The challenges of education funding

As the cost of education, housing and day-to-day living expenses continue to rise, parents (and increasingly grandparents) are becoming more concerned about the best ways to save for the next generation. Education costs in particular stand out as a focus item given that these costs have historically escalated at a significantly higher rate than other goods and services.

In the last two decades there has been a marked increase in attendance at both traditional and online educational institutions, leading to an increase in the number of years spent in education. This is particularly relevant for tertiary education, with increases in reported numbers for those completing graduate and post-graduate studies. As such, it’s likely that more people will require flexible and long-term solutions to fund educational expenses.

There are a range of options utilised as funding vehicles for future education costs. The challenge is being able to determine which strategy will provide the best fit for an individual’s circumstances. This is particularly apparent when realising that traditional managed investments may not offer the best overall value or effectiveness. Each strategy has its own set of advantages and disadvantages, often depending on the specific product used.

Education bonds

At its simplest, investment bonds are merely a structure; the underlying investments are the engine room of the returns. Investment bonds typically offer access to traditional assets classes (cash, fixed interest, equities and property). Availability of multi-asset strategies inside a bond is also common.

Education bonds are a variant of investment bonds that are designed for investors who are saving for education costs incurred by themselves or their families. They can provide superior after-tax returns not only compared with traditional managed funds, but also when compared with mainstream investment bonds, due to their structure as a “scholarship plan” in accordance with the Australian Income Tax Assessment Act 1997.

Providers of education bonds offer a range of underlying asset classes to suit different investor risk preferences. Some providers also offer further customisation, with investors able to specify preference for sector-specific funds or a choice between active or passively managed strategies. Regardless of the asset class or investment selection, the bond won’t distribute income over the term of the investment, as all earnings are reinvested.

The drawcard - superior after-tax returns

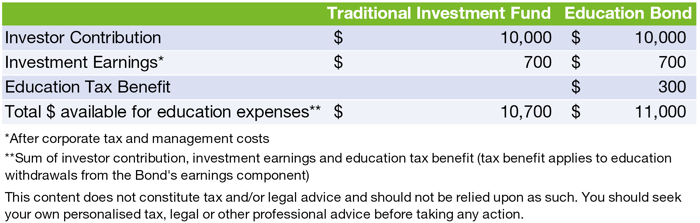

There are two primary reasons why education bonds can provide investors with a superior after-tax return when compared with traditional managed funds.

- A tax benefit that education bonds are entitled to, this being a unique concession which effectively recovers the tax paid on investment earnings when they are withdrawn to pay “education expenses”. At current tax rates, this credit can be worth up to $30 for every $70 of withdrawn earnings.

In the case of a $10,000 investment achieving a theoretical return of 7% p.a., an extra $300 could be returned to the investor.

- The bond provider pays a tax rate of 30% on investment earnings, making it particularly attractive for investors on a marginal tax rate above this level.

Education expenses – what qualifies?

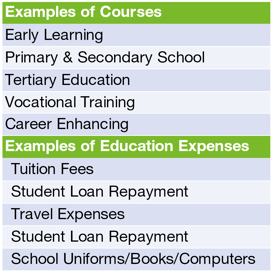

To qualify for withdrawal and the associated tax benefit, education expenses must relate to or be incurred for the purpose of a student attaining a qualification sought under an authorised education or training program. This is quite a broad definition and varies between providers. Generally acceptable education expenses can include the following:

Withdrawals for non-educational purposes are permitted, although they won’t be eligible to receive the tax benefit.

Education bonds – the optimal solution?

Ultimately, the optimal solution will depend on the personal situation of the individuals involved. Consideration should be given to not only cost but flexibility and post-tax outcomes.

Regardless of the end choice, the unique after-tax advantages afforded by education bonds are well worth considering for any investor who is committed to achieving spending outcomes relevant to education purposes.

For readers seeking further information on education bonds (or investment bonds more broadly), including ratings on options listed on Zenith’s Authorised Product List, these can be sourced from our subscriber based online research platform Mosaic.