- With the recent outbreak of the Coronavirus (COVID-19) causing ripples in the global economy, we believe it is important for investors to understand its implications on markets.

Prior to last week, markets seemed to overlook the potential impact of the Coronavirus on the global economy. However, following a large increase in cases outside of China, we have seen a sharp drop in global share markets, with the MSCI World $A Index falling 9% from 20 February to 2 March 2020.

What can we expect?

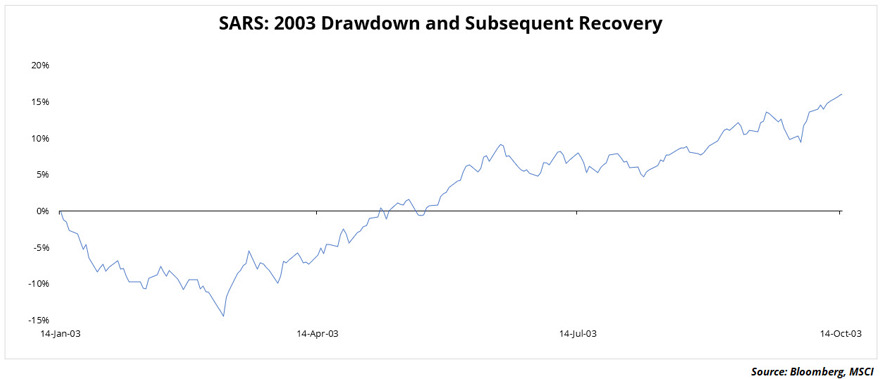

Many parallels can be drawn between the current situation and the 2003 outbreak of Severe Acute Respiratory Syndrome (SARS), where global markets (as represented by the MSCI World $A Index) declined by 14% within two months. Once fears of the virus abated, markets recovered the losses within two months, as shown in the chart below.

Investors who sold out of equities at the height of the SARS hysteria were left behind when markets rebounded strongly. In fact, in the eight months following the bottom of the market, equities rallied approximately 35%, finishing 15% higher than they were at the start of the drawdown on 14 January.

Investors are often tempted to time these movements by, for example, employing tactical asset allocation and moving to cash. However, doing so requires near-perfect timing, not only on exiting but also on re-entry (ignoring transaction and tax costs). Missing only a few days of a strong market can dramatically impact longer-term returns.

Is it different this time?

As negativity surrounds the Coronavirus in media headlines, investors could be forgiven for expecting the worst. However, we believe there are key differences between the current Coronavirus outbreak and SARS, which may bode well for the future of the economy.

Although the Coronavirus appears to be more contagious, it has so far had a materially lower mortality rate at 3% compared to SARS’s 11% (according to the World Health Organization). In addition, China has pledged to fuel its economy with fiscal and monetary stimulus in response to the outbreak, with the intention of keeping the economy buoyant.

What does this mean for portfolios?

It is during periods of sustained equity market stress where we expect asset classes such as fixed income, alternatives or listed real assets to buffer returns. As such, Zenith recommends a well-diversified portfolio, both across and within asset classes, that has “multiple ways of winning”.

While we caution that there is still much uncertainty regarding the Coronavirus and its impact on global markets, we firmly believe that remaining invested through increased market uncertainty, high-quality active management and appropriate diversification remain the key to strong long-term risk-adjusted returns.