|

As the need for ESG practices and regulation grows across the Australian financial services industry, Dugald Higgins, Head of Responsible Investment and Sustainability at Zenith shares his insights and commentary as the ESG landscapes evolves. With continued growth and change anticipated within the ESG space, Dug breaks down what this means for investors, advisers, and businesses. |

The real estate sector is one of the largest contributors to energy-related carbon emissions, producing nearly 40% of the global total. This means that huge changes lie ahead for commercial property and by extension, property funds. While the real estate sector needs to be a significant part of overall decarbonisation efforts, some may find structure and scale a potential inhibitor if planning is insufficient. With unlisted property syndicates having long been a popular investment model, what should investors and financial advisers be thinking about before committing?

Real estate and decarbonisation

At the release of the sixth UN Intergovernmental Panel on Climate Change (IPCC) assessment report in March 2023, UN secretary-general Antonio Gutierrez stressed the world’s need to “massively fast-track climate efforts by every country, and every sector, and on every time frame”. As Australia works to achieve its own net zero by 2050 strategy, the real estate world will see increasing focus on greater sustainability and higher disclosure. In many cases, individual cities are forging ahead of government. For example, both Sydney and Melbourne plan to enact regulations to ensure new buildings operate at net zero carbon by 2030 and all buildings by 2050. In Sydney, development applications for new office buildings, hotels and shopping centres and major redevelopments of existing buildings will need to comply with new minimum energy ratings from January 2023 and be net-zero operationally from 2026.

The property industry faces the challenges of not just ‘building greener’ but also retrofitting buildings to reduce emissions. While challenging, building emission profiles will increasingly influence pricing, debt, and liquidity. Early adopters will reap benefits, laggards however, will likely face challenges regarding attracting and retaining tenants, decreased access to capital, and increasing financial risks.

Business not as usual - regulation and attitudes are changing

Following other jurisdictions, the Australian Government is currently proposing to mandate reporting of climate-related financial risks across much of the financial system. While initially focusing on large, listed businesses and financial institutions such as banks, the implications will be far reaching.

Core to these proposals is the requirement for businesses to identify, assess and disclose issues. As part of this process, disclosure on metrics such as Greenhouse Gas emissions will be required. Given that many of the disclosures require assessing metrics on a value chain basis, even companies which are technically out-of-scope for mandated reporting will be captured to a certain extent.

This means that increasingly all parts of the value chain will be paying more attention to a building’s sustainability credentials. Everyone from future owners, lenders and tenants will need more information regarding emissions and other issues, and strategies will be planned accordingly.

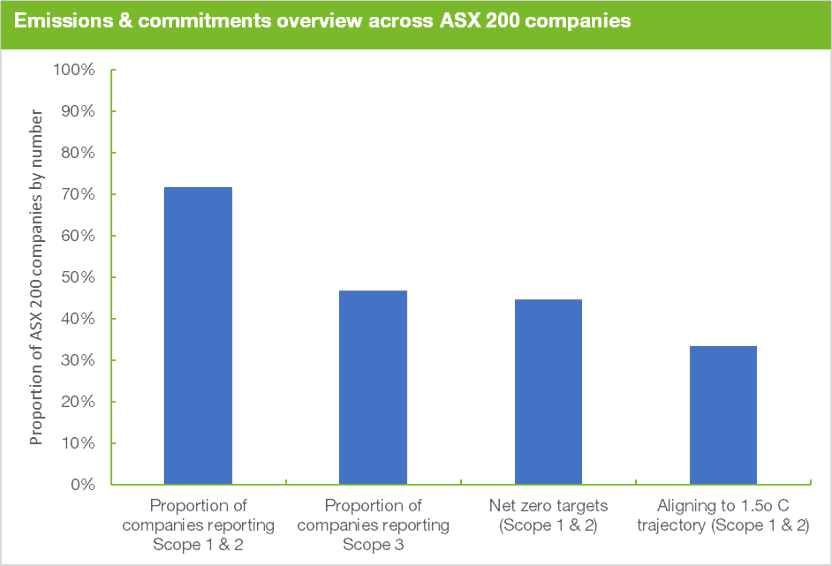

This is already happening, with corporates increasingly adopting net zero strategies. Data from real estate services firm JLL indicates that globally, approximately 69% of corporates are expected to commit to science-based targets by 2025. In Australia, data from the Australian Council of Superannuation Investors (ACSI) shows that 72% of ASX 200 companies already report Scope 1 & 2 emissions data and 45% have net zero targets on those emissions. Even more tellingly, 47% report on Scope 3 emissions, meaning value chain reporting is already happening, it's no longer limited to the big end of town (Scope 1 emissions are from owned or controlled sources, while Scope 2 are from purchased energy. Scope 3 are those not included in Scope 2 that occur in a company's value chain, as detailed here).

