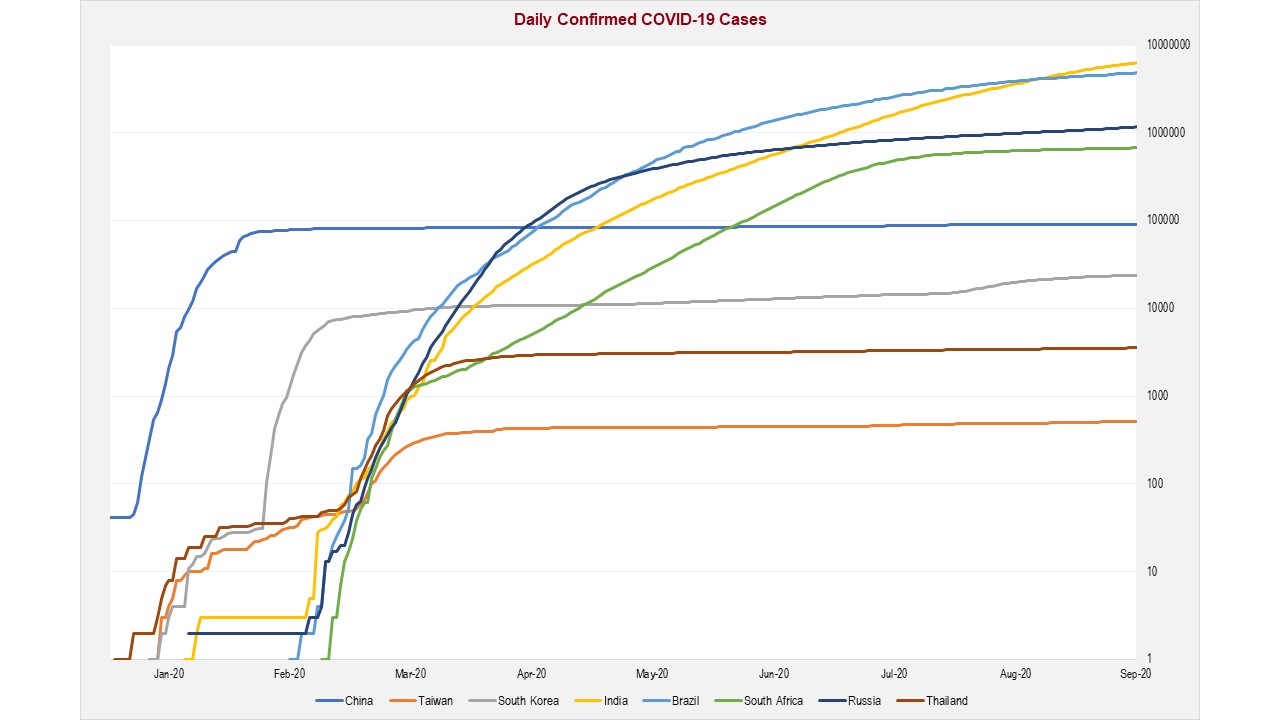

Given its origin, the first countries to be affected by COVID-19 were those in emerging markets, particularly those within Asia. However, some countries have been more successful than others in containing the spread of the virus, highlighted by the chart below, which graphs daily confirmed COVID-19 cases of the eight largest represented countries in the MSCI Emerging Markets Index.

Source: Bloomberg

As expected, there’s a direct correlation between a country’s success with managing COVID-19 and its equity market performance.

We assessed the average equity market performance of the eight largest represented countries in the MSCI Emerging Markets Index, grouped into Asia[1] and ex-Asia[2], and the largest eight represented countries in the MSCI Developed Markets Index[3] over the nine months to 30 September 2020. The average emerging market country within Asia fell almost 4% in January, which was the largest drawdown among the three groups, followed by ex-Asia emerging markets and developed markets that declined approximately 1.4% and 0.3%, respectively. However, emerging market countries within Asia (-20.3%) held up relatively well compared to ex-Asia emerging markets (-26.7%) to the end of March as the COVID-19 panic reached its peak.

Three of the top four performing countries over the nine months to 30 September 2020 were those within emerging markets, with China, South Korea and Taiwan exhibiting the best performance of the emerging market countries. We note that, although the USA has failed to contain the spread of COVID-19 to date based on the data available, its equity market has exhibited strong performance, primarily driven by companies within the technology and healthcare sectors, which were major beneficiaries of the pandemic. Despite containing the spread of COVID-19 relatively well, we note that Thailand’s equity market suffered the most of the emerging market countries, with its heavy reliance on tourism contributing to its poor performance.

