The battlelines have been drawn for the upcoming Australian Federal election, and like the ones before it in recent history, it’s going to be fought over the climate wars. Climate change policy has been political dynamite in Australian politics, with elections won and lost in the pursuit of countering climate change.

Similarly, overseas in the run-up to the presidential election, Joe Biden made combating climate change a key legislative priority. Consequently, following his ascension to leader of the free world, like death and taxes, it was inevitable that Australia would ultimately fall into lockstep and likewise commit to net-zero with our key allies.

And so, as the world leaders descended upon Glasgow for the United Nations Climate Change Conference in November, it was with much fanfare that the Australian government announced a net-zero 2050 pledge. This is important as it brings Australia back in the global climate tent whilst creating an array of exciting investment opportunities for investors.

Technology not taxes

The Australian populace has been assured that the greening of the grid will be done the ‘Australian way’, that is, through technology not taxes. Understandably, this has been met with scepticism as the green energy transition is hardly synonymous with Australia’s heavy reliance on fossil fuels.

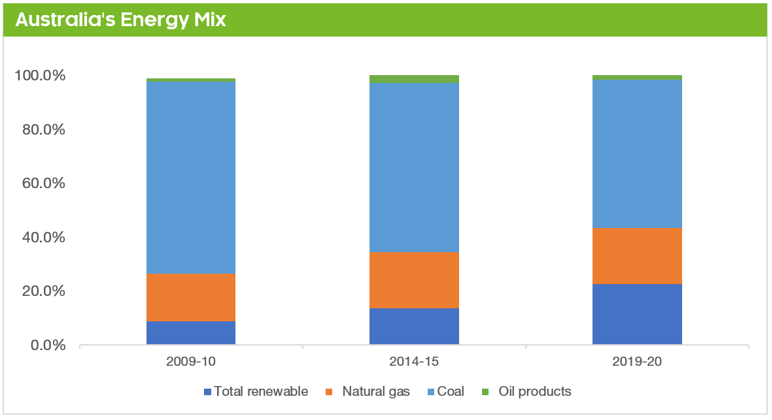

However, it’s important to note that the free-market mechanism has already steadily been pursuing this transition without strangling our economy. This is illustrated in the below chart which highlights renewables’ growing market share within the Australian energy mix.

Source: Australian Government, Zenith Investment Partners

Contrary to popular opinion, Australia is on the cusp of the revolution in green innovation through our unique exposure to many minerals and resources linked to the decarbonisation thematic. This creates myriad opportunities associated with the electrification megatrend and proves you can still strike gold whilst paving a carbon-light future.

Money, Money, Money!

The rapid adoption of renewables, nuclear, electric vehicles, and battery technology will be critical in reducing our carbon footprint in accordance with our net-zero pledge. Fortunately, Australia is sitting on vast swathes of minerals and resources which will prove vital in reaching this low-carbon nirvana.

For example, material investments in lithium will be required to meet the increasing demand for the batteries in electric vehicles, of which Australia sits on significant deposits. Australia similarly has meaningful reserves of nickel and copper which will prove vital in the electrification of our energy system.

Australia has likewise been blessed with the largest uranium deposits in the world, although to date our political leaders have been hesitant to venture down the nuclear path. And whilst fossil fuels may have become a dirty word, Australia’s high quality iron ore and coal are key ingredients in the steel which forms a key part of the renewable’s infrastructure - so they can’t be consigned to history just yet!

It’s this vast untapped potential that should leave investors excited about Australia hitching a ride on the net-zero bandwagon, although equally important will be selective positioning within the decarbonisation thematic. To create a performance firebreak in the future, investors will need to carefully assess mispriced transition risks and studiously avoid exposure to the climate laggards.

Baptism of fire

At the pointy end of the energy transition is the global listed infrastructure sector. The generation, transmission and storage of low-carbon alternatives will require a radical transformation of the existing infrastructure network once the fossil fuel-oriented incumbents are decommissioned.

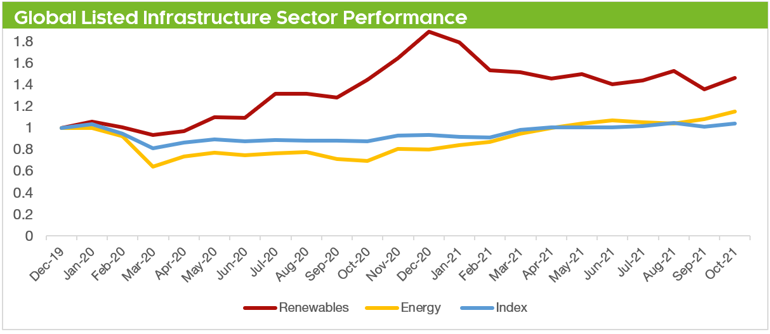

This will create a unique situation where trillions of dollars will be required to meet the investment needs associated with this transition. Market pricing already indicates an awareness of this structural shift, with the potential for stranded asset risk associated with old-economy infrastructure creating marked performance divergence.

This is best illustrated through the COVID-19 drawdown where the market retained a relatively positive outlook for renewables, whereas energy pulled back aggressively. This demonstrates that active managers’ agile positioning can still slingshot performance in a rapidly shifting investment landscape.

Source: GLIO, Bloomberg, Zenith Investment Partners

As the world moves to carbon-neutrality, clear winners and losers will emerge. Therefore, employing active management will be pivotal to avoid subsectors unable to generate a viable return and whose economic lifespan will be heavily curtailed.

An inconvenient truth

As Australia embarks on its net-zero journey, this creates lucrative opportunities for active management to take advantage of a multi-decade investment super cycle. Due to Australia’s unique terrain, investors can forge a pathway to lower emissions whilst capitalising on largely untapped investment opportunities.

This will see the phasing down of fossil fuel power generation, acceleration of electric vehicle adoption, and continued powering of the renewables boom. As such, the scale of investment required to meet these carbon reduction targets over the coming decades will be monumental.

Investors will have the opportunity to ride the renewables boom whilst simultaneously shrinking our carbon footprint. However, utilising active management will prove critical in accessing the secular tailwind of low-carbon solutions, whilst avoiding the stranded asset risks associated with old-economy industries.

Build it, and they will come

In recognition that we have a stake in the sustainability of the economy and society on behalf of our clients, we recently launched the Zenith Responsible Investment Model Portfolios. These portfolios expressly take into consideration ESG factors whilst accessing the structural growth opportunities associated with a low-carbon future.

If you’re interested in aligning your investment portfolio with your philosophical beliefs or want to be part of solving the climate change challenge, please get in touch with our team for more information. Because unlike the inevitability of death and taxes, Australia’s net-zero pledge should be met with unbridled enthusiasm.