Source ACSI, November 2022

Globally, approximately 4,800 companies are seeking to reduce their emissions in line with the Science Based Targets initiative. Landlords need to ask themselves, are my tenants among them? What about critical organisations in their value chains to whom they may need to report? The walls are closing in.

Property syndicates: a long-time market player

Property syndicates have long been a small but active part of the investment landscape. For supporters, unlisted commercial property has often been attractive given it avoids the added distraction of the higher volatility, albeit with greater liquidity, imposed by listed REITs. While not without its chaotic periods, this sector has often generated solid outcomes for those seeking steady yields with some capital growth.

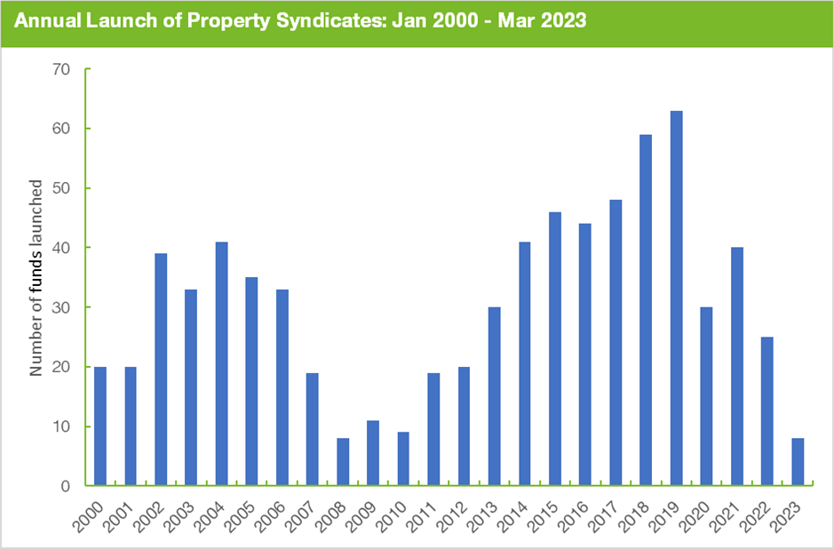

The nature of the sector has been surprisingly prolific over the years in terms of number of investment vehicles launched each year. Our own data conservatively suggests that on average there is around 30 new property syndicates launched each year, collectively raising approximately $A 1 billion in capital (excluding open-ended funds).

Source: Zenith Investment Partners

For syndicates, with their closed-end fund structure and single capital raising period, macro elements can make or break a successful outcome. Unlike open-ended funds which essentially have no fixed-term and can continuously raise capital and buy or sell assets to reposition the portfolio, syndicates are more tactically constrained. Once capital is raised and deployed, the structure does not easily facilitate further raisings. While this is often part of the strategic appeal for many investors where knowing what you are buying into for the life of the investment gives some level of comfort, it can also create challenges. If you need additional capital, can it be raised? If market dynamics shift materially, what does this mean for returns? Given the average expected life of a syndicate is typically five to seven years from launch, future forecasting can a tricky business.

Decarbonisation v syndication – what does it mean?

Fundamentally, we see two key issues – sophistication and duration.

As fund researchers looking across the landscape of managers, we observe a frequent ‘large company’ effect in the level of sophistication and implementation of both ESG and sustainability principles in asset managers. That is, larger managers are often better positioned to apply more resources to the evaluation of ESG and sustainability issues and determine which areas are most material and develop strategies accordingly. Like any rule of thumb, there are exceptions, with some smaller managers demonstrating highly developed skills in these areas. But these remain the exceptions rather than the rule and notable exceptions aside, syndication remains heavily populated by smaller managers who frequently appear yet to evidence deeper thinking on sustainability implications in their products.