Investors who identified the successful countries and appropriately allocated capital fared notably better.

Why is country selection in emerging markets important?

In real estate, it’s frequently argued that it’s ‘better to buy the worst house in the best neighbourhood, rather than the best house in the worst neighbourhood’. We believe this phrase rings true for emerging markets investing. Given the more volatile nature of emerging market countries compared to their developed market counterparts, we believe allocating capital to the best-performing countries is imperative for achieving superior investment outcomes in this highly-nuanced sector.

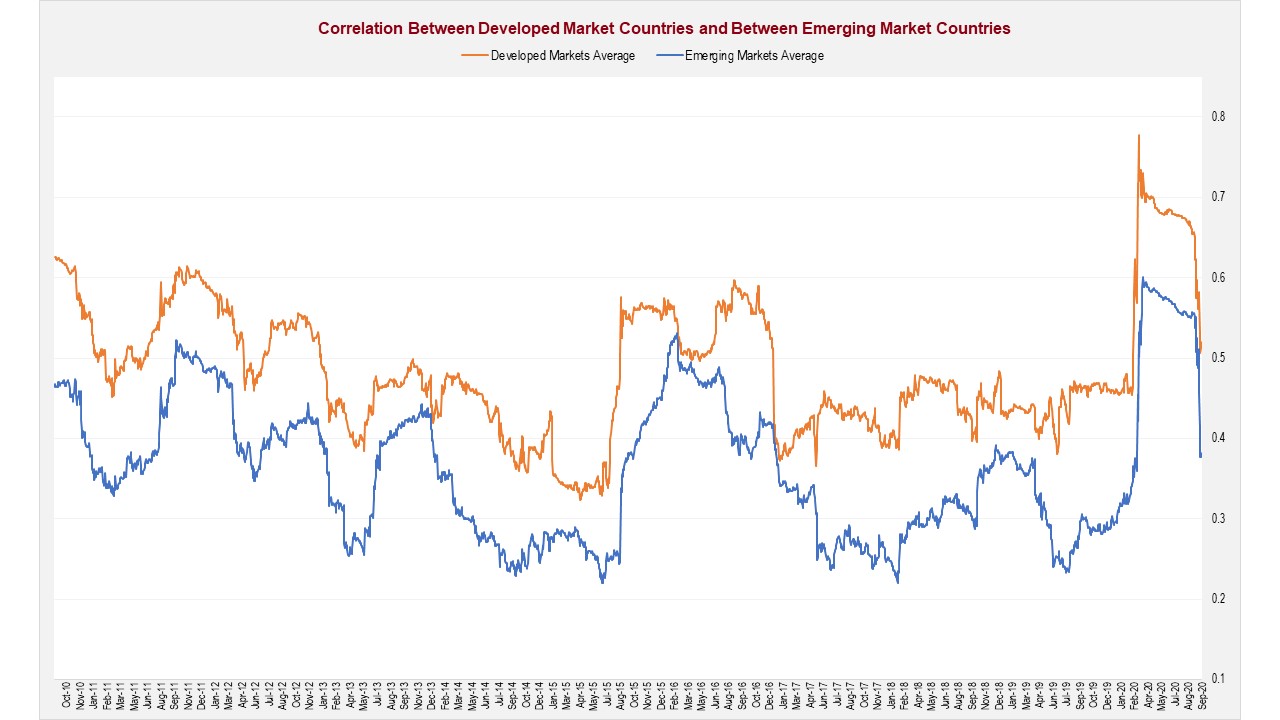

To illustrate the importance of country selection within emerging markets, the chart below shows the average rolling six-month correlation between the eight largest emerging market countries and between the eight largest developed market countries.

Source: Bloomberg

Given the lower correlations between emerging market countries, each country’s equity market is expected to exhibit a materially different performance profile. Comparing this to developed markets, there’s far less of a difference, on average, in the performance profile of two different countries. Therefore, we can deduce that country selection is more important in emerging markets than developed markets.

