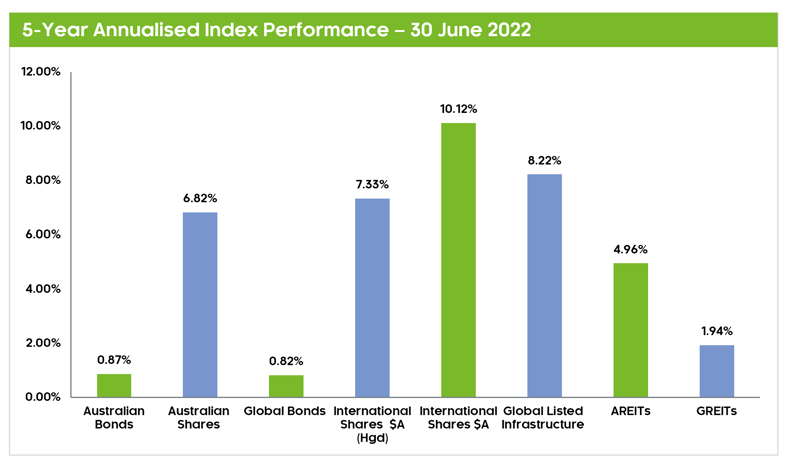

The 2022 financial year delivered choppy conditions for investors, as elevated inflation, rising interest rates, the war in Ukraine and recession anxieties created an air pocket in markets, leaving investors with few places to shelter. Yet notwithstanding the short-term turbulence, the below chart illustrates that medium-term returns remain strong across traditional asset classes and reinforces the longer-term perspective required when investing.

Source: Zenith

Ever-(not)-grande

Markets started the financial year with consecutive monthly gains, until September when rumblings of a default started to emanate from China’s cash-strapped property titan, Evergrande. This sent shockwaves through global equity and credit markets as the ASX300 delivered its first negative monthly return in 11-months, as investors braced for a harsh landing.

Fortunately, authorities were able to ringfence the contagion and the ripple effects to the global economy were relatively minor. Pleasingly, our portfolios held no exposure to Evergrande’s debt or equity securities, which demonstrates the importance of selecting high-quality active managers to navigate stressed markets.

A brief period of calmness then followed, until November 2021, whereupon the discovery of the COVID-19 Omicron strain, which the World Health Organisation characterised as a ‘variant of concern’, saw a swift repricing in equity markets. Unsurprisingly, with the miseries of the initial COVID-19 drawdown still raw in investors’ minds, the market adopted a sell first, ask questions later approach. Our intentional skew to ‘quality’ ensured that our portfolios were protected on the downside over this period, as the market absorbed the potential ramifications of renewed mobility restrictions and further lockdowns.

As these crosscurrents rattled global markets, in keeping with our ‘quality’ bias, we redeemed our global long/short exposure in lieu of a concentrated and benchmark unaware ‘quality’ oriented strategy. Underpinning this move was our analysis demonstrating that a more attractive upside participation and capital preservation asymmetry could be achieved through this alteration.

Omi-gone?

Fortunately, Omicron soon proved more transmissible, yet less deadly which was all the affirmation that markets needed to embrace a year-end ‘santa-rally’. However, the positive sentiment was short lived, with the investment landscape morphing into one characterised by central banks wrestling with multi-decade high inflation, tightening financial conditions, geopolitical risks and slowing growth.

Sensing that an inflationary outbreak posed a headline market risk, we recalibrated our alternatives sleeve to include a global macro allocation, explicitly targeting inflation protection through commodities, real-estate and infrastructure. Similarly, in recognition of the weakened defensive attributes associated with fixed income, we reclassified our alternatives exposures to 50/50 growth-defensive and materially increased our allocations for conservative oriented portfolios.

This soon proved prescient as equities and bonds experienced a correlated sell-off whilst alternatives delivered offsetting gains. This was particularly true for one of our managed futures managers which delivered 8.1% for the financial year.

Australian shares - the wonder down-under

As the new year rolled in, we undertook our annual Strategic Asset Allocation review, with our forecasts indicating higher returns for Australian shares relative to international shares, with broadly similar volatility levels. This prompted a pivot to overweight Australian shares. This view was subsequently supported by the change in market leadership which favoured Australia’s commodity exposure.

The remainder of the financial year delivered disappointing returns for investors, as both equities and bonds came under intense selling pressure. And although our short-duration fixed income sleeve and well-diversified alternatives line-up offered some insulation from the market dislocation, we were unable to fully protect investors from the excessively negative market sentiment and subsequent market overshoot.

The silver lining for investors

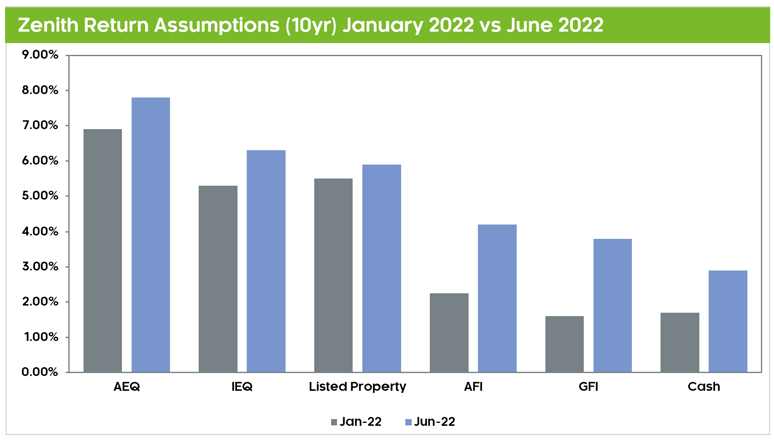

The washout in markets, whilst painful, has led to a lot of the normalisation expected to unfold over a longer period. The ensuing multiple compression leaves valuations for traditional asset classes looking a lot healthier versus the start of the year, prompting us to update our 10-year return forecasts.

Source: Zenith

For investors, the silver lining of the market turbulence is that you now have a higher probability of meeting your return objectives, particularly for lower risk-profiles given the dramatic repricing in fixed income markets. For investors in a ‘Balanced’ portfolio, this translates to a revised 10-year expected return of 5.7% versus 4.4% at the start of the year.

Fortune favours the brave

Despite pockets of weakness emerging in the global economy, we believe ample positive catalysts remain, including low unemployment, strength in the corporate sector and cashed-up consumers. For all the negative sentiment in the media, remember, that once it’s in the headlines, it’s in the price. And that recoveries from market corrections generally begin when the outlook is particularly dour. This means that with excessively bearish positioning and pessimism thoroughly priced-in, this sets the stage for a potential upside surprise.

But keep in mind, as policy settings continue their transition from accommodative to more neutral levels, we will remain highly active and discerning in our investment decisions for the remainder of the year. Clearly with the benefit of hindsight we recognise that this environment hasn’t suited our small caps bias, however we firmly believe investors will be more than compensated for this tilt over the longer term. And despite the elevated volatility associated with these market segments, this is the ever-present admission price associated with generating attractive returns through-the-cycle.

Are we there yet?

With longer-term investment returns now looking relatively attractive, we remind investors that generally the best and worst days in the market are clustered together, and that panic selling is typically a wealth-destroying endeavour. Lastly, we understand the temptation to base your investment decisions on the tunnel vision created by the recent pullback; however, we instead advocate for a more measured and forward-looking mindset to navigate the path ahead - and get back to the future.