The development of these key skills is of critical importance in real estate. Given the importance of decarbonisation, managers of these assets face material challenges to ensure assets are not left behind or become functionally obsolete in a world where higher demands on sustainability attributes are accelerating.

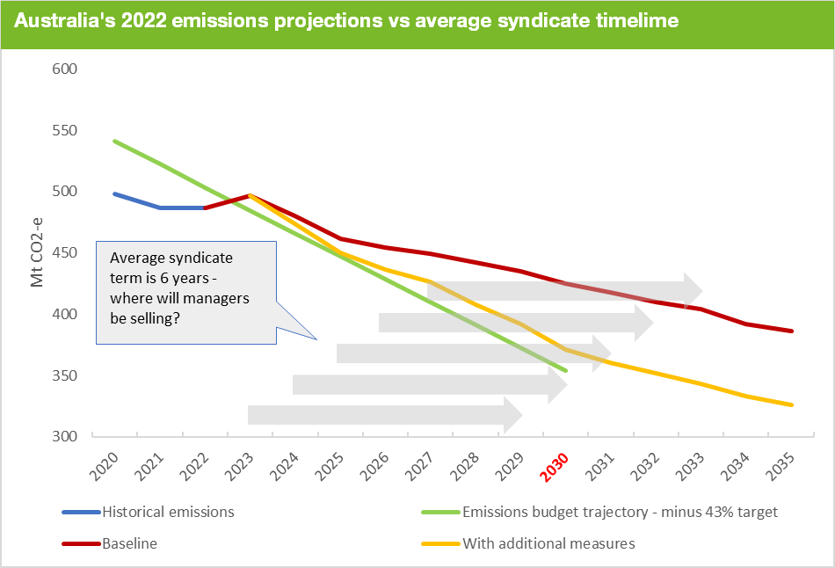

It is because of this accelerating pace of change that duration becomes critical. As noted earlier, property syndicates are fixed-term vehicles with no liquidity. Given the average term of around six years, syndicates launched from today onwards are looking at a potential termination date close to the 2030 deadline where deep cuts in emissions are required to achieve a Net Zero by 2050 scenario. The closer we get to these deadlines the more regulation is likely, with greater pressure to retrofit buildings to meet new emissions requirements. Today will not be like tomorrow, decarbonisation is a necessity, and it will not be without collateral damage if left inadequately addressed.

Source: Australian Government – DCCEEW, Zenith Investment Partners

Investigation, not condemnation

More broadly, unlisted property funds will remain a key player in the functioning of markets, acting as a custodian of essential assets for thousands of businesses around the country for whom physical real estate remains a critical part of their ability to operate. It also pays to remember that from an investment perspective, payment of rent ranks ahead of business profits, underpinning property’s popularity as a diversifier and stabiliser for income generation relative to asset classes like equities, where profits are more variable.

As the trend towards higher disclosures and compliance accelerates, advisers and investors need to ensure that manager and fund selection processes account for these rapidly evolving issues when dealing with syndicates. There is a very real risk that for some managers, the syndicates of today may not necessarily hold the assets of tomorrow as key decarbonisation milestones loom.

As with open-ended funds, syndicates have always needed to navigate cycles such as property supply/demand dynamics, capital availability and usage trends. The challenge of decarbonisation is no different. At minimum however, investors and advisors need to ensure their chosen fund managers can demonstrate both capability and credibility in key areas:

- Capability:

- Leadership commitment and vision, robust oversight and resources

- Sufficient capabilities to assess future transition risks and how that may impact asset selection, strategies, operations and sale price

- Ability to aggregate key data to establish materiality of issues and measure progress, requiring deep collaboration between owners, occupiers and other stakeholders

- Credibility:

- Are energy efficiency or decarbonisation strategies meaningful and credible? How does this play out in individual funds?

- Are strategies credible for the asset type? How will any necessary expenditure be funded?

- Are all claims credible, or are they potentially greenwash? (read our thoughts on greenwash testing here)

In many ways, the fundamentals of property syndication haven’t changed. You need the right combination of skilled management, robust strategies and the appropriate assets and leverage to fit the aims of the fund. We think that syndicates will continue to offer attractive strategic opportunities in the future. Investors and their advisers just need to be able to satisfy themselves that their fund selection programs can identify where the risks lie.