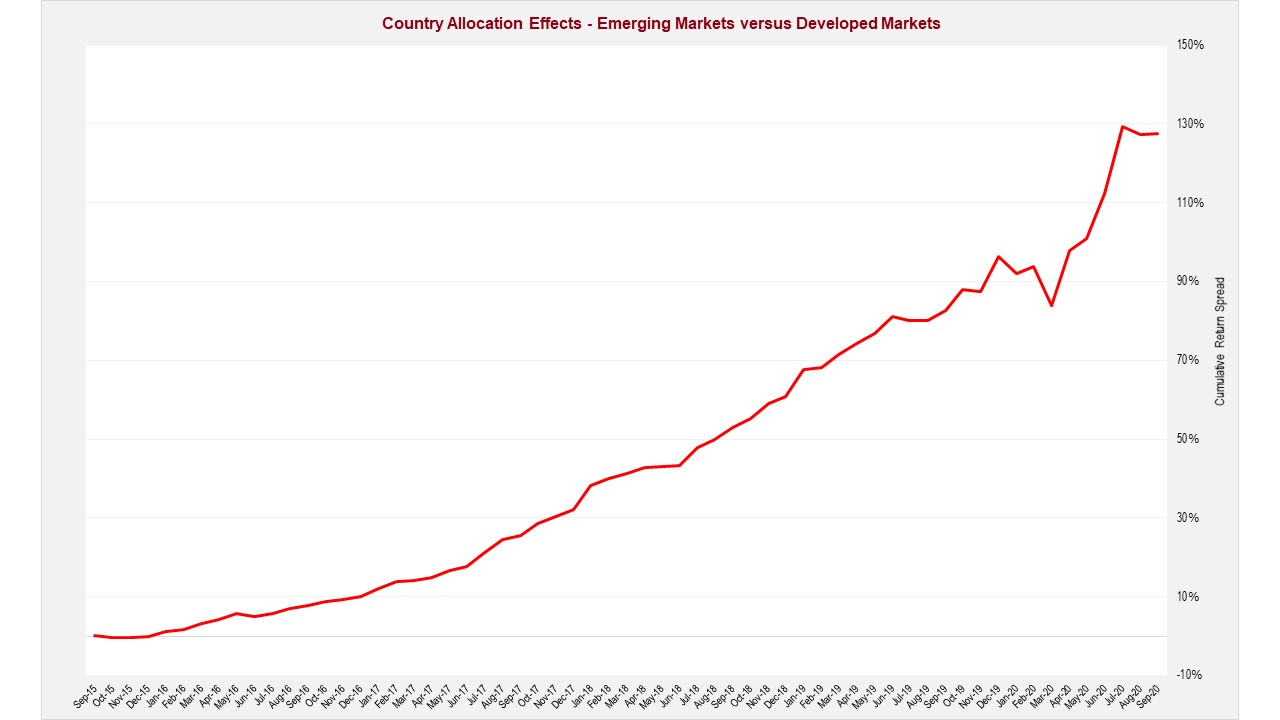

To further emphasise the importance of country allocation in emerging markets and developed markets, we developed a perfect foresight model[4] that allocates more/less capital to the best/worst performing countries. The model was run over the five-year period to 30 September 2020 on both our emerging markets universe and developed markets universe.

As we’re interested in the benefit of country allocation, we compared the performance of the models with that of the respective eight countries on an equally-weighted basis. The red line in the chart below represents the perfect foresight model out-performance differential of emerging markets over developed markets.

Source: Bloomberg

Given the red line is consistently positive and exhibits an upward trajectory, we believe this is further evidence that allocating to the best performing countries in emerging markets and avoiding the poorest performers can lead to far superior returns relative to developed markets.

Ultimately, a passive exposure to emerging markets is limited in its ability to strategically allocate to desirable countries and avoid poor performers. Conversely, an active manager has the flexibility to invest in the ‘best neighbourhoods’ and avoid the ‘worst neighbourhoods’. As such, we believe high-quality active managers remain well-placed to achieve attractive, risk-adjusted outcomes within emerging markets, which are highly inefficient.

[1] Countries included within Asia Emerging Markets: China, India, South Korea, Taiwan and Thailand

[2] Countries included within Ex-Asia Emerging Markets: Brazil, Russia and South Africa

[3] Countries included within Developed Markets: Australia, Canada, France, Germany, Japan, Switzerland, the UK and USA

[4] For the purpose of the model, we created an emerging markets universe and a developed markets universe using the eight largest countries represented in the MSCI Emerging Markets Index and the MSCI Developed Markets Index, respectively. Given the model has perfect foresight, it will allocate the most amount of capital (22.5%) to the best future performing country and the least amount of capital (2.5%) to the worst future performing country each month, with the portfolio rebalanced monthly.