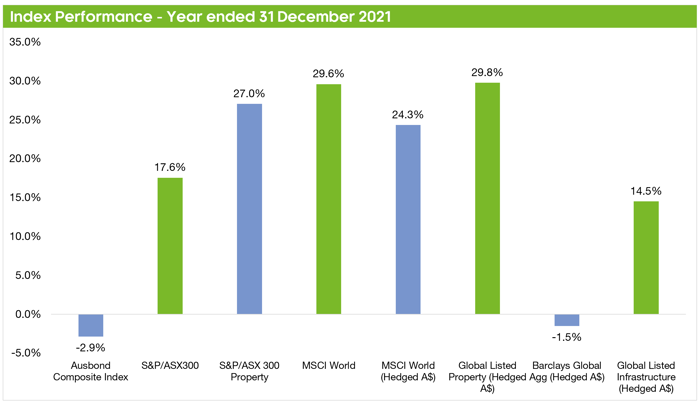

Equity markets went from strength to strength over the year, as ultra-accommodative monetary policy, wartime level fiscal stimulus, and vaccine optimism converged to keep powering the bull-market higher. Even lockdowns, COVID-19 variants, inflation jitters, and a weakening Chinese economy failed to dent investor enthusiasm. The result saw markets, both at home and abroad, repeatedly breach new highs.

Source: Zenith

Climbing a wall of worry

Notwithstanding the ongoing relief rally, in early January we remained circumspect as markets were grappling with weak vaccine penetration and growing COVID-19 caseloads. Consequently, to further differentiate our return drivers, we introduced an allocation to global multi-strategy to meet the competing pressures of generating absolute returns with capital preservation, whilst maintaining low correlation to traditional assets.

However, investors ultimately brushed aside these stumbling blocks, with the meme stock mania subsequently taking hold. This heralded a new breed of day traders on Reddit who conspired to drive up the share price of GameStop which the institutional hedge funds had heavily sold-short.

Importantly, our portfolios were immune to the speculative fervour associated with these ‘short-squeezes’, as we ensure that our managers with shorting capabilities implement robust risk-mitigation practices. Pleasingly, it was these risk control measures and stock selection aptitude which saw our long/short strategies profit on their short positions amongst this market turbulence.

Team transitory

The inflationary impulses soon started creeping in, as supply chain bottlenecks failed to unwind, and the tightening of the labour market gathered pace. This was despite the best efforts of global central bankers who had steadfastly subscribed to the transitory inflation narrative.

Sensing that a sustained inflation outbreak represented a headline portfolio risk, we recalibrated our fixed income sleeve to alleviate the asymmetric risk of rising rates. As cash is not a safe-haven in a high-inflation environment, we reduced our cash allocation and introduced a dedicated short-term credit manager to exploit the surge in yields.

Similarly, as our capital markets forecast viewed emerging market debt favourably, we likewise established a position in a fixed income manager with a flexible mandate and scope to invest across the emerging and developed market spectrum.

Avoiding the pain trade

To optimise our listed property sleeve, we reoriented our portfolios to favour international listed property over domestic. Despite the yield and diversification benefits of AREITs, we deemed an overweight exposure to GREITs as more favourable based on the lower volatility profile and greater stock, sector, and regional opportunities available in global listed property markets.

The benefits of this enhanced diversification soon became clear, as the pain trade associated with the concentrated Australian property retailers was again brought to the fore as the COVID-19 Delta variant triggered a new wave of national lockdowns.

Not with a bang, but a whimper

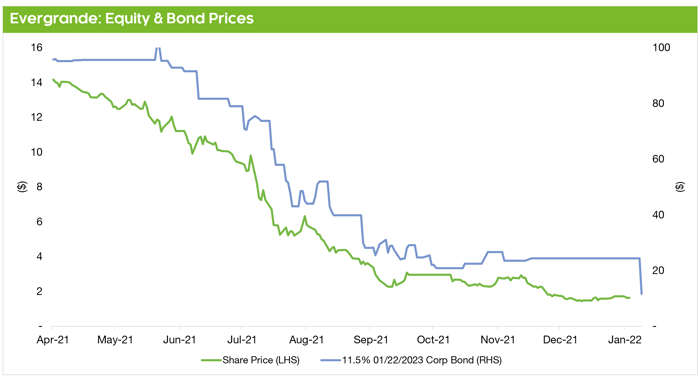

We finally saw the return of healthy volatility to global markets as China’s cash-strapped property titan, Evergrande, teetered on the brink of collapse. The catalyst was the Chinese Communist Party’s relentless pursuit of ‘common prosperity’, which saw price limits imposed on new property developments and harsh penalties for free-wheeling property developers who failed to deliver projects on time.

Fears over global contagion and a systemic meltdown had investors braced for a harsh landing, as the Australian share market delivered its first negative monthly return in almost a year. Fortunately, the saga ended not with a bang but with a whimper, as Chinese authorities managed to ringfence Evergrande and limit the spill over effects to other asset classes and regions.

Pleasingly, Zenith portfolios held no exposure to Evergrande’s debt or equity securities, which demonstrated the importance of selecting high-quality active managers to navigate stressed markets. This is further emphasised through Evergrande representing a disproportionately large weighting in high-yield indices, as the most indebted issuers are perversely the largest constituents in passive allocations.

Source: Bloomberg, Zenith

Sell first, ask questions later

In November, the discovery of the Omicron strain which the WHO characterised as a ‘variant of concern’ saw a swift repricing in equity markets. Unsurprisingly, with the doldrums of the initial COVID-19 drawdown still raw in investors’ minds, the market adopted a sell first, ask questions later approach. Our intentional skew to ‘quality’ ensured that our portfolios protected on the downside over this period, whilst the market absorbed the potential ramifications of renewed mobility restrictions and lockdowns.

During this period and in keeping with our ‘quality’ bias, we redeemed our global long/short exposure in lieu of a concentrated and benchmark unaware ‘quality’ oriented strategy. Underpinning this move was our analysis demonstrating that a more attractive upside participation and capital preservation asymmetry could be achieved through this alteration.

Omi-gone?

Fortunately, Omicron soon proved more transmissible yet less deadly which was all the affirmation that markets needed to embrace a year-end ‘santa-rally’. And as we move from pandemic to endemic, with inflation anxieties supplanting COVID-19 concerns, we’re faced with new risks with which we’ll seek to insulate our portfolios from.

With central banks now tasked with engineering a slowdown in the inflationary impulse, this requires a delicate balancing act between taming inflation and tightening monetary policy whilst avoiding a market rout. Although in the short-term this may derail some market gains, moving forward we remain constructive on equity markets, although caution investors to be alert for renewed volatility, yet not alarmed.

Otherwise, it’s pleasing to report another successful year supporting our managed account clients, with our portfolio construction methodology, monitoring and rebalancing schedule, and the insights shared with our Research Team, enabling us to deliver strong performance. Encouragingly, we finished the year in striking distance of $4b in funds under management and look forward to another strong year of growth.